(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm everyone and welcome back. With summer in full swing, we were quite surprised by the whirlwind of activity this week in NFT land. For the first time since late April (which feels like years), it seemed like, at least for a moment, the bull market was somewhat back. Unfortunately, it’s not. But the activity this week is nothing to bat an eye at. Despite low ETH volume, Opensea transaction volume hit an all time high this week, with 457,000+ transactions. The casino is still running hot and there is an argument to be made that our jpegs are actually outperforming fungie tokens at this point. Free mints came back hot, and there’s still 10-100x opportunities out there, if you have the stomach. There is a lot to cover here so we won’t waste anymore time.

Housekeeping

Mint Jobs: We’re launching the baddest web3 job board on the internet. Visit mintjobs.xyz if you’re looking to mint your next career opportunity, or if you’re hiring, contact hello@mintcalendar.com to get your job listing posted!

We have an amazing guest post from Brandon Galang later in this newsletter. Highly recommended following for anyone looking to stay up to date and educated.

Cacio e Pepe update. Don’t worry we haven’t forgotten you. We’ve spoken with the Joepegs team and will now be dropping this project on AVAX. If you filled out the form a few weeks ago, your address will be automatically added to the White List. Follow us on twitter for more updates and pasta giveaways.

Anon, nothing said in this newsletter or in any newsletter / tweet that we make should be deemed financial advice, especially our assessments around potential multiple gains. We just call it like we see it.

NFTs in the News

Point72 Asset Management in ‘Early Innings’ of ‘Big Crypto Push’

3AC Co-Founders Remain Silent, Creditors go to Court

Metaverse Land Prices Holding Up in Current Market Climate

DeFi lender Teller launches ‘buy now pay later’ feature for Bored Apes and other NFT projects

Reddit is releasing blockchain-based avatars — just don't call them NFTs

Konvoy Ventures launches $150 million fund targeting web3 gaming

Robinhood enables crypto transfers

Macro Update

This week has felt silly. The Saudis, hit a ~1.5 ETH floor in ~2 days off of a free mint and also did more volume than The Possessed did in over 10 days. This is quite remarkable and really sums up where we are as a market broadly. The Possessed has been building a community for 4 months, has over 230k twitter followers, and a massively experienced team behind them. On the other hand, The Saudis did a free mint seemingly on a few days notice and absolutely took off. Love it or hate it, these are simply observations. Meme’s are the name of the game. One final note here is that the Saudies are 50%+ off their ATH. We wouldn’t be surprised to see a project like the Possessed remain flat into this time next week, whereas the Saudis could be a 2-3x or a 0.

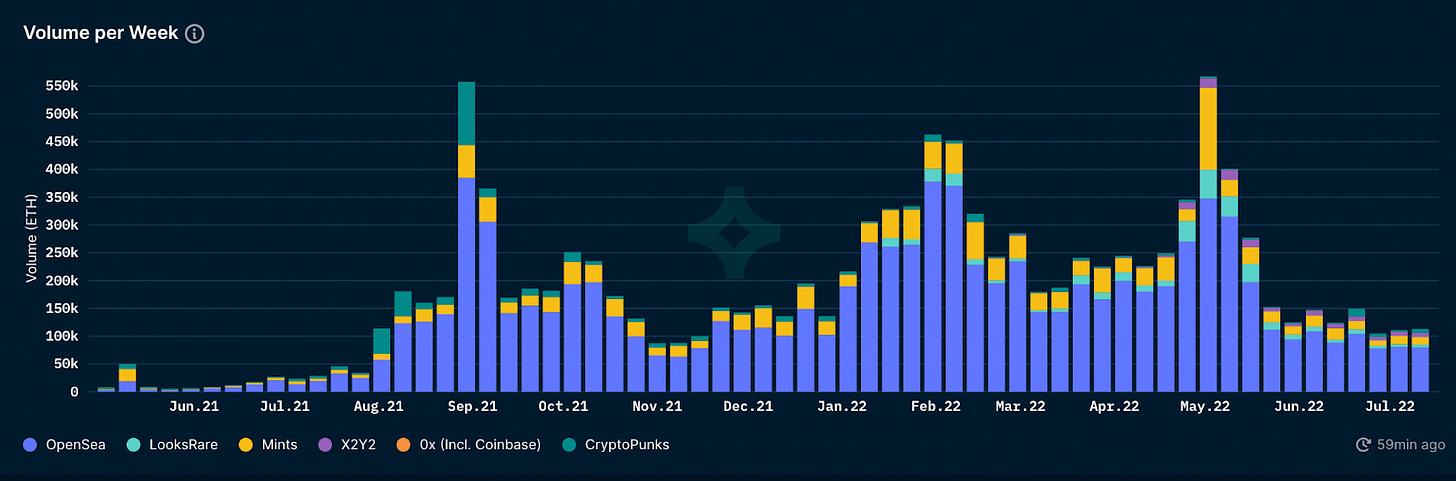

A lot of these free mints have been taking OpenSea by storm and every time the “free mint meta” seems to be over, something new emerges from the shadows. The chart below from Nansen sums up this state of the market perfectly.

