(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all and happy Monday. Jpegs are completely disregarding the fact that ETH is ripping and this week was practically up-only for blue chips and Azuki derivatives. Pudgy Penguins came back from the grave and broke over 50k ETH volume (now sitting at #25 for all time OpenSea volume). Another week where most new mints barely sell out half, and other mints are flying off the shelf. Believe it or not, there are still people saying we’ve been in an NFT bear market for the last 3-4 weeks as countless projects achieve new all time highs. As always, a week here feels like a year, so we’ll keep doing our best to cover everything that crossed our radar.

Below is a real photo of us navigating the metaverse this week.

MC Pass Updates

Very pleased with the way our community has flourished since the MC Pass minted out. Seeing the same 100+ faces coming back to chat every single day and provide value. Some highlights:

Members getting into Kiwami around ~.3 ETH (at a 1 ETH floor now, hit 2).

2x Flip for many on Fuzzy Felons.

20 lucky community members will win a WL spot for The Possessed later this week (one of the hottest pre-mint projects, period).

Lastly, another great jobs section at the bottom of the newsletter courtesy of TheChild. There’s no better time to break into web3!

Macro Update:

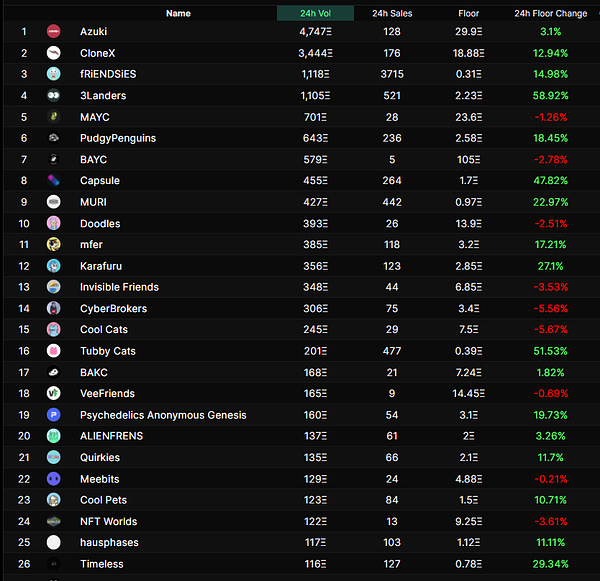

Commence the pump. While we’ve been *cautiously* bullish over the last several months, even we are bewildered by what we are seeing right now. BAYC steadily above 100 ETH, Doodles pumping to 16 ETH, Clone X above 20 ETH, Penguins back above 2.5 ETH, and holy Azuki, just flying above 30 ETH. All while NFT influencers were complaining about how tough the market was a week ago and their overhyped shills like Small Bros are 50% below mint price.

Money continues to flow to top projects. What’s interesting to note is that this is all happening while ETH has been ripping. More thoughts on this later, but we’d typically consider this to be more bearish for NFTs, which has surprisingly not been the case.

A few noteworthy observations regarding specific projects:

Cool Cats has been in purgatory over the last 6 weeks sitting in the 7-8 ETH range. Once said to be a blue chip, it seems that the ETH is flowing into “sexier” projects (like Azuki, Doodles, and Clone X). We will pat ourselves on the back when we shilled at 3 Eth back in 2021, but not sure if something specific has happened which is stalling growth. Will be monitoring closely.

Things are finally starting to look hopeful for long-time penguin lovers (like ourselves). It seems that the 6 months of pain may have come to an end and true believers were clearly rewarded, as the project has gone from .8 to 2.5 ETH on some absolutely insane volume. Obviously, this is due to the Luca Netz acquisition news. Many forgot about the Pudgies over the last several months, but the Huddle certainly didn’t let the fire burn out. Penguins are #25 in all time OpenSea volume, even with their recent stint of inactivity. We tend to have short-term memories in the NFT space, but back in August when Penguins were all over the mainstream media, they were one of the most talked about story in NFTs for weeks. Long-time readers of MC know our feelings, and Penguins are and have always been one of our favorite communities. Our final thought here, is that this is the first time (from what we’ve seen) a team has abandoned a project completely and the project still remained financially strong (0.8–1 ETH range) with 0 leadership involved. With Luca now on board, the sky is the limit.

Azuki owners are on cloud 9 as the pump continues and the floor hit a whopping 35 ETH with a 420 ETH sale. Along with this, all holders received a ~5 ETH airdrop. What’s amazing is that most projects usually dump after an airdrop, but Azuki defied gravity here and continued to pump from 20-30 on this news. We also see many Azuki wannabes pumping. Kiwami hit 2 ETH and did a ridiculous >8K ETH of volume traded on OS in the last week. We continue to expect these anime/azuki wannabes to pump/dump over the next week or so (assuming Azuki stays in the headlines).

