(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm internet friends. We hope you are all having a great start to the week. Since our last newsletter 8 days ago, UST blew up, ETH dropped below $2,000 USD on two separate occasions, and NFTs have taken a beating. According to Dune Analytics (writing this yesterday), May 16, 2022 is on pace to be the lowest USD volume day (in ETH) since August 2021. Wild. On the other hand, Sol NFTs have been raging these last few days and bringing significant volume (and degens) to the market. Due to current market conditions, we’re not going to cover any specific projects in depth this week. It’s been quite some time since we did a long form write up on our thoughts regarding the state of NFTs and it seems like now is the perfect time. We’ll also continue to explore music NFT’s in our Mint Music section below written by Angelo. Finally, and we’re still monitoring all new mints/projects mentioned in recent newsletters (many have moved dates due to volatility). Let’s dive in.

MC Pass – If you’re interested in joining our community:

As we potentially head into a global recession, TheChild has your back with another amazing ‘Mint Jobs’ section at the bottom of this newsletter.

Macro Update:

It Doesn’t Look *Great*...But It Could Be A Lot Worse

Not going to sugar coat it – the market has taken an absolute beating over the last week. While panic was already beginning to naturally set in with the market looking generally bearish in the medium-term, the UST blow up certainly played a role in amplifying that panic.

ETH prices falling usually correlates with NFTs prices rising (in ETH terms of course) but we haven’t seen this play out during the recent wave of panic. This makes sense as NFTs are incredibly risk-on, and people are looking to move to perceived *less risky* assets such as cash.

Since the NFT industry is still in its infancy, we haven’t had the opportunity to experience a multi-year bear market. This makes it tough to make long-term predictions on the market. If ETH stabilizes at a lower price, we think there is a solid chance NFTs outperform fungibles. People want to be apart of the ‘new fad’ in crypto and we continue to see new trends exploding almost weekly in the NFT space (far more than DeFi).

The Slots Are Still Turning

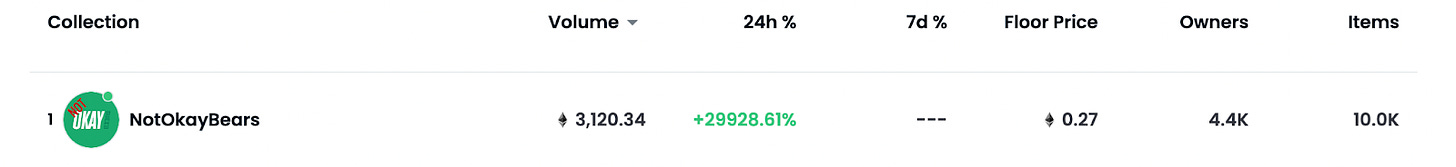

Yes, you read that correctly. NotOkayBears was the #1 trending project on OpenSea for 24 hour volume. This tells us that the market still hasn’t taken enough of a beating considering the absolute mania and degen antics are still prevalent. While readers know how much we don’t recommend derivatives (always a loser if you’re left holding the bag),it is relatively encouraging to see that anons are still “gambling in the casino” despite the overall turmoil in markets broadly.

Blue Chips & Chips:

The bellwether for the NFT market is and has always been the blue chip projects *(as we’ve said from the beginning). As such, its important to look at them to gauge where we might be heading.

Punks are floating around a 50 ETH floor and Apes have taken a ~50%+ haircut from their ATH (USD value) in the last 2 weeks. Doodles and Clone X are holding up decently and Azuki has taken a massive hit since the Zagabond news. Cool Cats looks atrocious and PXN / Ragnarok have both been cut in half post-reveal.

Bet on builders:

Historically, “crypto winter” is when some of the most compelling innovations with the most asymmetric risk/reward have been built. We’re not saying we’re going into a prolonged bear market (yet) but now is a good time to reflect on what you own. What are the intangibles and who are the leaders behind the project? While we see it happening now to some extent, various projects will continue to lose all volume and essentially go to “zero”. The projects that survive will have much less competition when we re-emerge from the gloom and doom. Ultimately, you want to bet on builders. These are founders who no matter the market conditions, will continue to push forward the objectives of the team, roadmap, and community. While it is not always easy to identify builders and good leaders (Azuki scandal for example has the space conflicted), it’s a smart idea to get behind founders who make little excuses and don’t let the macro get in their way. It’s also important to back founders who intimately understand the nuances of NFT technology, and are actively thinking about how it might be utilized at scale in the future once mass interest returns in full force.

