(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all. Another week in the books as we wind up what’s been a rough summer for all things crypto. Volume across the board is still depressed and there’s plenty of drama as Pudgy Penguins continue to pump. Practically everything is lower week-over-week in ETH and USD price. On twitter, you can tell that everyone is down bad due to all of the pointless fighting and arguing. Nonetheless, we’re still here, simply vibing online with anons. A lighter week than usual with an awesome guest post. Cheers!

Updates

We’ll be hosting another twitter spaces this week at 2pm EST on Friday August 26th

We have an amazing guest post this week on the BendDAO situation from YZY

NFTS In The News

Metaverse avatar platform Ready Player Me raises $56 million from a16z and others

NFT exchange SudoRare suffers $800,000 ‘rug pull’ six hours after launch

Sudoswap Erupts as NFT Traders Capitalize on Royalty-Free Sales

BAYC Creators Interviewed as NFT Lending Crisis Looms

Fractional Rebrands, Raises $20M to Expand Collective NFT Ownership

Pudgy Penguins Ethereum NFTs Pump 83% As Meta, Nansen Execs Join Advisory Board

Dapper Labs Opens NFL Version of NBA Top Shot NFTs to the Public

Ex-OpenSea Exec Argues NFTs Are Not Securities to Dismiss Insider Trading Charges

