(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all and happy Tuesday. As we gear up for summer, we face yet another slow week with volume falling off a cliff – bearish sentiment continues to grow. A lot of ‘selling at a loss’ across the board and regretful buying during the euphoria phase is clearly showing all over NFT twitter. While the jpeg environment is not necessarily fun at the moment, it’s times like these when the maximum wins are generated if you know what to pick. As opportunities slowly begin to present themselves, we can’t stress enough the importance of staying liquid, remaining patient, and surviving to see another day. While your colleague at happy hour dunks on you claiming NFTs are dead, it’s a good time to keep your head down, continue to learn, and look for potential long-term winners throughout the rubble. While we’re not fortune tellers, NFTs will have another bull run eventually, and when that time comes, we’ll all be nice and cozy once again. We hope you all have a stress free week!

MC Pass – If you’re interested in joining our community:

Check price, bad price? Need a job? TheChild has your back with another amazing ‘Mint Jobs’ section at the bottom of this newsletter.

Macro Update

OpenSea daily volume was even lower this week than the previous week (link), which if we remember was already the lowest volume week since August 2021. There’s no hiding from the facts, things have slowed down dramatically in internet picture land through the month of May. FUD continues to be prevalent on the timeline, and rightfully so as many of the blue chips are down 50%+ from their all time high in nominal USD terms. High supply new mints like Chain Runners XR and Demonica have been absolute disasters, unable to mint out even 25% as the broader market continues to look weak.

One intangible trend that’s been capturing our attention is how quiet discord seems. Most post-mint project discords have quieted down significantly over the past few weeks, and many are complete ghost towns. While we don’t think we’ve hit capitulation (yet), the NFT space has cooled off massively. Tl;dr, most market participants are simply not having a good time right now.

So, what to do in times like these? If you are reading this, chances are you are as much of a long term believer in the NFT industry as we are. While $500K Usd *may have* been quite high for a monkey picture, there are without a doubt long-term buying opportunities out there to be had, especially as panic sellers and flippers look for liquidity.

That being said, since this space is so new, we’ve never seen a >6 month deep NFT bear market, and coupled with the fact that we’re facing a global recession, there’s no doubt things will get uglier.

NFTstatistics.eth has an interesting thread about how the luxury market usually performs during trying times: “Luxury goods tend to do ok in downturns. Hard to compare pixelated owls & laser eye apes with diamonds & Prada bags but I think there are parallels.” What we’ve discussed in previous newsletters is that the NFT space is similar to the traditional art space in that the money flows to the top. Again and again we see this, as everything is down 80-90% from their ATH, Blue chips are down ~50% (USD terms), and only around 25-40% in ETH terms.

As mentioned before (also h/t to BTB who has been discussing this at length before we have), many high end art collectors don’t need the liquidity and are not forced to sell during tough times. If this parallel holds true to the NFT space, the best buying opps will come from depressed valuations in blue chips. However, this isn’t so cut and dry. Previously declared blue chip projects like Cool Cats and Azuki, due to either failed leadership, scandals, or general disappointment, seem to have lost their *blue chip status*. Since the market is so new, it’s truly tough to decipher which projects will have staying power. BAYC, Doodles, Moonbirds have all shown relative strength in this case, while still having depressed valuations. Anyways, while it may not be the exact time right now to pounce (we think there is more pain to come), if you have a long time horizon, get your wETH ready as there’s bound to be some incredible opportunities in the coming weeks/months.

When will things come back? We think that NFT vol will come back once ETH stabilizes above the ~$2200 USD range. Right now, many are panic selling NFTs just to sell their ETH, worried about sub 1K ETH and “goblin town”. Until this extreme volatility exits the crypto market, we won’t get our cherished NFT bull market back.

