(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm folks. Things continue to move at warp speed, with little time to breathe, eat, bathe, etc. With all the craziness going on in the world, there’s been a lot of FUD on the timeline recently (rightfully so). We’re personally still running through the internal debate of where the market heads next. However, since there’s a lot of things we can’t control in the real world, we’ll do our best to make sense of what’s going on in the anonymous cartoon world. A bit shorter than usual this week, with a longer macro update, 1 specific new mint we want to cover, and some thoughts to follow up on last week. Let’s dive in.

As always, if you are looking for a job in the Web3 space, please check out this week's postings at the bottom. Huge thank you to TheChild.

The MC Pass

White List is now open – click here to register (limited spots still available). A quick update from last week. We’re targeting March 12-16th to drop the MC Pass. We’ll be announcing the exact date and time via twitter. We highly recommend reading our Lite Paper before deciding if you’d like to be a part of our growing community.

Macro Update

Where do we even begin? For the first time in a long time, we’re seeing the NFT market take a nosedive simultaneously alongside ETH. Obviously, this is an extremely bearish macro signal, as these are typically inversely correlated. BowTiedGolem has a nice thread on where he thinks we’re heading and we agree with a key point here – the NFT market won’t be able to run up until ETH eventually stabilizes. Until ETH can figure out a range to hold for at least ~1-2 weeks, NFTs are one giant guessing game. This is because it’s extremely tough to value our jpegs when the underlying *currency* is fluctuating in value at +-10% a day. This is causing people to panic sell their NFTs below floor price on both sides of the chop – either they see ETH tanking and want to cash out, or ETH is going parabolic and they’d rather hold the ETH vs. jpeg. Until ETH’s direction can make up its mind, we’re in for some short term pain.

Additionally, an entirely separate factor impacting the overall market (which we’re going to pat ourselves on the back for for spotlighting it within our thesis from Feb 15th) has played out almost exactly as predicted (note: we’re not saying this is the reason for the recent downturn, but instead noting that the correlation is worth re-discussing).

What we stated on Feb 15th is that the ‘overhyped’ projects below will impact the direction the market heads (i.e. if these are successful, numba go up, vice versa):

“Our thesis boils down to our belief that the success of a very small handful of hyped projects will determine whether we see a continued bull run throughout the broader NFT space or not. We compiled a list below of what we believe to be the projects whose shoulders the weight of the market rests on (there is probably another 1-2 we’re not thinking of but should be sufficient enough for this explanation).”

Well… we know how this story ends. Every single one of these projects is down massively from their pre-reveal peak. Starcatchers, Tasty Bones, and Wonderpals are down over 50%, Weather report barely hit a .2 floor and is now significantly below .1 ETH, and Invisible Friends has crawled it’s way back to being just down a measly ~40%.

We’re not saying this is the sole factor leading the market. Going back to our original statement, we think that the current global macro environment is playing a much larger role in the down-tick. But, there certainly is no doubt that when ~5 of the most sought after projects of 2022 are all down bad, overall market sentiment will not be getting any prettier.

Anyways, a lot of things don’t look good. At all. On top of this, another blaring obvious factor impacting the market’s downturn is the fact that we’ve surpassed the point of over saturation. Supply is outpacing demand, and uncertainty around “real world” issues is not helping.

Here’s how we look at this:

We can think about what happened to many projects in Sep/Oct. The majority went to 0 and the remaining winners have done a 2-10x+ off the bottom (most notably Doodles, MAYC, BAYC), showing again that the money flows to the top. It seems as if we enter a cycle of oversaturation > majority go to 0 > money flows to top, blue chips get stronger > new projects emerge > repeat. The clear move here is to sell your more degen NFTs for ETH to accumulate if things go lower. Have we scared you enough? Enter our bull thesis.

Why is this time different from last time?

We still think we’re in the middle of a medium-term bullish cycle for NFTs. Some bullets below:

Yes, OpenSea volume has drastically declined the last 2 weeks and we’re seeing gas below 40 gwei for the first time in months. However, the overall number of unique wallets holding NFTs and onboarding continues to rise. More and more people simply want to get involved, despite the scams. It’s tough to be bearish when NFTs consistently are becoming more and more mainstream.