Volume for the month of June/July in ETH is as low as it’s been since November 2021 (when ETH was $4K). On the other hand, transactions are at an all time high. This is easily explainable since the degens are trading their free mints back and forth to one another for .01 ETH gains. That said, OpenSea is probably raking in transaction fees right now.

Multiple free mints this week hit a .2 ETH floor, which we can say is a 20x gain assuming the gas is .01. While most of these are quick spikes off high volume post-mint directly into down-only mode thereafter, it’s important to note how much demand there is for this kind of PVP degen trading. While there are no recommendations here, the simple observation is that trading NFTs is more engaging than the typical shitcoin casino – memes have power.

The recent meme on Crypto Twitter of the Saudis “Max Bidding” Bitcoin, quickly turned into an NFT project which swept Twitter and transformed our feed into almost entirely pixelated Saudi PFPs. Everyone wants to join the party and FOMO in – even if you’re left holding the bag, there is *some* sense of community.

While we don’t necessarily partake in all of the gambling here (and of course we never encourage any financial decision because this is not financial advice 😇), we like to observe. As the broader crypto market doesn’t look too hot, NFTs are where all of the “fun” is happening, despite many losing quite an uncomfortable amount in USD. We’d argue this is more of a FOMO driven market than the dog coin phenomenon, and *may* lead to more adoption from ”robinhood/tik-tok traders” since there isn’t anywhere else to go with this kind of volatility.

This actually makes sense if we look at the transaction volume chart again, and we see that for *most* of the bear market, OpenSea transaction volume has remained at elevated levels for ~2-3 months. We hope you’re having as much fun as us by simply watching/participating.

Moving on, Yuga assets and blue chips in general continue to trend up. These collections continue to outperform not only the NFT market but the rest of crypto as well. We see many blue chips at the respectable levels (in ETH terms) that they were for the majority of the NFT bull market (if we discount the 3-4 weeks during the mania phase). Doodles at 14 ETH, MAYC at 20, Moonbirds at 28, Clone X at 12, Punks above 70. We also saw mid-caps, such as Creepz, finally start to trend up this week with many of them doing a strong 2x off the bottom.

While there is no one single explanation for all of this, maybe it is simply that the sellers are exhausted and paperhands have been flushed out. However, if we take a look at the chart below, there is one constant that holds true whenever NFTs show strength.

It’s tough to deny that our jpegs love a stable ETH price. For the last 3 weeks, where we’ve seen volume, transactions, and price trend up, ETH has remained between $1,100 - $1,300 USD for the majority of this period. This simple correlation continues to hold up well and is worth watching.

AVAX Meta Update

Volume on Joepegs definitely picked up this week. Chad Doge, a 3,250 collection size and 1 AVAX mint price ($20 USD), sold out in 1 minute and 40 seconds. This is the fastest we’ve seen a paid mint sell out in quite some time. While the project quickly fell below mint post-reveal, the fact that it sold out so quickly in this market is quite remarkable. A few days later, Chad Doge has crawled back around 40% above mint. Otter Society, a free AVAX mint on Kalao, sold out a 999 collection in under 2 minutes this week as well.

Things look ripe for the AVAX NFT mint meta to take off. As more *legitimate* projects pop up, we wouldn’t be surprised if the masses started showing up more and more (the degens are certainly already here). Owlopper, the 2222 collection size and 2 AVAX mint price, still has decent volume while remaining 50% above mint price. And Smol Joes and Smol Land continue to reward early supporters with their floor price.

It looks like there are some new mints coming up over the next couple of weeks on Joepegs – we’ll certainly be monitoring closely. Yesterday, on the Joepegs twitter spaces where they revealed a free mint, over 650 people tuned in for over 2 hours. Whether you like it or not, AVAX NFTs are alive and well, and we still aren’t seeing much discussion around it.

Friend Forest is minting this Friday for 2 AVAX in public and will be another great bellwether to continue to prove or disprove this thesis.

[Guest Post] Exploring the Multi-Chain NFT Ecosystem Stance: By Brandon Galang

Gm gm everyone. Today, I’ll be dissecting a stance I see quite commonly on Twitter, oftentimes from VCs and alt-L1 proponents… “The multi-chain future.” More specifically, I’ll be digging into how this future applies to the NFT world. It seems clear at this point that DeFi has found considerable product-market fit on chains other than Ethereum; turns out, it’s pretty great not paying $150 for a token swap on Uniswap in the bull market. While gas fees have come down tremendously in these bearish times, there is still significant TVL on non-Ethereum chains.