Degening, Flipping, Pump/Dump

This is officially a flippers market, but you certainly have to move fast. The hype and death cycle reminds us of the late stages of the ICO craze back in 2017. Tops are being reached mere minutes after mint (many free mints) and crashes can happen a few hours later. The other day we saw this with ETH Robots (now taken off OpenSea) going from .01 to .1 back to .01 in a 2-3 hour timespan. Goblintown.wtf mooned from under .1 to .75 back to .4 now in under 48 hours. We watched in real time on twitter as popoPOPOpopo went from .02 to .1 in under an hour.

The theme here is that a lot of “alpha groups” seemingly have “degen callers” or twitter influencers essentially pumping low supply projects as the “next big thing” and then are completely forgotten under a week later. Maybe 1 or 2 will last, and while it’s cool to make a quick 3-4x, unless you’re super savvy we think this is how a lot of retail is going to get hurt. This ultimately adds to our *short-term* bearish sentiment. Players are becoming so bored they’re moving to low effort flips.

Finally, let’s discuss free mints. We’ve seen a few of these quick hype cycles happen to be free mints. We’re not going to advocate for buying into them post-mint, but if you find that you’re able to *mint* a trusted project for free, with some hype behind it, it’s probably a positive EV bet in this market (nfa). Sometimes, it’s also fun to have a funny NFT or *meme* in your wallet, as many in the MC community did with Zorgons. Again, not financial advice, but it’s certainly fun. We’ve seen many be decently successful projects like gh0stly gh0sts build real communities this way.

