(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all. Another big week and a lot of new followers, welcome everyone. So much to cover once again so we will keep this intro short and sweet. Just a few housekeeping items:

Disclaimer: nothing in this article is or is ever intended to be financial advice. These are all the opinions of an anonymous cartoon penguin and cartoon lizard. We simply gather information we find interesting and share it with you. Always DYOR.

We’re currently running a referral program to win ETH rewards and NFT raffle entries.Click here to join.

We have a great section at the end of this newsletter covering available career opportunities throughout the web 3.0 space. Please reach out to us on twitter @MintCalendar or @TheChild1996 if you have any feedback or suggestions for interesting job opps we may have missed.

Be on the lookout for some twitter spaces this week. We’ll be looking to host with the founders of some projects that we’ve mentioned in recent weeks.

With that, let’s jump right in, and happy almost valentines day. Thank you to the Golden Pups team for this cute cartoon!

Macro Update – Special Q&A Edition

While the bull market in NFTs continued to rip this week, we’re assuming many of you have begun to notice the various forms of FUD (Fear, Uncertainty, Doubt) taking shape on the twitter timeline. We can start with this thread which we absolutely think is a must read, especially if you are new here. With all of this overall uncertainty and the resulting onslaught of questions which naturally followed, w decided to structure this week’s macro update in the form of a more traditional Q&A (thanks to contributor BowtiedDropBear for the questions).

How big of a catalyst will Coinbase’s NFT platform actually be?

We think the Coinbase NFT platform will be a larger catalyst for adoption than people imagine. Coinbase remains the dominant platform which onboards new users to crypto. Right now there are ~20 million MetaMask wallets and 56 million registered users on Coinbase. Even if we assume that 100% of MetaMask users use Coinbase (which will not occur), Coinbase will still increase access to the NFT space by over 100%. Ease of use and trusted platform security will drive mass adoption and keep this train rolling for the foreseeable future.

Is this the point at which pop culture adoption of NFTs hits critical mass and accelerates (e.g. Bieber buying an Ape, Super Bowl ads) or are these top signals?

“Top signals” are seemingly everywhere these days. However, we think these could just actually be misinterpretations of a nascent trend picking up steam. All of these instagram influencers (who already flex their lifestyles publicly) are starting to realize that they can perma-flex through a digital identity by spending a “few racks” on some jpegs. This also enables them to growth hack their audience by tapping into a highly engaged pre-existing community. Plus, why flex a rolex to people in person when you can reach 100x more people online? We imagine many of these instagram models or fitness influencers haven’t learned how to use metamask yet, and since their entire lives revolve around showing people “how much fun they have”, the wholly digitized version of this should be coming sooner than you think.

If these are top signals, do all projects get rekt? Could blue chips weather the storm largely unscathed?

We think blue chips don't retrace more than 30-40% (from their average 30 day price, not ATH in a "bear" market), which is really quite insignificant in the NFT world. In the traditional art world, the majority of capital flows to the top, and the types of individuals who can afford to own these pieces can afford to remain illiquid for longer (i.e. most Punk/BAYC owners). A significant majority of the projects from the last cycle went to 0, and it does seem like we are getting to a point of over-saturation again, however, we think this cycle may last a bit longer due to the greater number of new entrants. A hypothesis we’ve been floating is that there will be a new, more established secondary tier below the ‘blue chip tier’. These are the mercedes/bmws of the nft world, for wealthier individuals who couldn’t necessarily afford the ‘lambos’ of the nft world (punks/bayc) but want to flex and hold an nft that will actually retain its value. Tldr, we feel that the space is broadening and that valuable nfts that hold their value wont strictly be for the ultra wealthy for much longer.

What are you most nervous about? What gives you FUD?