New mints are still selling out left and right. Seriously, absolute garbage is selling out. With gas lower than usual and ETH below $3K USD, the degen itch to mint as much as possible hasn’t gone away. Along with this, most new mints are still rising post-mint (majority pre-reveal) and generally have been extremely successful in the short term. Demand is still extremely high for new mints that most projects still find they must do a WL only mint to avoid a gas war.

There are still projects behaving extremely well. Cyber Brokers which essentially had a stealth mint, has rocketed above a 1 ETH floor *post-reveal*. Dippies which wasn’t a WL grind project or super hyped has done a 3x+ mint *post-reveal*. Azuki hit an 8 ETH floor for a few hours and sling-shot right back to 10 ETH, showing that dip buyers are coming in to accumulate high quality projects. Low-key projects on the cheaper end such as Sunnies remain healthy at a 2x above their mint price.

TLDR: Our thoughts are that the NFT market can simply not be in a macro bear market when profiting from new mints is still fairly easy.

It is true that market participants have gotten smarter. The days where any Bored Ape PFP on twitter could shill a random project to glory are over. This is a good thing. We expect a lot of *extra* volatility in the coming months, and this shouldn’t surprise you as jpegs are at the highest end of the risk curve. While we aren’t going to lie and say we think things get easier in the near term, it’s tough to confidently spread doom and gloom when NFT markets and broad digital ownership will undeniably increase tenfold in the coming years. There are A LOT of good projects, incredible builders, future blue-chips, and opportunity out in the ocean of OpenSea. You just have to do a bit more digging (or sub to MC 😂).

New Mint: Fresh Fools

Since we’re only covering one new mint this week we’ll go fairly in depth here so you can get a sneak peek into how we think about these things. At a high level, Fresh Fools seems like another 10K PFP collection, although with some exceptionally awesome Keith Haring-inspired art. A project like this will clearly have little trouble selling out in the current market and most likely perform well (at least pre-reveal). Luckily for us, we had a chance to speak with some of the team and we’ll look to peel back the layers here. Under the surface, there is definitely a lot of potential.

Things we like:

Fully doxed team based in Porto, Portugal. Luminimal, one of the founders/devs is clearly extremely talented with a high-level of technical expertise. “To keep gas prices low, we went with off-chain random generation, and also decided on what’s effectively becoming the new smart contract standard for multi-token gas saving on multi-mint, the ERC721A, developed in the context of the famous Azuki project (www.erc721a.org).”

Website is extremely well done. Highly recommend checking it out. Team is also very transparent about their vision in the ‘about’ section.

Private discord. Discord isn’t super large and has no spammers due to exclusivity.Similar to past projects we’ve covered like Sprite Club, this smaller discord is extremely active at all times of the day. Not only is the community engaged but it seems as if somebody from the team is always available to answer any questions.

Minted Fresh Fools pieces are licensed under the CC0 license, making them public domain. Owners can use the image however they want, putting on clothes for example.

This is the first *exclusive* project we’ve seen that is not doing a white list. We think this concept is unique and the team believes they are tech savvy enough to avoid a gas war and botting. They also mentioned to us how WL can promote short term flippers and people who won’t actually be engaged in the community and to be fair this does have some merit.

Bear Case:

The primary bear case here is that the mint doesn’t go well since it isn’t WL only (gas war, bots, angry community, etc.). We can’t really put any % of likelihood on this as we’re ‘vibe curators’, not technical experts.

There is also the risk that the masses view the Fresh Fools as “just another sleek cartoon PFP project” that isn’t differentiated enough or doesn’t have an ambitious enough roadmap.

Quotes from the team (italicized):

“Everyone's afraid of the Big Bad Wolf having no whitelist, and our stance is different. For now let us just say that many collections talk about organic growth and a community that participates, but we REALLY want it. No... seriously. We REALLY want it. So the Fool concept will grow over time, and the people that stick with us will have a MAJOR upper hand in the next project.”

Most projects look to slowly build organic hype. The fools want to build organic community *without* public hype. They’re not going to wait until 15k or 20k followers to release a mint date (7k now and growing fast so we assume this happens soon).

“We don't picture a gas war happening. We know there's advanced methods of interacting with a smart contract, and we will have the basic bot protection in place, along with a somewhat innovative system to prevent it, but in reality we see this collection selling out over a few days as the hype grows around the art. We don't picture a bunch of bots selling us out if we drop before our twitter grows to a critical status.”