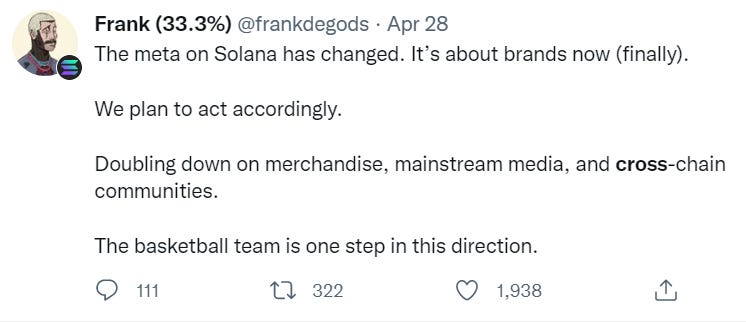

Given what we’ve seen with DeFi, it’s an easy extrapolation to assume that the same would occur with NFTs. We’ve even seen many “blue chip” NFT projects like Bored Ape Yacht Club and DeGods proclaim their intent to explore cross-chain futures.

I do think the future of NFTs is already multi-chain. However, it will not be evenly distributed. NFT ecosystems will look different on each chain... They will not be homogenous. In most cases, it does matter what chain your NFT is deployed on.

As things currently stand, Ethereum is king; it is the premier market with the largest NFT brands and the deepest liquidity. Due to scalability constraints and high gas fees, EVM-based gaming NFTs and low cost collectibles have found a home on the Polygon chain, thanks in part to their early integration with OpenSea in 2021 and their tremendous business development expertise, and significant investments in their Polygon Studios arm. For those not building in the EVM world, the Solana ecosystem provided a compelling alternative. With elite teams in Metaplex and MagicEden facilitating the development and go-to-market and community-driven NFT projects like DeGods, Solana Monkey Business and Famous Fox Federation, the Solana ecosystem developed distinctly from the EVM in that both big ticket PFPs, gaming tokens, and utility passes have all flourished. With scalability built in from the start, it didn’t suffer the same fragmentation that occured in the EVM world. Alongside these permissionless chains, the Flow chain has achieved significant success in a permissioned approach (though this is now changing) to launch consumer app successes in NBA Topshot and related properties (NFL All Day, UFC Strike).

There remains a spattering of NFT activity on other chains like Tezos, Avalanche and NEAR, but it’s unclear how these will shakeout. The current NFT landscape is multichain with Ethereum, Solana, and Polygon as clear leaders; what is the case for another chain developing significant traction? Big ticket PFPs failed to develop on Polygon as those teams simply deployed to Ethereum to play in the largest market. For non-EVM developers, Solana proved itself as a strong alternative with interesting growth potential. While there is potential for other chains to foster a critical mass of development and customer behavior in emerging NFT verticals like music, there are first movers on the top chains that will likely capture most of that activity.

Much like Dapper has done with Flow, the opportunity for new chains to establish white glove NFT partnerships with large brands breaking into the web3 space will remain. When there is an existing audience and the underlying blockchain technology is largely abstracted away, what chain an NFT is on doesn’t really matter; the project will draw in their own customers and liquidity. The best web3-native, bottoms up teams will likely continue to deploy on Ethereum, Solana, or Polygon where they have the greatest chance to draw in customers and plug in to adjacent dApps.

Other chains will inevitably find ways to attract NFT development teams with incentive programs much like DeFi incentives pulled heavy hitters like AAVE and Sushi into the multichain world, but NFTs can’t go cross-chain as easily as fungible tokens can. They have to commit to a base chain for a number of technical and operational reasons. These chains will attract good teams, but not the best. The best teams will shrug off incentives and go for the gold in the established NFT markets.

I’ll clarify that this is my high level POV and I think there are a lot of considerations, edge cases, and concessions to be made. I do think that for a chain like Avalanche with strong TVL, brand, BD, and unique technical capabilities (e.g., NFT gaming projects running on a subnet), there are multiple ways to horizontally differentiate and seed a thriving NFT ecosystem. While we haven’t seen huge PFPs take off in the Polygon or Avalanche NFT markets (the market landscape drives the best teams to Ethereum), there may be a team that strikes gold and sets off a new meta of builders to chase that opportunity. NFT ecosystems are bottoms up, emergent processes; it’s hard to predict how they’ll develop, but we can look at structural forces to make predictions.

My initial point still stands. The future is multi-chain, but each chain will look very different. Don’t assume new NFT ecosystems will develop just as the previous ones did… Mint carefully my friends.

-bgalang.eth

Conclusion

wE’Re sO eArLy. No really though.

When an entire industry which has the potential to usher in a new and sustainable wave of community-led culture, has the same market cap as the average individual late-stage tech startup, you know there’s a great deal of growth to come.

Reality check – most of the projects you know and love today will die 😂. That’s okay though, as it’s a necessary growing pain to achieve what we believe to be the more mature, utility-minded future for NFTs.

Until next time anon,

W + P