Zooming out, a trend we’ve been thinking through a lot is the performance of projects who secure high-end collabs. As you may have noticed, some of the most notable projects are doing WL partnerships with several of the “over-hyped” projects we’ve discussed here. While we don’t endorse many of these over-hyped projects (as most readers know), many (not all) turn into fairly profitable flips during the post-mint, pre-reveal stage. Analyzing new/existing projects to see who they are collabing with may be a key indicator in measuring a team’s clout, and more importantly, their ability to excite top talent and garner collective buy-in.

Finally to bring this back to the top, the reason we still remain *cautiously* bullish is because ETH is ripping. As we’ve seen in the past, NFTs in a downtrend become increasingly correlated to ETHs price as it continues to rise above the ~$3800 range. We’re not traders, don’t read charts, and have no clue where the price goes next – our best guess is a chop in this range until USA tax day (in the words of BTB, the worst day of the year!).

We are long-term ETH bulls, and have been contemplating how the rise of ETH over the coming years will affect our jpegs. We do think if ETH rips above 4k for a while, most jpegs are in trouble (denominated in ETH… they'll go up in fiat value). That said, various blue chips may in turn be a bet on ETH, as most of those holders don't need liquidity. If something like JPEG'd takes off, this will help improve liquidity throughout the market as well.

We’ll see what happens. Last time ETH hit $4.5K, BAYC/Punks floors dropped ~30% in ETH terms, while many others went down 90%+ to never recover. This was during what we referred to as a true NFT “bear market” back in Oct/Nov 2021. The general consensus strategy is to slowly de-risk short-term holds during this pump and either hold the ETH yourself or pour it into projects you are comfortable holding for the long term (that ideally should outperform ETH). As always, nothing we ever say ever, at any point, ever, is financial advice. Please DYOR.

The Possessed

We first touched on The Possessed back in February. They were right under 20k followers at the time and just starting to gain real momentum. At 125k followers, Tom and Joe are now commanding the attention they deserve. Not to fanboy too hard but look at the attention to detail on their website. We’re confident that this will be one of the top 3 projects of H1 2022, full stop. As we said when we first mentioned this project to our community:

“In a market where many projects get overhyped quickly, we think the Possessed will ultimately become one of these mega-hyped projects. However, from what we’ve *seen* watching them grow organically, this looks like it could be a breath of fresh air.”

Well, this played out quite nicely didn’t it? With what seems like no paid marketing or big collabs at first, The Possessed grew organically via gamification and dope art. We also tuned into their Spaces last week which had a whopping 2,500 listeners in attendance. This is a great tweet that sums up some of the major points from the Spaces if you didn’t have the chance to attend:

While we don’t usually hold these awards in high regard, it is still worth noting to better illustrate the team’s capabilities, that Tom is a Forbes 30 under 30 entrepreneur and Joe runs a London-based design studio. You can read their personal bios here: Tom / Joe.

With no discord yet and over 100k followers, we’re certainly impressed with the creative ways they’ve come up with rewarding their loyal followers. Almost every tweet, picture, hidden places on websites, etc. has some sort of code to break, and the first one to “crack the code” gets to be a lucky test subject (white list). They also have been rewarding early community members who interact with them frequently. A member of our community got granted a test subject spot for just constantly interacting with tweets and joining their twitter spaces. He has under 200 followers. It’s great to see a massive project offering up rewards based purely on merit.

The Possessed is a 10,000 collection but minting a Possessed NFT will grant you 3 NFTs:

1 Jpeg of the Blessed state

1 Jpeg of the Possessed state

1 fully animated GIF between the two states

This means that there will be 30,000 total and 3 separate collections. We’d wager that the majority of the value will be in the 1 fully animated GIF between the two states. We expect WL flippers to sell either or both of their jpegs of the Blessed/Possessed state, but hold the GIF. If you own the gif, it feels to us that you’ll be able to use both states as a PFP, vs just owning one. On the other hand, hardcore collectors may pay a premium to make sure they own the *full* possessed nft (3 states).

Risks: Every project comes with risks. We think the biggest risk to The Possessed is buying in right after mint and having a similar situation to Invisible Friends take place (13 ETH to 6 ETH over the course of a few weeks). While we’re confident this team will deliver long-term, it’s going to be extremely difficult to price this project not only due to the hype, but because of the 3 separate NFTs per mint. We haven’t seen this done before so we can’t predict what will happen during the price discovery phase. That being said, if you’re looking to buy in, we think the GIF will *possess* (😂) the most value.

Our consensus: Well deserved of the hype and won’t be surprised to see them gain 200k+ followers by the end of April. Mint still looks some time away so be sure to give them a follow and search for hidden clues. This has the potential to be one of the biggest NFT projects of the year, and we don’t say this lightly.