If they manage to pull this off, it would be a quite unique approach for projects looking to launch under the radar. That being said, we think that even the attempt to execute this style of mint shows integrity and character from the team, which goes a long way in a space full of shills and scams.

Summary:

The team isn’t overpromising and clearly is highly talented – not much to dislike. We’re not sure how under the radar they will be after this newsletter is released, so keep your eyes peeled ;). In sum, we think it’s worth following along their twitter and trying to get a discord spot to feel out if this is the right project for you (and learn about stealth mint date). We’ll be looking forward to minting and at the absolute minimum should be a winner short term post-mint.

Conclusion – Bet on Culture

A great tweet by BowTiedNightOwl to kick off this train of thought. We mentioned something similar briefly last week as well as a few times in this newsletter. We’re all aware that memes have value but they seem to really drive outsized value in NFT culture. Crypto Twitter (CT) has its own specific culture to it and if you follow along you’ll pick up on many of these things, more than just wagami/ngmi. CT is the reason that CryptoDickbutts have held their value strongly above $2,000 USD.

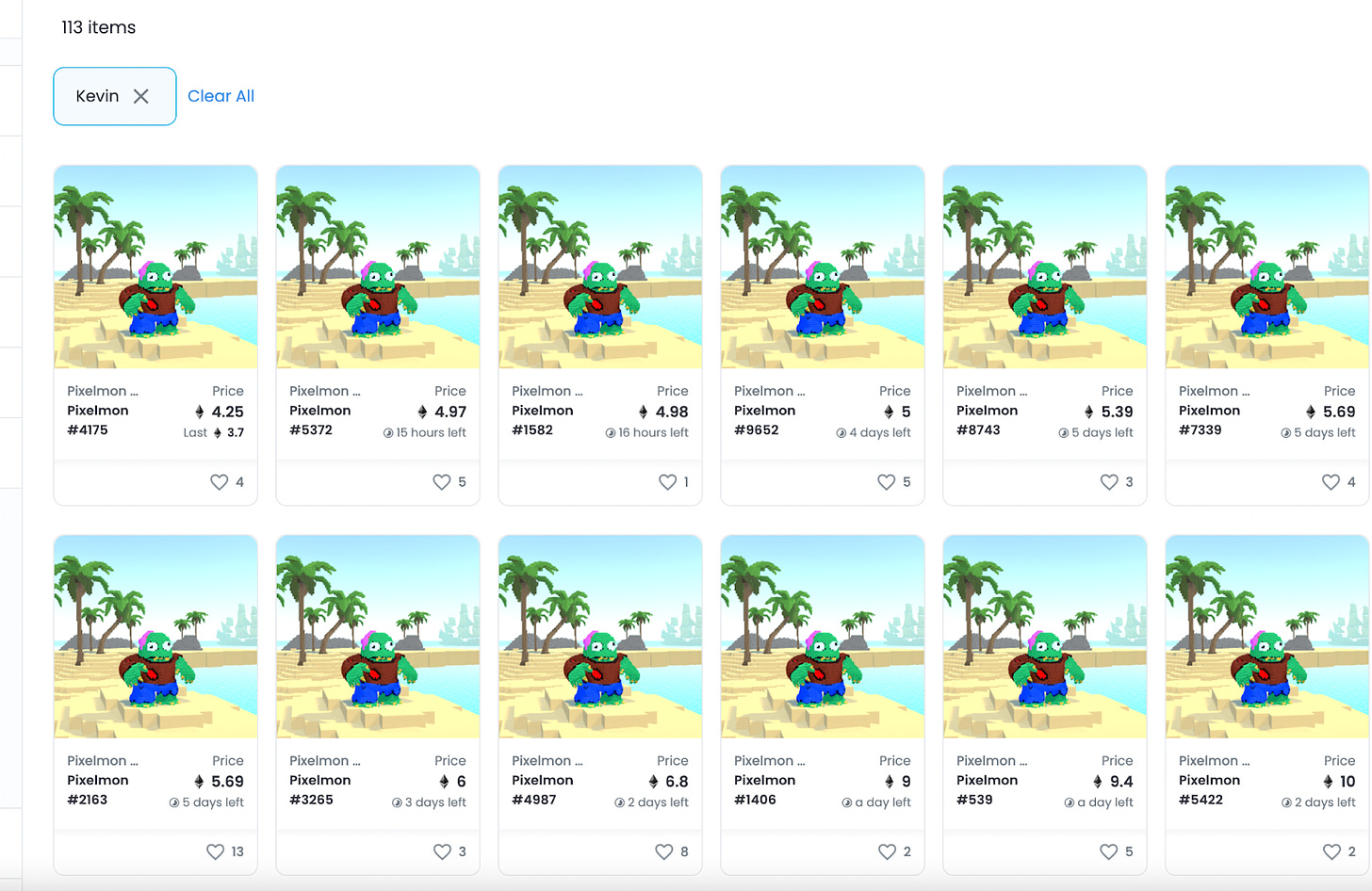

We also covered the Pixelmon debacle briefly last week as well, but to quickly recap, essentially, after the $70 million dollar rug pull, memes of the reveal began trending everywhere, specifically one’s of the “Kevin” species. Pixelmon was 3 ETH to mint and has dropped 90% to a .3 ETH floor. But take a look at the “Kevin” floor.

Over a week later, the floor price of Kevin’s are above 4 ETH with plenty of sales greater than 8 ETH. Seems wild on the surface, but we’re really not surprised that a trending meme on CT has blown up in value. It is the wild west out here and these things may actually accrue real value over time as CT culture blends more and more into the “real” world.

Shifting away from Kevin and back to the big picture, it’s no lie that things aren’t looking too pretty at the moment. To reiterate, we think there’s a high probability of continued short-term pain in the broader market and long-term pain in low quality projects.

It’s tough to call this a true “bear” market when new mints are selling out, blue chips aren’t down more than 20- 30%+ from ATH, and ETH is under 3k.