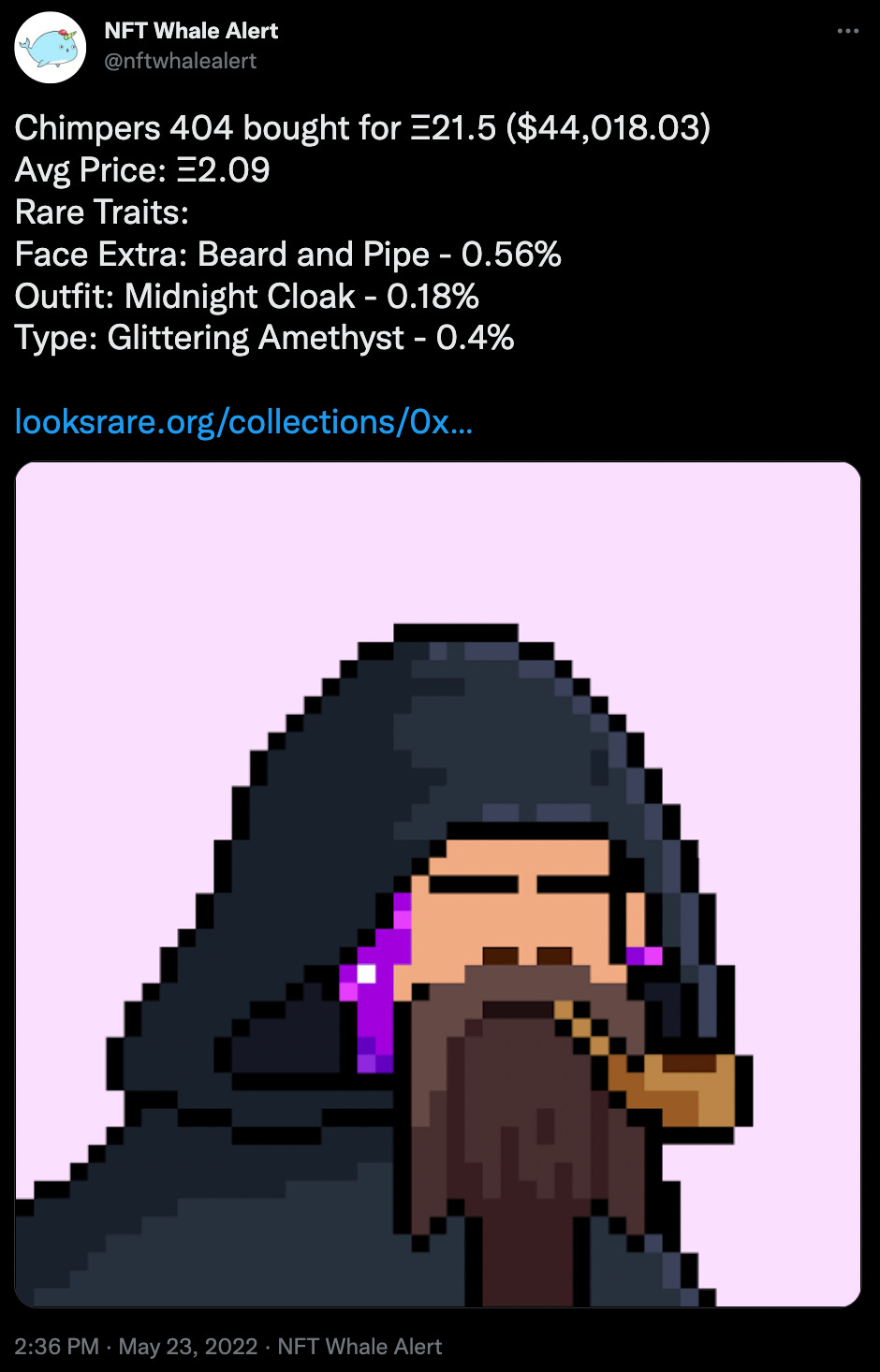

Expensive Mints Are Still Winning

We saw this again this week with Chimpers. While the mint was ~.07, the majority had to buy an ebook for ~2.5 - 3 ETH for the snapshot. Chimpers immediately floated around a 4 ETH floor for over an hour post-mint. So if you purchased an ebook for 2.5 - 3 ETH, minted for .07, and sold right away you came out with a ~1 ETH Profit and the ebook NFT (which obviously dumped post mint) which is still worth around .5 ETH. So, overall, a quick 1.5 ETH profit for many flippers if you were willing to risk 3 ETH or so.

If you won WL for CPG, which was a 2.55–3 ETH mint, you most likely had the chance to flip quickly for above 4 ETH for a quick profit as well. The floor has now dropped to 1.75 ETH.

Where are we going with this exactly? This makes us bullish on a project like RENGA from a mint and flip standpoint (a bit conflicted long-term due to market conditions but some of our favorite art we have seen yet). As mentioned a few weeks ago, the only way to get a WL for Renga is to hold a The Art of Seasons NFT (1 TAOS = 1 Renga WL spot). TAOS floor has gone from ~.4 ETH to 1.3 ETH since the announcement and this clearly shows that there is demand for Renga. What makes this more interesting is that the TAOS floor hasn't moved from 1.2-1.3 ETH since the announcement despite all of the market turmoil. We haven’t made any purchasing decisions yet but if you’re looking for a higher risk/higher reward play, we think this is one of the best opportunities in the market today that still remains overlooked.

NFT Tech & IRL Utility - DNNR

We’ve spoken about NFT technology disrupting legacy industries and we’ve worked closely with the founder of DNNR Ivana to empower her to do just that. While we’re in a bear market, we actually don’t see NFTs with fundamental IRL utility being deeply impacted as they’re not intended to be tradable assets, but more access passes.

DNNR is using NFTs to bring together web 3.0 and the exclusive London Nightlife scene.

Ivana and the DNNR team are working to build the first membership community for exclusive access to the best restaurants and venues in London using the immutable blockchain, blending their IRL events and secret party invitations via Discord.

Today, exclusive dining clubs such as Soho House, Zero Bond, and others, are known for attracting a very specific demographic of professionals that come together for various reasons. DNNR has already thrown sold out parties at some of the most high-end venues in London and is looking to take their community to the next level which excites us.

Coming from NYC, it’s quite difficult to get reservations at the best restaurants even months in advance, and nearly impossible last minute. Since London is quite similar, one of the primary perks of DNNR is that they use their unique network to help bypass these limitations for pass holders.

London is also only stop #1 on DNNR’s quest to provide unique access to exclusive nightlife globally, so if you aren’t based in the UK, just sit tight.