Market Update

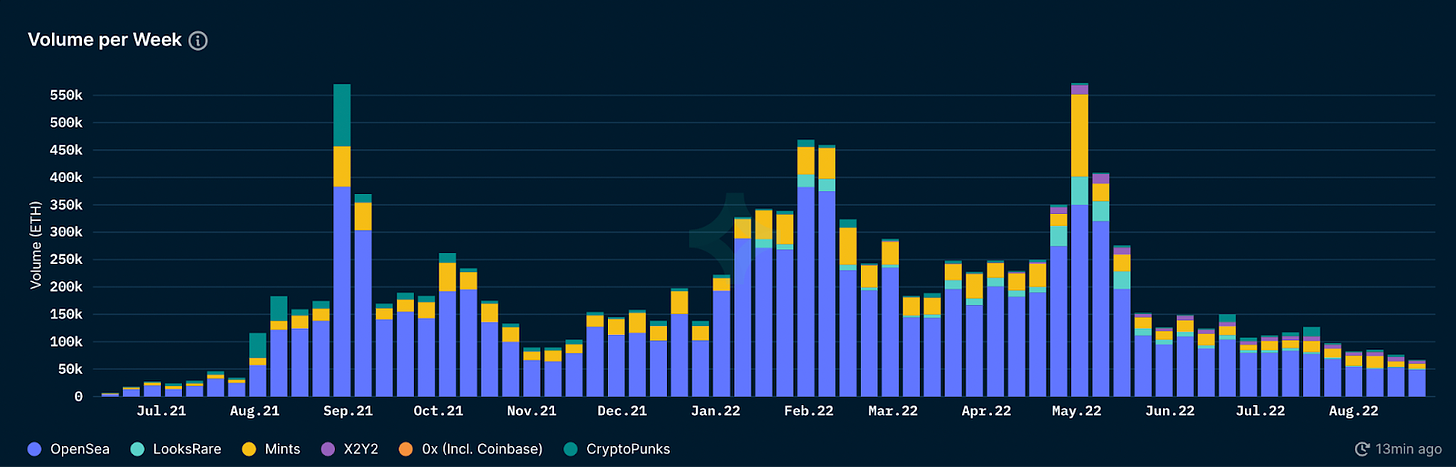

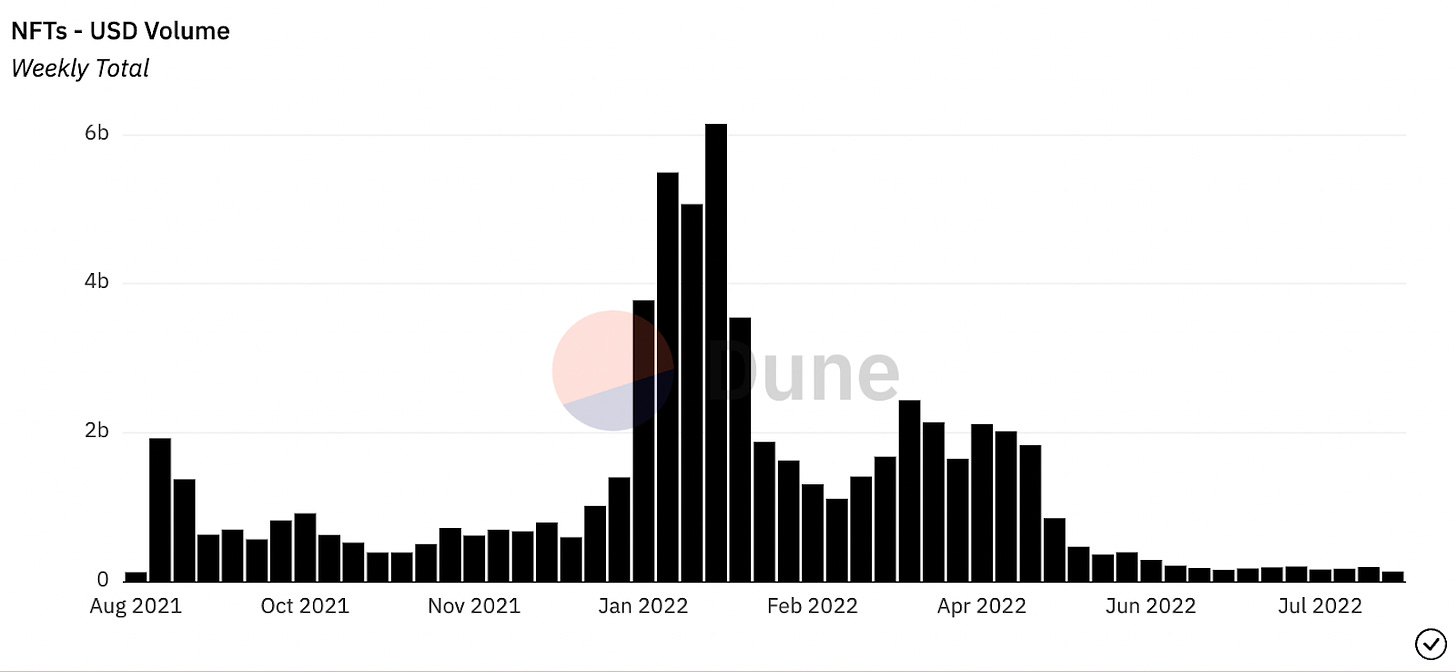

Eth took a real tumble this week, dropping from the $1900 range to the $1500 range in what turned out to be a quick 72 hour flush. As we know, NFTs don’t love ETH volatility and we saw the prices of our jpegs continue to fall in both ETH and USD terms. Last week's sad excuse for a bounce only lasted a few days and we now have the lowest volume week of the bear market.

Adding insult to injury, volume per week in ETH is now at its lowest point since July 2021. We did it! While the ETH volume is no fun to analyze, we still need to ask ourselves, why is volume so low? Despite what looks like more users abandoning NFTs on a high level, the main reason for this is due to depressed floor prices. Let’s take a look.

