(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all. Another week in the books. At this point in the market cycle many of us have gotten used to the current conditions and are constantly adapting our strategies to survive and thrive in what’s been largely “down-only”. While things are slow, we’ve seen a ton of “grail” sales this week which definitely brought some life and volume into the market. A $4.5 million dollar punk sale is nothing to bat an eye at and there were a few more 6 figure sales and sweeps as well this week. With everything being down so bad, attention is still everything and we see this with RENGA breaking to all time highs every other day with little pullbacks. Slow week again with a few notable stories –let’s dive in.

NFTs in the News

OpenSea partners with Warner Music Group on music NFT drops

Facebook, Instagram Users in US Can Now Share Ethereum, Flow and Polygon NFTs

Latin American NFT marketplace Minteo raises $4.3M seed round

Anchor creator Coral raises $20 million led by FTX Ventures and Jump Crypto

Japanese prime minister says gov't investment in digital transformation will include Metaverse, NFTs

Steve Cohen-Backed Firm Invests $10M in Web3 Game Marketplace AQUA

Market Update

We’re in a bear market where the majority of assets are down 90% and volume is practically non-existent outside of a few collections that dominate the narrative each week. As always, we have winners and losers every week.

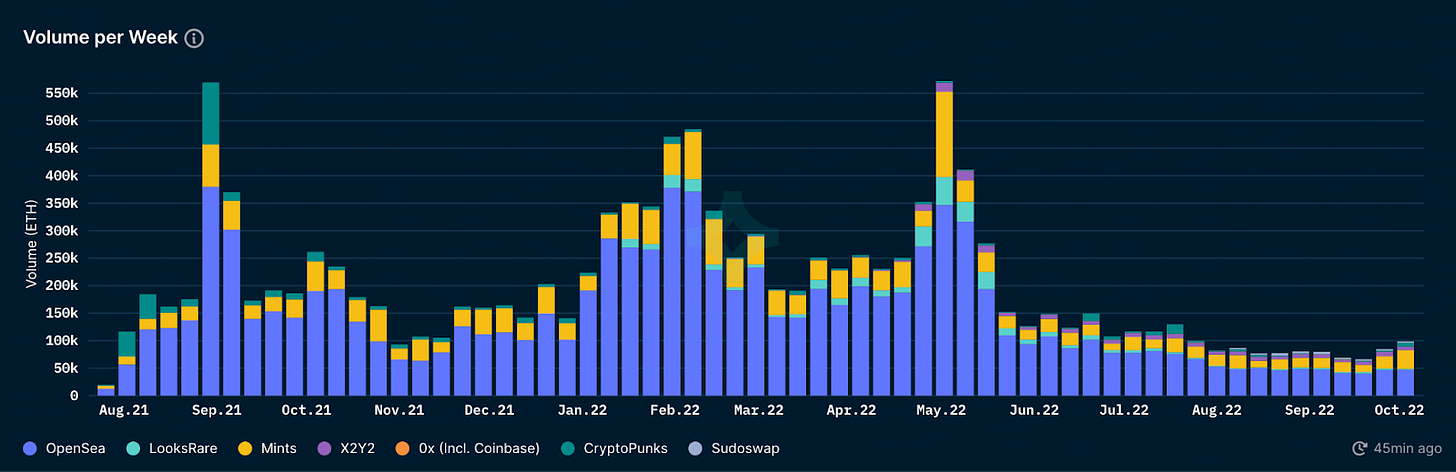

We saw a decent uptick in ETH volume this week (big on a relative basis), mainly due to Seedphrase’s 2 rare CryptoPunk sales which totaled 4,280 ETH. For reference, that’s almost an entire day of OpenSea volume in this market.

Opensea volume was up slightly week-over-week. This is somewhat notable since we’re now on week 3 of increasing volume since the absolute ghost town of a week post-merge. Also keep in mind, ETH has stayed within the $1200-$1400 range for the last 2 weeks now which aligns with the increase in trading volume. Correlation is certainly not causation but a “steady price” in ETH is clearly a trend where NFTs are a beneficiary.

