(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm folks! Another week in the books and we’re now operating on Ethereum’s new POS chain. Exciting stuff, except for the part where we had even lower volume than last week! Anyways, no need to fret, we may be due for a market bounce soon – we’d be surprised if volume kept trending down through October with no relief. There’s a ton to cover this week so we’re diving deep on where we think to look next in this market. No time to waste, let’s jump in.

Today’s post is brought to you by NiftyCat

NiftyCat is pioneering subscription NFTs for brands - these are NFTs that brands can distribute to their customers (often for free) as an incentive to subscribe or reorder, and grow in value the longer a customer is subscribed or the more money someone has spent.

With NiftyCat, brands can create NFT collections in minutes and send them to their customers through a simple URL - crypto wallet and crypto-literacy are optional, not required.

Web2 brands have too often used NFTs as lazy cash grabs without any real understanding or desire to actually execute, these have largely flopped and not how more people will be onboarded into web3. NiftyCat is enabling brands to create low-cost NFTs to support the revenue streams they already have and grow loyalty vs. trying to milk the crypto community for money.

Brands can get started for free and for most brands, will cost less than $100 per month. To learn more, sign up on niftycat.com

Housekeeping

A quick note: We will be hosting weekly twitter spaces and sharing our thoughts on the market and specific topics every Thursday from 6-7pm EST. If you’re interested in a specific topic, please email us at wilson@mintcalendar.com.

NFTs In The News

Doodles announces $54 million raise, plots hiring spree

PGA Tour Golf NFTs Coming to Tom Brady’s Autograph Platform

This San Diego Car Wash Is Using NFTs to Drive Up Demand

Fortnite Creator's Epic Games Store Launches First NFT Game

KKR experiments with listing private equity investments on Avalanche: WSJ

Fidelity to offer bitcoin trading to retail customers: Reports

Yuga Labs Hires Chief Gaming Officer to Further Web3 Gaming Push

An NFT minted after The Merge cost $60,000 in transaction fees

Market Update

If you read Mint Weekly last week, it should be no surprise that we took another dip in volume. In anticipation of the merge (which was successful), many were flat in ETH (or hopefully USD) and were awaiting the completion. As expected, there were no issues (on POS) that we know of and all was smooth. Because of the time we all spent in pre-merge purgatory, there was extremely low trading activity, so much so that we hit another yearly low for volume on OpenSea.

Floor prices on the other hand have held up surprisingly well in ETH over the last week throughout this low volume environment. This is a nice surprise and we didn’t see this coming. On the other hand, as predicted, ETH volatility is back and the price is unfortunately going in the wrong direction.

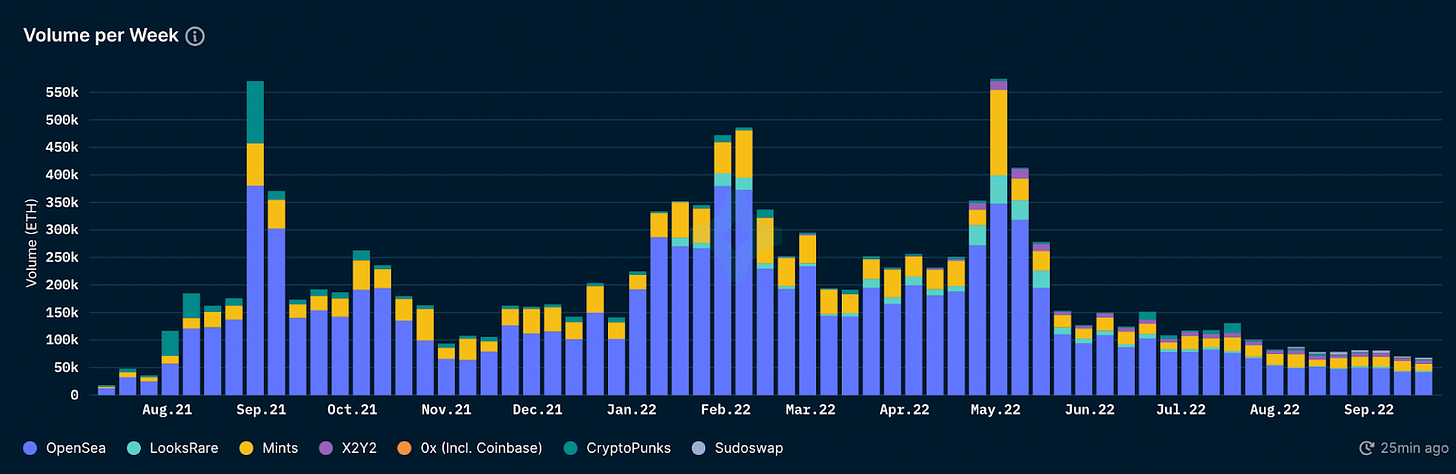

Chart: Nansen

As we can see in the chart above, volume ticked down and we’re still in a broader down-trend since the beginning of the NFT bear market which commenced toward the end of May.