We are now living through what we believe to be a transition from copy/pasta garbage, to nft projects with legitimate utility. With this in mind, we believe DNNR has the ability to be a massive winner.

As always, NFA, DYOR, and if you’re interested in learning more, go hangout in their discord to connect with the founder directly.

New Mints

If we’re going to keep it real (like we always do), new mints absolutely suck right now. Practically every project is delaying their mint, decreasing supply, and lowering price. Even with historically inexpensive ETH, nobody wants to mint a 10k PFP project unless it has significant hype behind it. On the bright side, we expect to see less cash grabs, and more projects building real communities and products. We’ll touch on a few below that we’re still watching and don’t expect to mint for quite some time. Also, for what it’s worth, we’d throw Renga in here but we already touched on them in the macro update.

BUZOKU

As advisors to the founders, we’ve been extremely pleased with the organic engagement from the discord community and the slow & steady growth looks like it’s paying off as the team is building some solid momentum.

We tie a lot of the active community and engagement to their “journey-based project”. When you join the discord, you have to pick one of 3 clans to be a part of, assigning you a role. As expected, these niche’s form small communities within BUZOKU, making for more friendly banter and unique engagement vs. just a sea of gm’s.

Diving deeper – you’re able to determine your own in-project journey based on your decisions, discovering new traits and new characters. We’ve seen from others in the market that a “choose your own adventure” project has the ability to capture meaningful attention & hype. It’s important to cautiously monitor how the team goes about executing, but it seems they’re heading in the right direction.

With the bear market engulfing us all, it’s important that projects keep their community discord engaged. Having 100 “true fans” in these tumultuous times is what will steer new mints to be successful. Nobody wants to mint a project where the discord is a ghost town, and BUZOKU has done some impressive community building. There’s still a lot more info to be released here and they have a long way to go but we like what we’re seeing – definitely keep them on your radar.

Vivid

A decent amount of new info has been released since our last write up, but mainly we got to see what the PFPs would look like. This tweet got over 7K RTs and Vivid just surpassed 70k followers. This project is starting to gain some real hype and it’s probably one of the few upcoming new mints that we are excited about. While many other projects are losing hype and momentum right now, Vivid is just absolutely steamrolling through the FUD on social media.

We’re not fashionistas but they’ve already released their clothing brand as well. We won’t comment on whether this is bullish/bearish as we’ve yet to see PFP NFTs drop a truly successful fashion brand, but the main takeaway that intrigues us is that they’re releasing their roadmap and beginning to execute prior to mint. We like projects that have pre-built roadmaps prior to minting and Vivid looks like they’re on the right track. If nothing else, there should be a successful mint and flip at the bare minimum (nfa, dyor).

Nimrodz

Throwing this in here as we’ve been eying it since day 1. Right now, they have a very small private discord that has some solid engagement. Either super degen or there’s something here, not sure yet but will be watching over the next few months.

The art and community is hilarious and if we do re-enter a bullish period in the near term, this is a project that we can see making a run, especially with the meme-a-bility. For a tiny twitter account they have an impressive amount of engagement. Definitely NFA but we’re certainly early here.

Finally, below are a few more projects we’re following (not super closely) but may dive deeper into in the future. We’ve heard some readers want to research projects on their own but don’t know where to start, so hopefully this list is helpful. Feel free to DYOR if you have time.

Mint Music

Hey everyone, Angelo here with another week of Mint Music. Not going through too much today - hitting some macro and I’ll be on my way :)