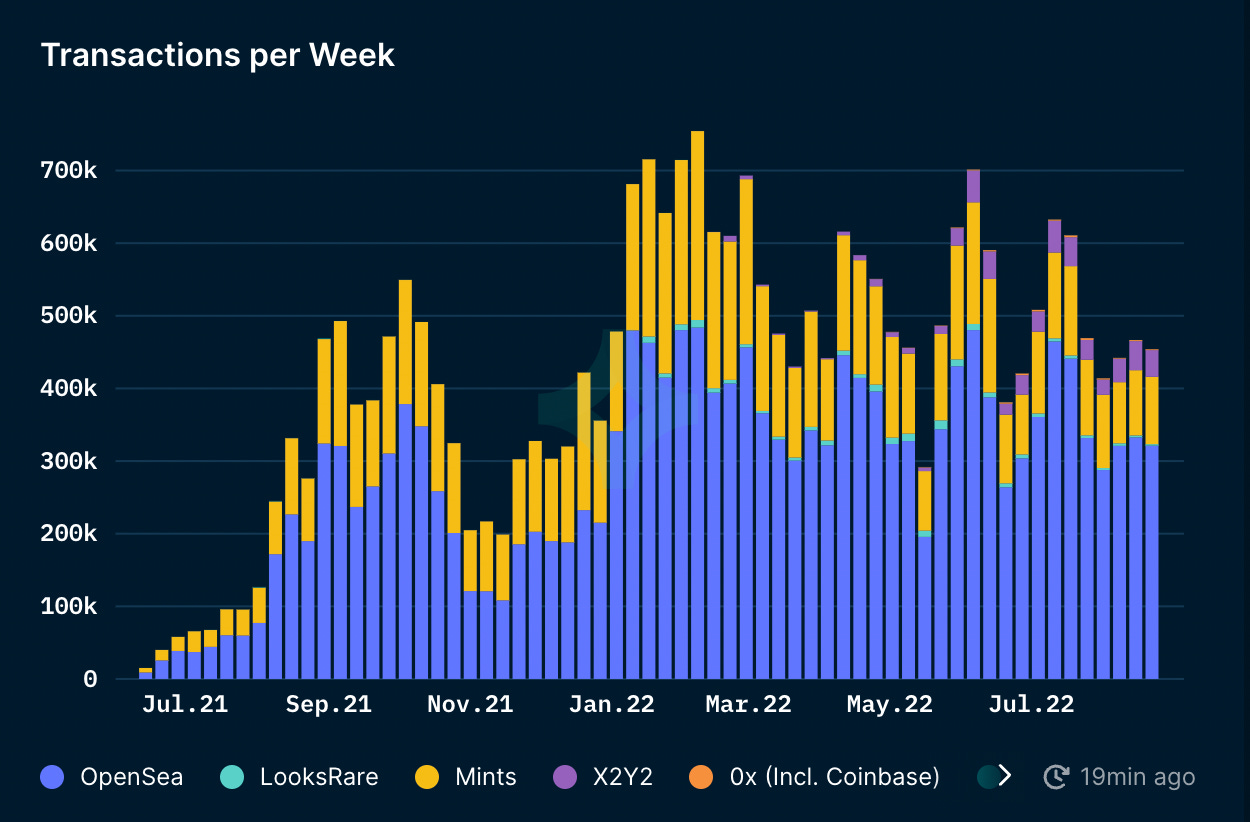

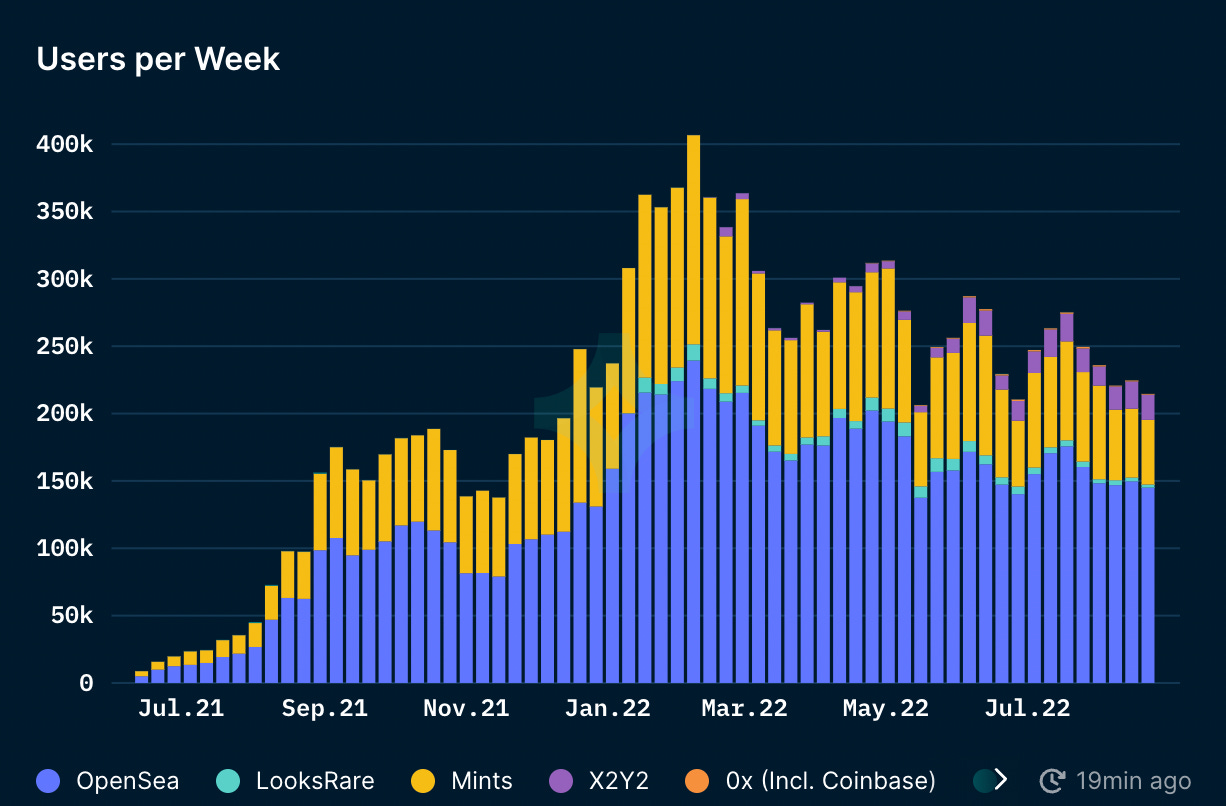

Weekly transactions and users are down slightly week-over-week (WoW), but nothing too notable. We’ve been arguing that over the past month or so there haven’t been many *new* people leaving, and instead what we have is the same X amount of wallets trading against each other in what is a purely PVP market.

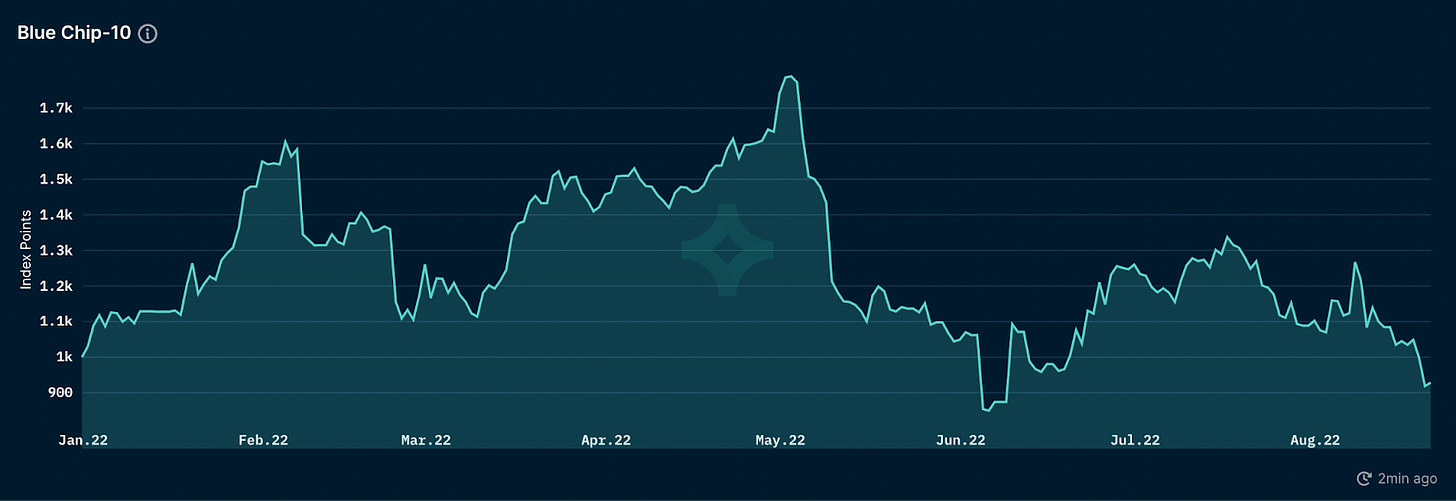

A primary reason why we see the ETH vol drop off WoW is due to floor prices continuing to drop. BAYC below 70 ETH, MAYC below 14 ETH, Azuki below 6 ETH and Doodles/Clone X teetering on the edge of 6. The highest trading volume collections or “blue chips” continue to fall in the month of August.

As we’ve seen prices (in ETH) continue to nosedive, it begs the question – what even is a blue chip NFT? Outside of the “big 3” for ETH (BAYC/Yuga ecosystem, Punks, Nouns), projects like Doodles, Clone X, Azuki, and Cool Cats, which were once-upon-a-time universally recognized blue chips, have been absolutely devastated. It really is quite the spectacle to watch diamond handed holders abandon these projects, and we all know the art doesn’t look as good at 6 ETH as it did at 20 ETH.

Moving on, the combination of the downtrend in NFT prices (in ETH) and ETH also going down in USD value makes for unsurprising yearly low for NFT trading volume in USD value. This chart is certainly not fun to look at. As mentioned last week, 99% of NFTs have gone to “Zero already” or in other words, down 95%+ from the ATH with little to no hope of coming back.