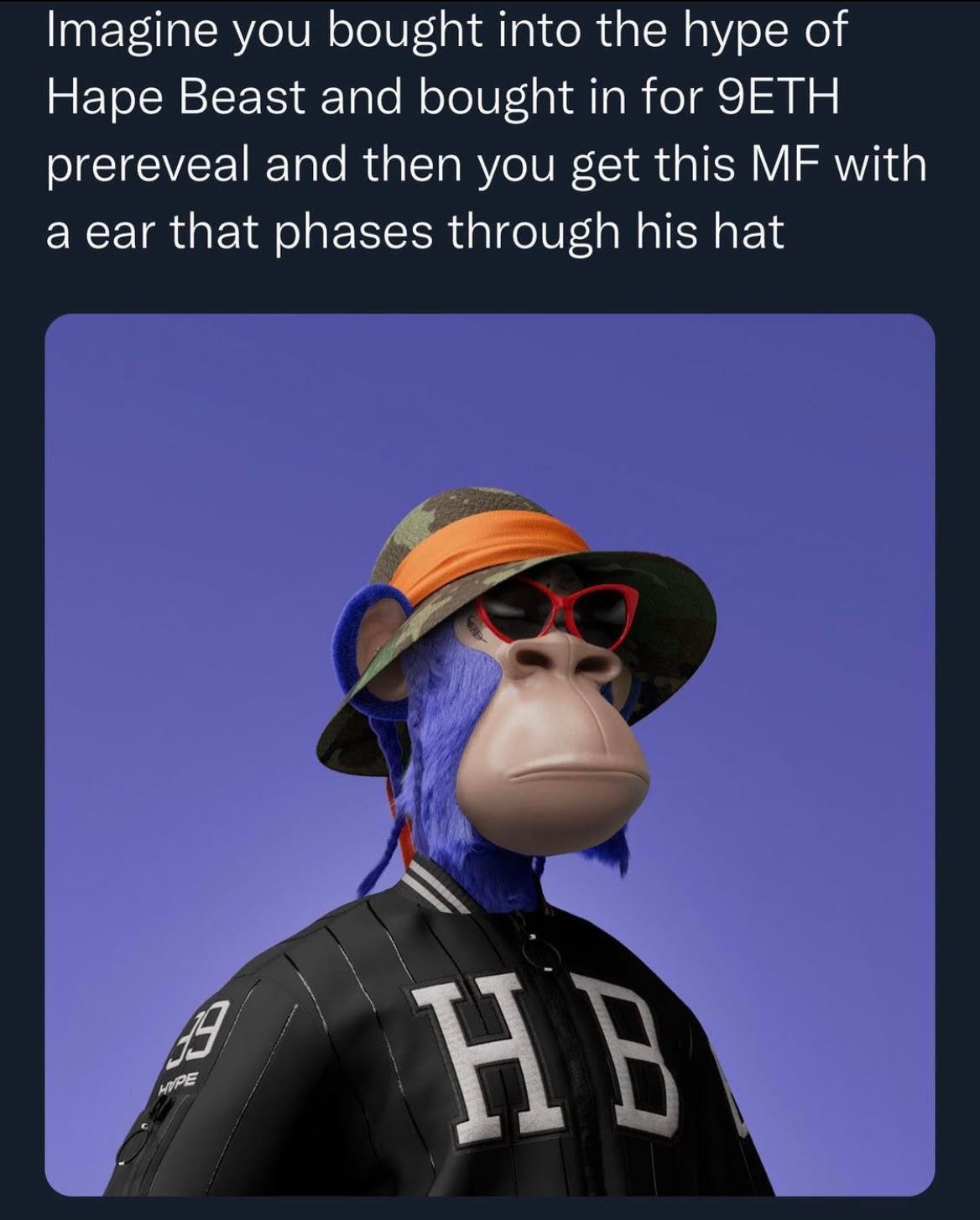

How easy most new entrants think it is to mint random projects and hit a quick 3x and how true this has been the last month. This reminds us of the tail end of the last NFT bull market back in September, when it was almost impossible to lose on a new mint. What gives us FUD is the image below.