At some point, this game of hot potato, trading garbage art PFPs for thousands of dollars, will end, but not yet.

Since we believe the biggest contributor to the entire flush is global uncertainty/war, it’s tough to predict what happens next. Certainly, it’s not easy to feel safe in jpegs at the moment and we think there is justified selling out there. Hopefully this flush concludes on the sooner side and we can resume the fun. We think there is still a ton of opportunity to profit from quality new mints as well as projects that have gone into drastically oversold territory (Creepz and Cool Cats).

Luckily, we’ve been here before. Watching the jpeg market drop 80%+ (in ETH terms) for back-to-back months was way worse than what we’re experiencing now. The shillers, grifters, and scammers are all still here taking advantage of those looking for a quick flip, so there’s plenty of liquidity still out there. The nice thing about NFTs is that sentiment can turn on a dime.

Cheers,

Wilson & Paul

Web3 Careers:

GM job hunters! Flagging a great list of jobs this week with a focus on native Web3, crypto, and NFT companies/projects. The industry is so fresh that even the companies hiring in this space don’t quite know what they’re looking for. If you’re on the edge trying to decide whether to apply to these roles, do it! Almost every company in the space (or it’s Web3 branch) is operating like a start up so more than anything they need talent that will roll up their sleeves and say yes to anything! Next week we’ll focus on roles that are NFT or Web3 focused with traditional companies.

Let us know if you’re hiring for incredible roles or if there are other types of opportunities you’d like to see in this section! Tweet/DM us @MintCalendar, @TheChild1996, or send an email to hello@mintcalendar.com.

Community:

Social Media and Community Manager (Spaceminer NFTs, Remote Europe or Middle East)

Community Builder (ConsenSys NFT, NYC)

Marketing:

Brand and Marketing Manager (Zapper, Remote Europe or North America)

Director of Marketing (Archway, NYC/Remote US)

Strategy/Miscellaneous:

NFT Strategist (Horizen Labs, Remote US)

Lead Product Designer (Ripple, San Franciso)

Product Manager, NFT (Coinbase, Remote US)

Digital Licensing Executive (Major League Baseball Players Association, NYC)

Head of Partner Development (Autograph, Los Angeles)

Software Development:

Head of Engineering (Goobig, London Remote)

Other:

Jobs at NiftyKit: Community Manager / NFT Drop Manager / Software Engineer / Social Media Manager