We’re beyond proud to say we’ve been supporters of the project, finding this gem below 2K followers. Excited to raffle off 20 WL spots later this week to our community of MC Pass holders.

As always, NFA, DYOR.

Crayzillas

Twitter | About

Spent some more time in this discord over the last week and became more convinced that this is a project worth watching. Discord is constantly active, anti-grind WL vibe, and the ethos of the project is super unique with art that is customized by the minter. No need to be upset by not pulling a rare, as you’ll be able to mint a coloring book and various crayons to design your crayzilla just how you like. Also, doxxed founder with a sizable following on Youtube.

There are two important bullish catalysts here that we’ll focus on. Due to customization, we expect a lot of trading between community members in order to pick the exact crayons/colors they want to use. With 5-8 crayons per mint + 1 random coloring page with various different traits to be colored in, we expect a lot of trading individually. Higher transaction volume in turn generates good revenue for the team to build on their vision, and propels a project into the OpenSea spotlight. Adding to this, using the coloring book and crayons to mint a Crayzilla will burn both of them, potentially leading to a color/trait supply shock if something in high demand is depleted. We also think that similar to Sprite Club (which is seeing a nice recovery), core holders who are seriously keen to build their own Crayzilla, become more incentivized to hold on, as they built it themselves.

Finally, we’ll re-mention our new “thesis” we’ve been testing, but Crayzillas' team is clearly well connected. Some great collabs including Gutter Cat Gang, WonderPals, Whiskers, and Sprites. Feeling good about this project if you’re able to mint - recommend following along on twitter to get into the discord.

The Randoms

Sizable following, active discord, not impossible to get WL, and there’s something about the art that catches the eye. Worth looking into if you want to scratch your degen itch. We think The Randoms have a solid combination of enough hype + unique artwork to do well post-mint.

Similar to many new mints in this space, nothing revolutionary with the roadmap here in our opinion. A lot of messaging revolving around art, streetwear, and creating murals. While not eye-popping, we think this is the right direction for a project like this and there is already a lot of community-submitted artwork. Something like murals of The Randoms could be great for spreading awareness IRL, and the artwork just fits.

We think this is a project that can do well solely due to under-the-radar hype and artwork. The art stands out and this community doesn’t seem to have the “everyone will flip this” mentality that many of the cute copypasta PFPs with an absurd number of twitter followers have (purely a grift). Will definitely be following along – with some good collabs along the way, this project can build some real hype.

Conclusion

A lot of *new* money is flowing into NFTs, seen below.

With new money comes new opportunity. What should be the ultimate test for the leaders of the NFT space, is how effectively they can take this surplus of capital they’ve earned from their mints, and utilize it in a way that turns their projects into self sustaining “businesses” which don’t rely on new money coming in to buy the bags of old money. The leaders who can figure this out will be the only ones still standing when the next true bear market eventually comes and goes, and the dust settles. Look to seasoned media and IP vets to lead the way here. The possibilities are endless but it takes creativity, relationships, community, and a healthy dose of luck.

While the future may look uncertain in this sense, there is one absolute certainty which we can guarantee (aside from death and taxes) – MC will still be standing after the dust settles, calling it as we see it, and continuing to support exciting emerging creators.

Until next time, anon.

– Wilson & Paul

Web3 Careers:

Gm job hunters! This week’s list is very Web3 native and we saw a TON of community and social media roles posted this week. Again, this is the lowest barrier to entry for Web3 job seekers. If you want to get in and don’t have a computer science or business background, this is where you should be applying.

I also want to highlight the Investment Principal job with 6th Man Ventures. We’ve talked a bit in the jobs section of our discord about investment positions in Web3 and this role lines up well with that discussion.

Let us know if you’re hiring for incredible roles or if there are other types of opportunities you’d like to see in this section! Tweet/DM us @MintCalendar, @TheChild1996, or send an email to hello@mintcalendar.com.

Community/Social Media

Community Strategist (Venly, Remote Europe)

Social Media Marketing Manager (Clubrare, Remote)

Social Media Manager (YG Recruiting, Miami, 50k-70k)

Trust and Safety Manager (makersplace, Remote US)

Marketing:

Senior NFT Marketing Specialist/Manager (Eyekandy, Remote, 70k-120k)

Product Marketing Manager, NFT (Kraken, Remote)

Product/Miscellaneous:

Investment Principal/Senior Associate (6th Man Ventures, Remote NYC)

Product Manager – Protocol (Rarible, Remote)

Computer Science:

Blockchain Data Scientist (OpenSea, Remote Canada/US)

Web3 Frontend Engineer (DoinGud, Remote US, 80k-160k)