It does seem like we are getting to the point where there are almost too many top signals. The real question is how much longer can new entrants outpace new projects? In our opinion, we think this can last until roughly the end of Q1 (which aligns with the length of the previous cycle). We still see many white list-only projects that are super confident about minting out and don’t even open to the public which is a sign of strength. A tell-tale sign of impending danger will be when projects start moving their mint date sooner than expected – this is a nervous tell that the creators think impending doom is coming to the market. We also think that there'll be a lot of ETH selling into March in order for folks with massive 2021 gains to pay their taxes. The nft bull market shouldn’t end as long as ETH is in the $2K–$3K range.

Thoughts on NFT Hate?

Think this is super bullish. All of those calling NFTs scams, money laundering, bad for the environment shows cope from their lack of involvement and seeming inability to do basic research. We think that this will continue to induce more FOMO from non-jpeggers and onboard more people into space. At the end of the day, slinging jpegs is super fun. Most people who get involved get addicted to it, like we are.

Mass adoption is coming. NFTs aren’t a fad anymore and will become a more important part of society year after year. The space isn’t going anywhere and expensive jpeg purchasing will become more and more normalized. Even Nintendo is looking into the space. We are Hyper-bullish on not only the future of NFTs, but think more and more well-run projects and communities will become household names, just like BAYC has.

New Mints

Ahhh, the part of this newsletter that most of you probably skipped straight to. We’ll be covering 2 new interesting projects *that we plan on minting at time of writing* as well as some other interesting observations in space. For those who are new, we recommend checking out last weeks newsletter. We’re not going to cover any of the projects mentioned last week, but we still think that every project mentioned will be, at a minimum, a short term winner. Will be getting involved with as many of them as we can.

Catblox

Mint Feb 17th | Supply: 9999

Cool idea with unique art and concept. Large twitter following and extremely active discord, especially for being private. Recent AMA in discord had over 500 listeners at one point. While we’re exclusively bullish on projects that use the whole “let’s be super mysterious to gain hype” strategy, we think CatBlox has done a decent job with this approach and has been transparent enough for our liking. Anyways, here are our thoughts on why this could be a potential winner:

It seems like they want to do some sort of open canvas model here. Essentially collaborating with unique brands and other projects. Since the cats are relatively sleek and plain, our expectation is that the team will enable holders to upgrade their cat and continuously change the design.

We like projects that constantly host AMAs and interact with the community. We listened and were impressed with the thought out answers to various questions.

Video production here is extremely well done. Seriously, the team is not lying when they say they're backed by a Web3 studio in LA and that their team is full of veterans.

Memability. While the cat's cuteness caters to the NFT crowd, the discord is actually hilarious, with 100s of members repeatedly saying things like “I’m ready for my milk”. The team has played to this vibe very well, giving White Listers a “Got Milk?” tag.

SUPERPLASTIC has a 11 ETH floor - same art style.

Bear case is pretty simple: team either ends up being unable to collaborate with communities and real world brands or the open canvas model is too expensive with gas.

A lot to unpack here with a project that has a massive vision and we’ve seen that most don’t end up executing. What is clear is that the artist is extremely talented and these guys get an A+ on marketing, community management, and engagement with discord members. Think we may have found a hidden gem here and as a result we will be minting. Recommend following along on their twitter in order to get a discord invite and keeping on your watchlist.

Blues

Supply: 5555 | Price: .075 ETH

One of those projects where we’re betting on the founder, Condz. This dude knows his stuff and is fully doxed and runs a crypto youtube channel. There’s a lot to unpack here with Blues, but their main value prop is to create a large organized group of blue chip NFT whales to collaborate and identify future winners together. They’ll then plan to use the profits from these new mint wins to acquire current blue chips, or other undervalued projects.