While volume is still dead, it’s interesting to see pockets of hope with new mints, like we did during the week of May 16th, primarily due to Tyler Hobbes QQL Mint Pass with 999 at 14 ETH.

Chart: Nansen

So what are the takeaways here? It’s tough to make a proper call since the big increase in volume is basically due to 2 Punk sales, the QQL pass, and of course RENGA pumping. We’re still clearly in the depths of the bear market but it’s nice to see a rebound (on charts) at least. We’ll need another week or two in volume to come to any conclusions about where the market goes next.

Blue Chips

No real news this week for any of the “blue-chip” PFPs we cover in this newsletter. Most are flat on a week-over-week basis. The big moves last week in Moonbirds and Apes retraced slightly, and the other PFPs are doing a whole bunch of nothing.

To no surprise, Yuga assets are holding up nicely still and show the most relative strength. Apes are down slightly floating around an 80 ETH floor while Mutants are flat week-over-week around 15.5 ETH. Penguins are flat again on barley any volume as well.

Azuki’s are up slightly and reclaimed their 10 ETH floor, Doodles are flat at 8 ETH, Clone X flat at 6.5, and Moonbirds took a dip from 11 ETH down to 10 ETH.

The main notable take away is that the market is clearly exhausted. As of yesterday morning EST not a single one of the above 6 collections were in the top 100 for 24-hour OpenSea volume – not sure the last time we saw something like this. Most participants panic sold a while ago and if they didn’t, then they’ve likely come to terms with the idea of holding onto their bags tight. This is represented by the low volume and “quick” pumps we see on anything news related.

Musings and Narratives

Attention, attention, attention. With almost nothing going on, attention is everything. Whichever project can garner the most attention in this environment has a major advantage. Even more so than in the bull market. We can see this playing out week after week with Renga (including black boxes also), which is now beginning its 5th consecutive week as a top 5 most traded collection on OpenSea (ETH volume).

RENGA has managed to go from a .25 floor to 3 ETH in a few short weeks with little pullback and is showing similarities with sign goblintown’s rip to 7 ETH back in June. However, goblintown’s pump happened over a 2 week period before slowly grinding down 90%. RENGA on the other hand is about 50% of the way there, but with a slower grind up. No predictions here but the price action has been truly remarkable and much respect to all of the high-conviction holders.

RENGA is the clear beneficiary of this down market, and is practically the only thing new anyone is talking about since the y00ts mint. History shows that if RENGA continues to dominate the headlines and OpenSea volume then the positive price action will follow.

Paid mints continue to do better than expected for the most part. Coming up this week we have Prive and HELIX which both have some decent hype behind them. If both of these mint out in similar fashion to a project such as Multibeasts, it would be a safe assumption that the paid mint meta has returned. Overborne is another one we’re watching which mints on Oct 13th. Funny enough, these are all priced at .1 ETH which back in the bull market was considered “expensive” but now nobody bats an eye at these prices when ETH is $1300 and gwei is at 4.

Moving on, the small collection (~200-700) of unique 1/1s has finally died off. No surprises here. Outside of a few derivative collections and then Kitaro pumping, this wasn’t a huge week for quick flipping projects. Unless you aped into RENGA, most likely sitting on the sidelines has been the best play of the last week.