What’s next? We spoke about this in depth on spaces last week but we may be in for some sort of overall market bounce in October (in terms of ETH volume, not prices). It’s certainly been a ghost town and we haven’t had any relief besides the Goblintown / WAGDIE twitter spaces meta in early June (both down over 80% from their all time high… nice) and the 1 week of “degen season” in early august.

Moving ahead, we need ETH post-merge volatility to settle. Whether it’s in the $1,200 - $1,400 or $1,400 - $1,600 range, once ETH stabilizes (hopefully!), this should set up a nice environment for us Jpeg enthusiasts. Both ranges provide *historically* cheap ETH, but it’s the lack of volatility that’s more important than price. We’ve seen an extremely small number of new paid mints and free mints and think we’re overdue for a mini degen season that may hopefully last a few weeks. By mini-degen season, we mean very high transaction volume and the peak of PVP NFT trading. The silver lining is that this should bring higher ETH volume back to the rest of the market.

Why? There’s been practically 0 relief, the # of users remains flat (not going down which we’ve touched on), and a lot of money is sidelined waiting for something to pounce on. Of course this does not mean our bags will be saved, but we think the new projects that emerge over the next month (*usually better to look to new shiny objects in this market*) will drive the next narrative.

Putting things into perspective, August 2022 had 5x+ higher USD volume traded than Feb 2021 (when ETH was $1800) and over 60X+ from Jan 2021 (you can’t even see the bar) so we’ve definitely come a long way in under 2 years.

Blue Chips

Ah yes, another week with 100 ETH+ jpeg purchases. The elephant in the ‘blue chip’ room is the Doodles raise. Doodles raised $54 million at a $704 million valuation. We discussed our thoughts on spaces in depth but overall we think this is bullish for the NFT ecosystem as whole, and can argue bullish/bearish for Doodles holders. Nonetheless, projects in the Doodles ecosystem had a nice floor price pump and the OG Doodles collection is back above 8 ETH. Overall this is a tremendous valuation for a PFP project - Pudgy Penguins was purchased in January 2022 for only $2.5 million!

Azuki's look great right now (who would’ve thought) and pumped from their sub 6 ETH lows this bear market to above 10 ETH now. This seems to be due to an upcoming announcement on September 23rd with whales like dingaling loading up on floors.

Yuga ecosystem looks strong with BAYC and MAYC essentially flat week-over-week. Except for one thing, we’re back to sub $100k USD monkey pictures (see image below).

Clone X is the big outlier here and is still below 6 ETH, continuing to deal with the usual FUD on twitter.

Our darling Pudgy Penguins broke below their 3.5 range that they spent ~10 days in this week as well. At 3.4 they’re basically flat and consolidating still but can’t seem to break above a 3.7 floor for a prolonged period of time. Besides news, the main catalyst for Penguins would be flipping a project like Clones. If Clones continue to trickle down slowly with Penguins remaining flat, this may bring a surge for the Pengus, but we’re not there yet.

Finally to end the blue chip PFP summary, Moonbirds had their best week in a while. MBs have dealt with a slew of FUD ever since the CC0 announcement (down ~50% since) and reclaimed their 10 ETH level. All in all, this was a good week for high-quality projects and the best in class projects continue to show relative strength in this market.

Updates, Musings, and Specific Projects

RENGA, another Mint Media darling and our CFO Chuck's recent project of choice, had itself an absolute week. After bottoming around .25 and rallying to .6 last week, RENGA rallied to a 1.8 ETH floor and has settled around 1.2 (a modest 5x or so) and black boxes are now around 2.2 ETH (these minted at .4). This past week, RENGA dominated the OS volume charts and continues to grab attention. While we can argue that people are great-art-appreciatooooooors, there are usually only 1-2 “shiny objects” that dominate the weekly and/or bi-weekly narrative. It still seems to be RENGA’s turn as it continues to outperform. This is the first time we’ve seen the combination of a very hyped project and paid mint continue to outperform post reveal since before the bear market started – overall, a positive sign.