Generally speaking we really don’t love the idea of alpha groups but Blues has the best approach we’ve seen so far – to get a “blue whale" role, you actually have to use collab land to verify your own assets (there’s 100+ verified Cool Cats and MAYC along with 25+ BAYC). If this project can stay organized then the alpha in the private discord of the “blue whales” can be extremely valuable. Their bluepaper is quite insightful and lays out their acquisition plans moving forward – if these projects stand out to you, but you don’t have enough ETH, then blues could be a good proxy bet.

Again, we’d usually steer clear of the alpha group concept, but for .075 ETH and access to 1000+ verified high-eth-floor project owners, this project simply makes sense to us. All you need is for somebody to get you 1 WL on a moonshot project and blues pays off tenfold. There’s a lot of NeoTokoyo folks in this discord and NT seems to have a similar idea going on in their own discord, which is why the floor is 30 ETH +. Anyways, high risk/ high reward mint. DYOR.

Sappy Seals Update

Quick follow up here. Seals have been absolutely killing it. Wabdo.eth is a brilliant operator and has taken what was once seen as a joke of a project to a ~1.4 ETH floor and flipped pudgy penguins. When we touched on them a month ago we noticed a .1-.4 floor rise sharply due to only 6% of the supply being listed. Now, under 3% of the total supply is listed. Worth keeping them on your radar, think there is good long term value here.

Hape Prime is Mekaverse 2.0 (not a hot take)

Mentioned over 2 weeks ago in our discord, we said, do not buy into the hype of Hape Prime. Now at a cozy 4.5 ETH floor at the time of writing, you could have got this gem for only 9 ETH just a week ago. Again, this will have the same fate as Mekaverse, over-hyped, shoots up to a 8-9 ETH floor pre-reveal, and then once revealed the art all looks the same and is generally nothing special. There never was a roadmap here and insiders dumped on retail again. Lessons learned. Don’t buy into over-hyped projects that influencers shill. Look for teams that are building while staying under the radar, that’s where the real value is.

Conclusion:

Uncharted waters ahead as we expect another choppy week. Overall things still look good for the bull market in internet pictures to remain on schedule. Cherish your ETH as it may become harder to hit those quick flips.

Have a wonderful week everyone,

- Wilson & Paul

Web3 Careers:

Another great week for Web3 jobs with positions all over the US, Europe, and our first highlighted role in Saudi Arabia. Truly awesome to see the demand for Web3 job seekers no matter where you are.

There’s a million software development and engineering jobs out there – if you have these skill sets you are the most hire-able job hunters in the space. If you don’t have that background take advantage of the increasing demand for community managers. I’ll be focusing a bit more on these low barrier to entry positions over the next couple of weeks because most folks don’t have that computer science background!

Let us know if you’re hiring for incredible roles or if there are other types of opportunities you’d like to see in this section! Tweet/DM us @MintCalendar, @TheChild1996, or send an email to hello@mintcalendar.com.

Community:

Head Community Moderator (Kolex, Remote Global)

Analyst Manager, Trust and Safety (Coinbase, multiple locations)

Tezos Community Manager (Rarible, Remote)

Community Moderator, Discord (Autograph, Santa Monica)

Marketing:

Marketing Manager (Zapper, Remote Europe/North America)

NFT Marketing Lead (Admiral Media, Remote Spain)

Chief Marketing Officer (Mars4, Vilnius, Lithuania)

Strategy/Miscellaneous:

Metaverse Product Manager (ClubRare, New York or Remote)

Product Manager (Cryptomena, Saudi Arabia)

Chief People Officer (NFT.NYC, Remote US)

Software Development/Data Engineering:

Senior Fullstack Web3 Engineer (Lazy Lions, Remote)

Frontend Engineer (GFX Labs, Chicago)

Loved the macro outlook on this one sers, great info

"slinging jpegs is super fun" ... no, making a quick buck is super fun ... people would get addicted to windmilling their dicks in circles if they made a few grand every time they did it ... the core idea that this whole market has long term legs just because its fun is mega naive ... and thats coming from someone who is a believer in nfts ha