Solana Summer

It’s quite obvious if you go to OpenSea stats that Solana NFTs seem to be becoming more established. Led by Okay Bears, which has a floor of ~240 Sol or $13K USD as of writing this, Sol NFTs are gearing up to be the next ‘meta’, especially with FTX involved. While we’re not sure absolutely certain, we think that this Sol NFT bull run was ignited by the OS SOL integration.

We don’t think this newly sparked intrigue is due to over saturation in the ETH market (though it is over saturated) or due to gas fees (fees have been generally low recently). Yet Solana activity > ETH activity in the last 24 hours, with the majority of volume coming from Magic Eden.

So what do Sol NFTs have that ETH NFTs don’t in a seemingly deteriorating market?

First of all, our favorite short to medium term bull case, “shiny object syndrome”. Additionally, SOL NFTs provide a much more attractive entry fee (2-3 SOL being $100 to $200) and no extra surprise gas fee (that newbies complain about), making SOL good for onboarding n00bs.

We’re sure you’ve noticed your favorite NFT influencers sporting an Okay Bear or another Sol NFT on twitter. Sol NFTs like Reptillian Renegade are already up 40x+ from their 1 Sol mint price. Since it’s newer, we see this as much more degen, however, it may be worth your time to learn about this corner of the market if things stay relatively quiet. Transparently, we’ve remained a bit ignorant to this up until now, but will be going full steam to learn more and find “alpha”. Expect us to cover this more in the coming months.

Random Musings

With all of the craziness going on this week's edition is shorter than usual without a deep dive into any specific projects. We’ll be back next week with some updates on projects we’re looking into and curated “alpha”. With that being said, below are some thoughts on the current state of the market, strategies, and plans going forward.

“99% of projects will go to 0”. We see that starting to play out right now. *Most* projects that either 1. aren’t in the top 100 for all time vol on OS or 2. minted within the last month, are struggling to maintain any relevance. The veterans in the space we talk to are looking to cut losses quickly, take profits earlier, and remain as liquid as possible.

For those wondering what we’re up to, we mentioned last week that we are personally working to stay as liquid as possible, cutting down our core high-conviction holdings to ~5ish projects to follow and the rest are short term flips. It’s worth considering keeping your core holdings to a reasonable number where you are able to follow along practically daily. In this space, projects can make large moves very quickly on news, and it helps to stay on top of this.

In volatile times, there is a lot of opportunity to make high-risk / high-reward moves. Staying liquid allows you to take these risks. Buying Azuki at 8 ETH or Beanz under 1 ETH turned out to be a quick 2x+. In the coming weeks there are going to be plenty of opportunities similar to this presenting themselves.

Seemingly, scams are popping up left and right these days. This is certainly something that hasn’t improved and in order to onboard new members into the space, there will have to be UI improvements to smart contract signing/connecting a wallet. Stay vigilant and safe.

Post-reveal sell off is still a thing. If you’re betting heavily on a project pre-reveal (especially for flippers), the best time to sell is usually an hour or two before the reveal, when the vol is high and running the price up. As many projects have a floor price that gets cut within 24 hours post-reveal, your chances of pulling a 1/1 in 10k collection is extremely low compared to immediately losing 50%. Have a post-reveal plan, don’t be a gambler.

After all this time, discord is still one of the best indicators of a healthy community. *Redacted* projects have 100k+ followers on twitter, 30K+ in discord, and if you scan the chat it’s just a bunch of people saying “gm” so they don’t lose their WL spot. Remember, if everyone is looking to flip, then your strategy is not unique. Find projects that have a cult like community and the majority of minters want to *gamble* on revealing a rare stay for the long term. You essentially want to be fading the crowd.

This should be instilled in your head but just because somebody has a large following or a $100K USD PFP does not mean they know what they’re doing. Some of the worst takes and advice comes from these influencers. Many people are looking to pump their own bags, and it’s important you ask yourself “what is this person's incentive.” Nonetheless, there are also some amazing people out there providing value for free.

We are still not in a true bear market for jpegs. While NFT cycles seem to be “quicker” than general crypto, it’s amazing to see *experts* who think they can predict the future. The entire space is in its infancy and nobody truly knows what will happen next. We will know we’re deep in an NFT bear market within the next year when there is a 5-6 month+ period where prices are depressed and liquidity fully dries up. Hopefully, you like the art during this period because it won’t be fun, but the ones who survive always come out stronger.

Finally, we cannot stress this enough. While we’re not super positive in the near-term, NFTs are here to stay. Right now is the best time to learn, get comfortable, make mistakes, take risks, and get involved. The industry in general is going to grow exponentially and by the end of this decade we imagine the majority of those with internet access will have at the minimum used an NFT product (we expect token-gated access/verification for IRL stuff will become normalized). We’re not going anywhere.