As we stated on our twitter spaces last Friday, most of these projects will not come back next cycle. Please read that again. The majority of projects will never see an ATH again. Similar to the 2017/2018 cycle, these need to be treated like altcoins (read: shitcoins). Well-read market participants who continued to double down on shitcoins buying the dip, instead of the shiny new object (sol / avax this cycle) were outshined by a bunch of anon degens (a tale as old as time). Just look at the charts of old winners like NEO, EOS, and IOTA in the altcoin world – many projects will have a similar fate.

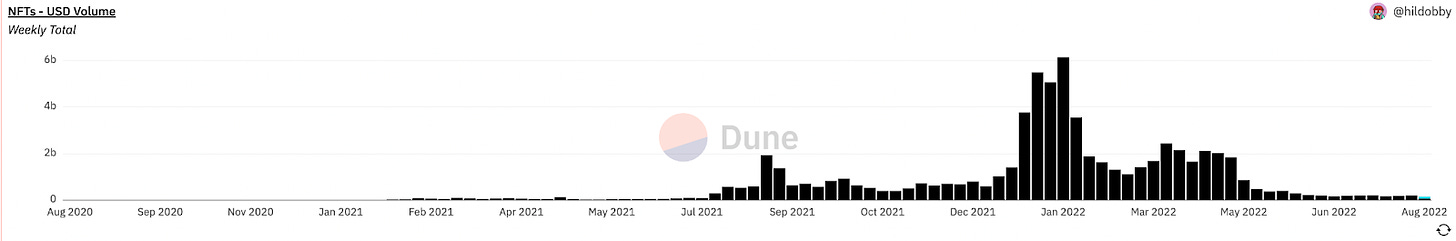

If we want to be optimists, the chart below shows $140 million USD weekly trading volume for NFTs, so this isn’t so terrible considering everything is dead, right?

If we zoom out, we’re still doing more volume than any week before the week of July 26th 2021, which was roughly the start of the initial NFT bull market (specifically PFPs). ETH prices were also higher then compared to now (yes, we know there was a quick flush to the $1700s). So, now what? Are these the lows?

It’s tough to tell mainly because of volatile ETH prices. That being said, based on users and transaction data we’d wager volume doesn’t get much worse in ETH terms (impossible to tell in USD due to volatility).

Most hyped PFP projects are down 95%+ as shown last week and will continue to drop in price as naive community members continue to buy the dip on weakness. But, you’re smarter than that, you have patience. For now, free mints and winning *degen* plays will continue to appear as the remaining participants battle it out for quick gains in this head-to-head “casino”. Remaining on the sidelines has never felt better.

More Thoughts On “Blue Chips” & Penguins

To start with a note on blue chips, we’ve discussed Pudgy Penguins many times in this newsletter over the last year, preaching the undervalued NFT (we own a lot) and got laughed at for saying it will be a blue chip PFP some day.

If you followed us in the fall of 2021 we mentioned that the Mint Media team’s heaviest bag was in penguins. While we’re clearly bias, the fact is that Penguins have been the best performing NFT asset since the bear market started and hit an ATH of 4.3 ETH floor this weekend (ATH in USD was ~12k so not quite there). The idea that memes are currency has not gone away, and now with the new team running the project like a traditional business bringing in revenue with the launch of pudgy toys, we’re confident there’s a bright future for the team here.

The guy who recently paid 400 ETH ($630,780 USD) clearly thinks so.

While we’re not here to shill a specific project, what we’ve noticed is that buying *strength* in the bear market has been a good strategy thus far - the main issue being the lack of strength😂. It’s never smart to buy into a pump if you have FOMO, but buying into strength has worked out well for other projects like Punks which briefly passed BAYC this week and even a collection like DeGods on Solana which is holding up extremely well and still staying under the radar. CryptoDickbutts is another project that has rewarded many holders with its rise in floor price.

When the majority of the timeline doesn’t *understand* a pump or seems angered by it, it’s always worth taking a look. This resentment only feeds into more momentum, plus it makes the memes much better. While this isn’t a hot take anymore, definitely think this week's 4.3 ETH ATH for penguins will be broken at some point in the coming months.

One final note, the *best* strategy for most is patience and remaining sidelined, don’t overtrade yourself to oblivion in the chop.

What the heck is going on with BendDAO (Guest Post YZY)

Initial Note From Mint Media - we spoke about BendDAO on our twitter spaces last Friday, but since this is making noise all over NFT twitter, we figured we’d bring in an expert for a guest post. YZY is a power-user of many of these lending protocols and is highly competent in this area. Here’s a great explainer below:

Hi, this is YZY with a short guest commentary on the current BendDAO situation. Currently working as founder of Mythicals and full-time yield-farmer since early 2020. I have been using all the big NFT lending protocols (mainly as a borrower) such as NFTfi, JPEGd and BendDAO basically since day one. Over the last few days there has been tons of coverage on CT and news sites alike about recent developments over at BendDAO, oftentimes missing the point entirely and posting just for clicks/engagement baiting ('depositors REKT' and/or 'market will crash') or out of ignorance.