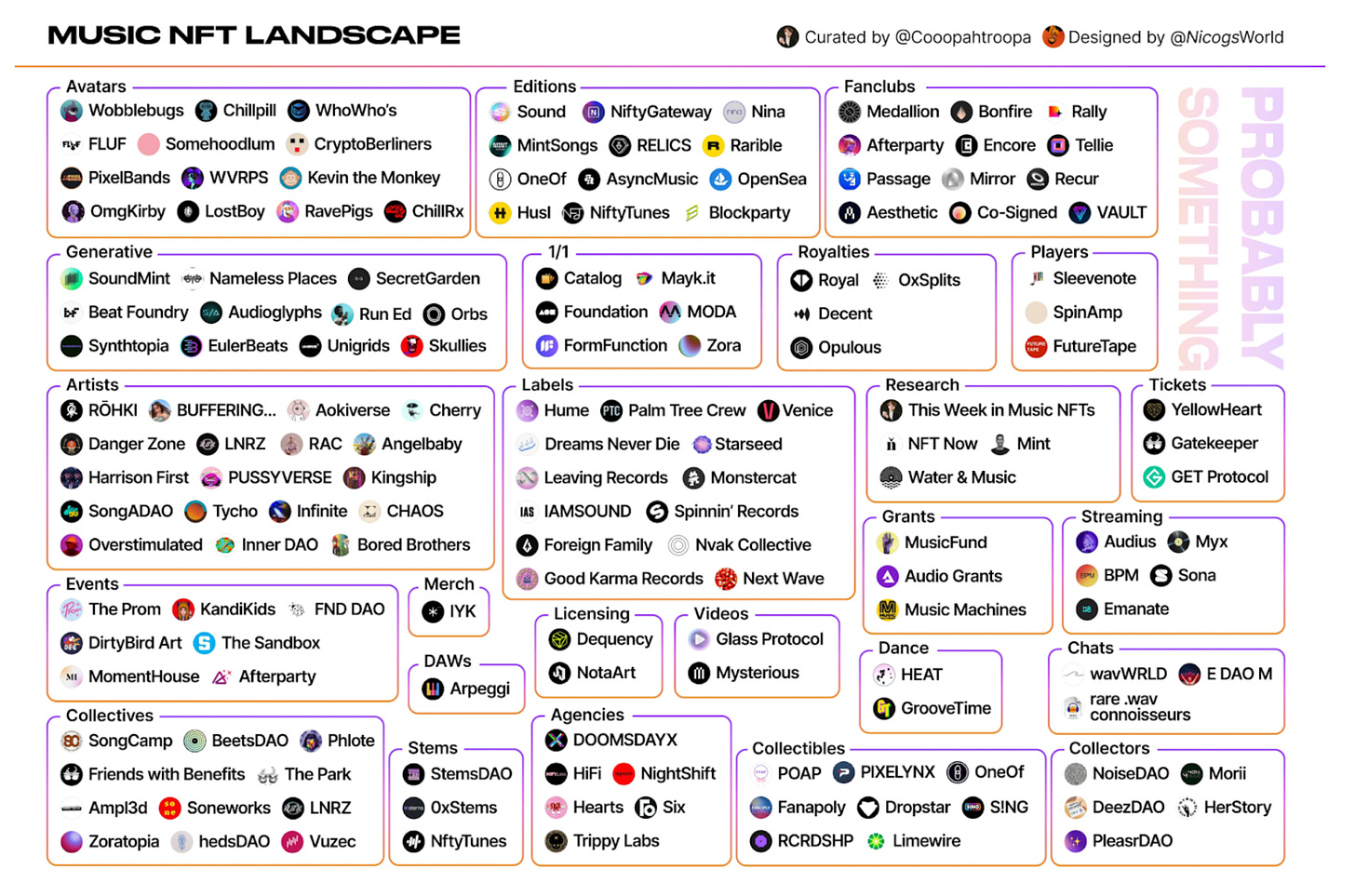

A quick throwback - David Lee Roth - lead singer for Van Halen sang, “Summers’ here, and the time is right for Music NFT’s.” Alright, while he didn’t actually say “Music NFT’s” in the track, (take a listen to Dancing in the Street for the original lyrics,) i’m sure he’d be a supporter. For real though, it’s looking like summer could be the turning point for Music NFT’s to break out in the spotlight. There’s been continuous positive buzz around Music NFT’s, despite the bearish commentary on crypto broadly. Twitter alpha lords like @coopahtroopah, @degendavinci and @famous_dyl have been putting out deep alpha about the industry. Check out an overview of the projects and protocols being built in the space - there is so much happening:

The past couple of editions of Mint Music have already gone in depth on a few of these projects, namely GET Protocol, Royal and Sound.XYZ - but we have much more to cover going forward. Even though ETH is trending lower, and the media and your parents are saying “dude, crypto is over,” projects keep building, communities keep growing and artists keep creating music. Some wild figures to take into consideration - The market cap of ALL MUSIC NFTS’ is around $10m, that’s smaller than many individual PFP projects. To put this figure in perspective - Yuga Labs (BAYC) is valued at $3.5b - we have tremendous room to grow. Another figure; the ALL TIME volume of the highest traded Music NFT project is 6k ETH. This wouldn’t even break the top 250 projects all time volume for PFP’s. As PFP projects boom and bust, some remaining for the long haul, but most crashing and burning - all this capital has to go somewhere, with some investors wanting their capital to go towards projects with utility. Music NFT’s fit that bill. Some successful PFP NFT artists are now turning towards Music NFT’s as well. Sartoshi, creator of MFERS recently created the artwork for a Music NFT project from singer-songwriter, AJC. While her music might not be for everyone, this is an interesting application of bridging visual art and music. Creating a Music NFT with a unique visual component + great music (a given) could be the key to taking these puppies mainstream.

That’s all for this week. In the meantime I’d put your dancing shoes on and prep for the show to begin.

- Angelo

Conclusion

Another week in the books, yet still day 1 for NFT tech. We tend to agree with a lot of the NFT critics who compare the recent NFT boom to the dot com bubble. Most people during the dot com bubble had no idea that Amazon would become Amazon (for better) or that AOL would become AOL (for worse). If you zoom out on the stock charts of tech companies which launched during the dot com bubble, you’ll notice deep value cuts across the board. This blind overarching selling is what truly creates generational buying opportunities and we expect the same to happen in the NFT market.

NFT tech isn’t going anywhere, community-driven businesses aren’t going anywhere, and people are increasingly spending more of their lives online versus IRL. We constantly reiterate the importance of remaining liquid because you do not want to miss these opportunities (and there WILL be opportunities). We’re going to make it through to the other side if we remain patient and persistent. When we do, it should be glorious.

Until next time,

W & P

Mint Jobs

GM job hunters! Here’s the good news: quality companies are continuing to hire talent to build teams and products that will survive poor market conditions. As you can see below, several of these roles are hiring in the 100K+ range and even the ones who don’t have salaries listed are probably well into the six-figures. Here’s the bad news: the market woes and fears of economic downturn are beginning to impact hiring. There were far less job postings this week in the Web3 and NFT space than over the last several months. If the market does get worse, you can expect to see fewer job postings and greater competition per position. Get your resumes in order and start firing them off because on the positive side it's a safer bet that the companies hiring now are serious and here for the long haul rather than cash grabbing at peak market mania.

Let us know if you’re hiring for incredible roles or if there are other types of opportunities you’d like to see in this section! Tweet/DM us @MintCalendar, @TheChild1996, or send an email to hello@mintcalendar.com.

Community/Social Media

Community Manager, Web3 (Playco, Remote, 80-180K)

Community Manager Mobile Game (Legendary Play, Hybrid/Remote Berlin)

Marketing:

Head of Product Marketing, Global Web3 (Google Cloud, Multiple US Locations)

Marketing Manager (Raremint, Remote)

Content Marketing (Topl, Austin, 90-110K)

Miscellaneous:

Web3 Account Executive (Multis, NYC or San Francisco, 70-130k)

Special Investigations Analyst, NFT Wallet Data (Coinbase, Remote)

Software Development:

Senior Backend Engineer Web3 (Rolla, Remote)

ZORGODS

Bullish on IRL projects as well. Any thoughts on Crypto Citizens and their art galleries?