MC Music

Hey everyone, Angelo here with another week of Mint Music. Before we get into it, hope the majority of you were able to exit relatively unscathed from the dip and nobody held Luna. But please buckle up, because it’s looking like a rocky couple of months ahead (seatbelt emoji, shrugging emoji).

This week we won’t be dipping into any new projects, however, we do think it’d be useful to investigate the ‘1000 true fans’ model. Given the inherent network effects that NFT’s afford, acquiring and monetizing “true fans” will be much easier for artists.

The 1000 true fans model defines a “true fan” as “a fan that will buy anything an artist produces,” often equating to over 100 beans a year. True fans will drive hundreds of miles to see a show, buy any new merch an artist releases, engage and support their social media posts and livestreams - really anything else a degen music fan would do. We know not everyone in MC is a hardcore music fan, but trust that these people are out there, supporting artists to let them do what they do - make music. If 1000 fans each spend 100 beans on a musician over the course of a year, this creates a livable environment for them - no more “starving artists!” This is a relatively small amount of beanage compared to some of the degen plays the MC Community has engaged in over the past year. NFT’s allow for artists to easily put out monetizable content tied to IRL perks, royalties, collections of songs or just cool art.

Out of all of the entertainment mediums, music is the most in need of a disruption to its economic model. When music transitioned to streaming, artist revenue was squashed. For example, Spotify pays artists $.006 per play, with 1M plays at roughly $3,200, it’s peanuts. Netflix went to streaming and movie stars continued to make a killing. The creator economy now allows for top tik tokers, youtubers and patreoners to monetize their content and make healthy profits. Why should music be any different? Web 3 presents itself as an opportunity for artists to profit, while rewarding their true fans with ownership in their success. The market might be down right now but protocols haven’t stopped building - will be interesting to follow how the space matures in a bear.

That’s all for this week and if you didn’t already, check out the new Kendrick Lamar, it’s fantastic.

Signing off - Angelo

Conclusion

As mentioned last week, NFT tech is not going anywhere. While nobody can pinpoint what will happen to the industry next, we’re 100% positive that in 10 years from now, NFTs will be a greater part of our lives whether we realize it or not. Ok, maybe a stretch since we spend 100 hours a week staring at pictures of cartoons, but you get the gist.

While we’re all generally confident that NFT tech is and will continue to be meaningful, where do our PFPs go from here?

Look toward traditional social media as a sneak peak at what the future of PFP NFTs may look like. While most people found the release entirely uninteresting, we firmly believe that the NFT platform that Coinbase built will establish a gigantic transformation in the way we buy, trade, display, and communicate using our PFP NFTs. PFPs are built for social flexing by nature. Zark Muckerberg knows this, Parag Twitter (h/t to Tim Apple) knows this, and we know it too. PFPs aren’t dying – just the bad ones are 😂.

Until next time anon.

Love,

W + P

Mint Jobs

Gm gm – we’ve got a phenomenal batch of jobs for you this week. It’s been about 6 months since we started covering Web3 jobs and as more things change in the market the more they stay the same in hiring. Social media and community focused roles are still by far the most commonly listed positions which, conveniently, also shouldn’t be out of reach for people with little Web3 experience.

Let us know if you’re hiring for incredible roles or if there are other types of opportunities you’d like to see in this section! Tweet/DM us @MintCalendar, @TheChild1996, or send an email to hello@mintcalendar.com.

Community/Social Media

Twitter Specialist (The Coral Tribe NFT, Remote)

Head of Community (Campus Legends, Remote, 90-130K)

Community Events Coordinator (OpenSea, Remote/San Francisco/New York)

Communications Lead, Social and Community (Phantom, Remote US)

Marketing/Miscellaneous:

Technical Writer (Coinbase, Remote)

Product Marketing Manager, NFT (Kraken, Remote)

Senior Director, Business Development (Ticketmaster, New York/West Hollywood)

Software Development:

Web3 Developer (Pudgy Penguins, Remote)

Full Stack Web3 Engineer (Nifty’s Inc, Remote)

UI Engineer, Protocol (Blockswap network, Remote North America or Europe)

Would love to hear thoughts or opinions on Alien Frens and if that's a project where you would "bet on builders." I do agree 99% of nfts will go to 0, and only some will survive.

100% agree with the Kendrick Lamar album, true art in the pop industry is hard to come by (I'm a classical muscian, so admittedly snobby, but KL as an appeal I can't deny)