Keeping this high-level only here and not going into technical details, feel free to DM me on Twitter if you have any questions or leave a comment here. Thanks to NFTStatistics for highlighting the wallet activity and a good summary (https://twitter.com/punk9059).

What is BendDAO?

BendDAO is a NFT lending protocol which allows holders of 'bluechips' to take out a loan (in ETH) against their NFT which is used as collateral. Loan-to-value varies from 30% (CloneX) to 40% (Punks & BAYC). So for instance, if the Punk’s floor is 100 ETH, you can take out a loan of up to 40 ETH by depositing your punk into BendDAO. Getting your punk back requires you to pay back the full loan amount plus interest. Liquidity (ETH) comes from lenders who deposit ETH into BendDAO for a yield (which of course is lower than the interest rate borrowers pay).

What's going on there now?

In short, they have been running out of ETH on Sunday night, meaning that lenders could not (temporarily) withdraw their deposited ETH. Something around 15,000 ETH has been deposited by lenders. This lack of liquidity also led to exploding interest rates on borrowed ETH (around 100%), while deposit rates are going up too (around 80%).

Why has this happened?

It's mainly because of the flawed auction mechanism BendDAO is currently using. Liquidated NFTs only get put up for auction once the LTV reaches 90%, meaning that going back to our example above, the punk floor would have to drop to around 45 ETH (ignoring accrued interest) for an auction to happen (40 divided by 45). BendDAO requires all bidders on liquidated NFTs to lock up their ETH for bids for 48 hours plus the bid has to be higher than the outstanding debt AND higher than OS floor * 0.95. This quickly becomes an issue in bear markets when NFT prices dump quickly. That's why there are now quite a lot of NFTs that have an outstanding debt higher than their current floor (floor dropped below outstanding debt since auction start), meaning that there is 0 auction demand for bidding on a lot liquidated NFTs, and thus the loan is not getting paid back, which led to this current lack of liquidity.

Why this is very likely to be a non-issue?

A proposal has already been set up to change the liquidation threshold to 70% and make it more attractive for bidders in the future (remove current strict bidding requirements so it will be possible to get a good deal in an auction). This will lead to more paid back loans and thus more liquidity.

However, even without any change, everything would likely be fine over the long-term anyway. If no one bids on those liquidated NFTs, they remain with BendDAO who could just sell them for let's say 80% of the floor price within seconds (bots will just pick it up immediately) on OpenSea. The entirety of the deposited collateral exceeds the ETH deposits by around 80%, so there is no issue if they were to dump them with big discounts.

Let's have a look at the BendDAO ETH wallet.

Since the ETH balance reached almost 0 a day ago, it has been sitting firmly above 400 ETH (at time of writing this) after some loans got paid off, without getting botted by depositors who might want their ETH back. Depositors are apparently not in a rush or have any desire to withdraw their ETH, maybe because they understand the mechanics better than engagement farming news sites/CT accounts?

Final note is that the impact of a potential cascade of collateral liquidations on the broader NFT market in general and floor price of a specific project in particular is an entirely different discussion (most likely non-issue as well in my opinion).

Everyone always claims to fade CT to be on the right side of a trade, but people rarely follow through on their words and just larp. I have high conviction that capitalizing on those current high deposit rates is a plus EV decision for the time being, that's also why we are using a part of the Mythicals Collection treasury to farm on BendDAO as a depositor for the next few weeks ('put your money where your mouth is').

Shameless self-promotion, join the Mythicals discord to find out more (we yield-farm with the treasury and airdrop ETH every month to our active holders).

Conclusion

With another tough week in the books, and the environment not seeming to be getting any friendlier, we’re still breathing. There are still big players coming in making massive purchases, showing strong conviction in a space that’s just experiencing its first ever bear market. Should we have blind faith in these whales? Do they know something we don’t? Or is this just another greater fool who is playing with casino chips?

Time will tell. Don’t forget to check us out on our Friday twitter spaces if you want to chat or just simply listen to us spew hot takes on the market. Finally, let’s all be nicer to each other. Have a great week!

Cheers,

-MM Team