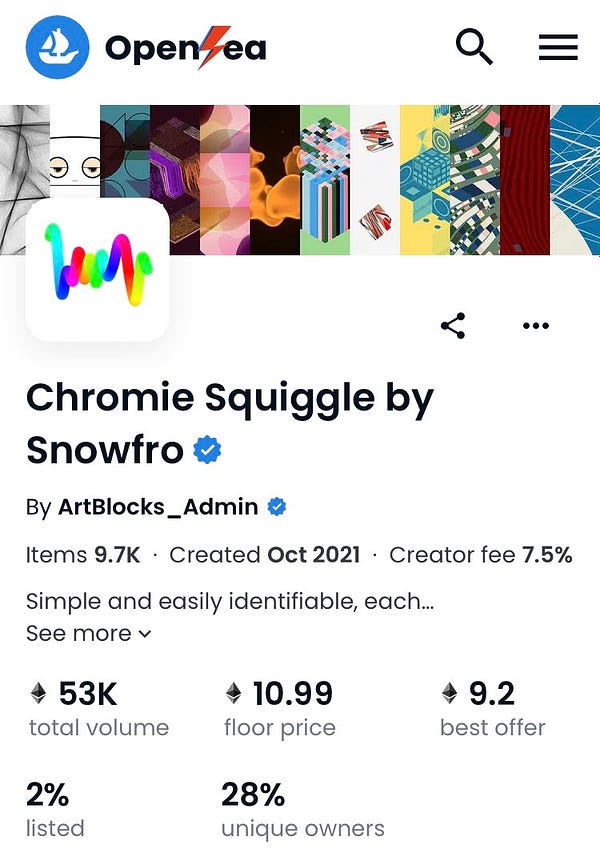

OG art collections like Squiggles and Fidenza’s are holding up quite nicely. We don’t hear much about digital art these days but many of these collections are catching a bid in the bear market. The thread below is funny, since it still shows that the majority of folks in the space still prefer a PFP over art. A few months ago goblintown was 6.8 ETH and squiggles were 6 ETH. The majority answered they’d rather hold goblins, which are now 1 ETH, while squiggles have almost doubled in the same period of time to an 11 ETH floor.

Finally, one thing to look out for is Seedphrase deploying his capital (4280 ETH). We saw a handful of projects have “quick pumps” due to massive sweeps such as Creepz, Wolf Game, and Doodles. These 50 ETH+ sweeps are nothing for him, and they’ll most likely be plenty more to come in the upcoming weeks as he has hinted.

Ideally, you want to see the floor prices of these projects hold up. If a whale is propping up the floor of any project it probably isn’t the best sign. If you’re looking for a “true” price for an illiquid project, check out the bid,ask spread between the floor and highest collection bid. This is probably the best gauge for the “true” price of the project.

Market Exhaustion

It’s clear the market is exhausted. We saw the chart below on twitter this week (forgot who posted this so feel free to dm us so we can credit the original creator).

This is an ETH chart but the idea of price based capitulation and time based capitulation happens to resonate. Our opinion is that NFTs have (hopefully!) finished their price based capitulation. Outside of blue chips and a handful of other projects, the majority are down 95%+ with no signs of ever recovering.

While the NFT cycle and the general crypto cycle are correlated, the peak of the NFT bull was in March/April when ETH was already down 30-40% from its all-time high. We’re now at the point where things are going lower on a steady grind down due to low volume and people simply giving up. If you go through the majority of the collections in the top 200 all-time volume on OS, you’ll notice that a significant portion of the volume is in wETH bids that people are accepting. Whether they’re realizing the losses for tax purposes or abandoning their “forever PFP”, we feel like we’re now in the next phase of capitulation, time based capitulation.

Ultimately, nobody has any idea how long this will last (if they do they’re trying to sell you something). While we may be in store for some bursts of volume this month, if projects are not trending on OpenSea, the prices will continue to slowly grind down.

Conclusion

The market is still no fun, but companies are still finding ways to capitalize in the space, as seen with drink brand Neuro spending 777 ETH on a rare BAYC.

While this is obviously a marketing stint that we’ve seen over and over again, it’s still quite interesting to see it persist. A relatively unknown drink brand literally “apeing” in 777 ETH on a rare BAYC in this market is incredible. Most of the times we’ve seen this these collections purchase a floor, but this, whether smart or not, shows some conviction.

And when everyone is fighting with one another for being “down bad”, purchases like these help inspire hope for what’s to come in the future.

Or maybe their marketing just flushed 1 million dollars down the drain. Time will tell.

Cheers,

Mint Media