Always fade the pump? Well, after falling from a 15 ETH floor to 8 ETH, DigiDaigaku is back to 13 ETH and continues to defy gravity. With the airdrop Spirits now at a 6 ETH floor, if you had bought the top around 15/16 ETH and held until now along with the airdrop, you are in the black! It’s been a long time since we’ve seen this type of comeback and continued strength. Fading Gabriel Leydon has turned out to be an extremely poor decision thus far.

On the other hand, DeGods turned out to be what some in the industry may call a “pump and then dump.” The DeGods floor is down ~40% in the last 2 weeks and the $DUST protocol is down over 50% in that time period as well. This is the same old story where buying into FOMO does not work. This is by no means a knock on the team, just a simple observation.

Chart: Dune / @tntclub

Continuing with Solana NFTs, let’s look at the chart above. Have you noticed recently that all of your favorite Solana NFT influencers seem to have gone silent? Solana NFT volume has come down just slightly above where it was before the DeGods mint. Even we got caught up in the hype as we wrote about a potential “Solana Fall” last week. This was certainly premature if we take a look at the daily volume. For what it’s worth, we still believe Solana will continue to capture a good share of NFT volume and overall it is great for the market as it helps onboard new users. However, after the quick spike in volume from DeGods, this uptrend will continue to happen at a slower pace than we expected.

Paid Mints…Back?

Are paid mints back? With the lack of new mints recently, there’s a lot of room for the few quality mints out there to grab a meaningful slice of mind share. Multibeasts minted out yesterday halfway through their 12-hour WL mint window. They’re also sitting well above 2x the .08 mint price at time of writing.

Funny enough, .08 used to be a hefty mint price but with ETH sub $1500 it’s not much higher than what we’d pay for gas during the 200+ gwei days when ETH was also $3,800.

Whether this early success is due to the “IP Meta” we’ve discussed or not, it’s great to see what we believe to be a high quality paid mint sell out fairly easily. It’s still too early to say if paid mints are back but this does play into our thesis that we may get *overall market relief* (volume going back up, not older projects going up in floor price) in October.

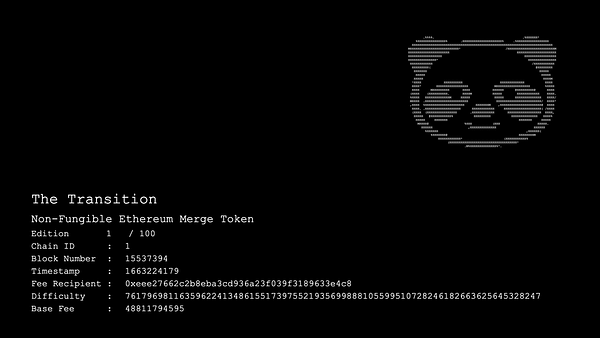

Another interesting project on our radar is thetransition.wtf. A Nouns-style auction, “The Transition is an on-chain generative NFT collection intended to mark a milestone on the path towards decentralization.”

These are the first 100 NFTs minted on ETH POS and 1 is auctioned every day. They’re currently going in the 2-5 eth range. Whether you’re priced out or not, it’s nice to see that folks are willing to pay a hefty price for what they believe will be a potential historic project in a market as bleak as this one.

Final note here is that small collections continue to outperform. These seem to appear quickly and be free mints or sub .01 mints and are typically sub 1,000 collection size. For example, we saw 8pes pump from .008 to .6 in a single day this week, with a handful of 1 ETH sales. We also saw 100 supply Hedz (massively hyped project from PEPE artist) mint at .66 and immediately go to a 2.5+ ETH floor on great volume.

The low supply, high volume set up can turn these smaller collections into a 2,5,10x fairly quickly. But, be careful, just as fast as these rise, they can just as easily fall.

Conclusion

Thanks for reading folks! Another week in the books and another exciting one ahead. Come chat with us on Thursday at 6pm EST for our next twitter spaces where we’ll be discussing the latest and greatest within this chaotic market.

Until next time,

MM Team

Great article. Mint weekly is one of my must reads. I appreciate how thorough the team is.

When it comes to Renga, would you recommend holding the Black Box or burn for Renga itself. It always seems logical holding when the supply is decreasing, but I just wanna hear opinions if you had to choose between holding a Black Box or burn, which would you prefer?