(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all. First of all, our heart goes out to everyone who was affected by the FTX scandal and contagion. This has been one of, if not the worst week ever in the crypto industry. With new information appearing almost every hour, the 24/7 twitter spaces with 30k+ people including CZ, Elon Musk, Jesse Powell, Charles Hoskinson etc. It’s been tough to stay level-headed. While NFTs aren’t top of mind for most, we’re still here doing our best to provide a sensible overview of the market and previous week. If you’re still here with us, congratulations. Most have packed their bags to never return, the remaining few of us are all that’s left. They’ll say you “got lucky” in the next bull market, but times like now are when resilience and conviction are truly tested.

Housekeeping

We’re live on Spotify!

NFTs In The News

A CryptoPunk could soon be coming to an art gallery near you

Yuga Labs acquires Beeple’s 10KTF, names him advisor

NFT royalties: The story so far

Nike Launches .Swoosh Web3 Platform, With Polygon NFTs Due in 2023

OpenSea Pledges to Enforce NFT Royalties After Creator Backlash

Market Update

Well folks, it continues to get worse. With everything going on in crypto, it’s tough to justify paying close attention to NFTs. It even feels a little embarrassing to focus on jpegs right now, but since we’re still alive, we’ll provide you, the good soldiers still standing, with our sobering take on the space as it exists today.

We’re starting to see some capitulation as many are down badly due to the FTX fiasco, and NFTs (Blue Chips specifically) are at their all time lows in USD and ETH terms since the bear market has started. If you’re full time in the NFT space, you’re probably not having the best time at the moment. That being said, we keep pushing forward. Is your family still asking you how your internet pictures are doing now?

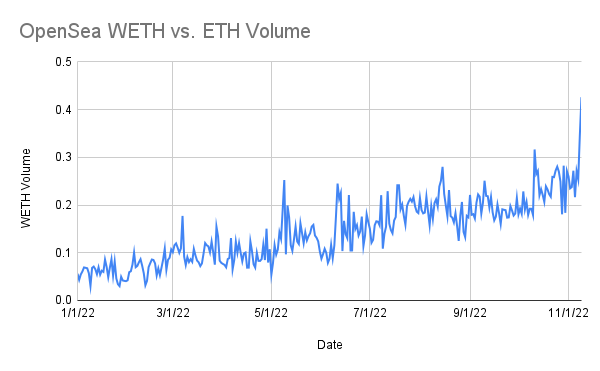

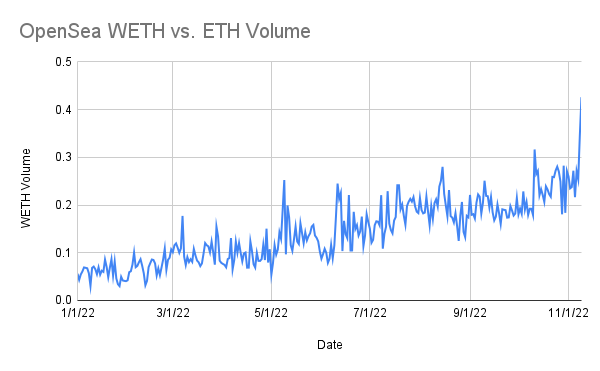

This week we saw days with the highest percentage of wETH volume ever. This means that many are giving up, accepting bids below the floor due to the want/need for instant liquidity. This does give off capitulation and panic selling vibes, but we still continue to trend lower. Despite the constant panic selling and undercutting, overall ETH volume is still sitting at the range lows for the bear market. We still have not broken above 100K ETH weekly volume since the week of July 18th. Rough…

With ETH extremely volatile and uncertainty at an all time high, floor prices have been shattered and morale is low. The next few weeks will probably be consist of more contagion related news, which makes us think that things may not cool off just yet. We can see how patience and the ability to sit on your hands has been massively rewarded. As CZ says, Stay #SAFU.

Blue Chips

While the markets crater into the ground, the most resilient PFPs are no longer immune to the carnage. *Blue Chip* PFPs tanked this week and almost none were spared. All except one, the holy grail of NFT PFPs: CryptoPunks. Punks held their 65 ETH floor which is flat week over week, quite remarkable. Only 6 months ago, 1 BAYC = 3 Punks. Now, sitting ~10 ETH higher. This not only shows the conviction from these holders but bolsters the idea that the largest NFT whales hold Punks, and are in no need of liquidity to sell.

Rough week for Yuga Labs, as the apes are getting crushed, trading below 50 ETH on blur at the time of writing. These are well below 70K USD, the lowest we’ve seen in the bear market. Adding to this, MAYC hit the lowest USD price they’ve ever seen, and are trading below 10 ETH. The worst of them all though is Otherdeeds, which is trading below 1 ETH for the first time ever.

Clones, Moonbirds, Doodles, Azuki all took massive hits this week. Clones are back to 7 ETH and Doodles are now well below 6 ETH for the first time in the bear market. Azuki’s are floating just under 9. Notably, Moonbirds floor became temporarily lower than its mint price in USD for the first time ever.

Penguins and Cats. Cats are trading below 2 ETH for the first time in what feels like forever, or in other words, roughly since the inception of this newsletter. Penguins PA isn’t looking too hot either, trading around 2.3 compared to 2.9 the previous week. While both of these projects had more tame declines, they’re each down roughly 20%+ week-over-week.

Last week we mentioned consolidation of many of these projects getting ready for the next leg up or down. Well, the FTX catalyst brought us that next big leg down. Some of these (Mutants specifically) have been good flips in the last 48 hours off of their panic bottoms. It should be an interesting week to see if these projects can recover, or if they’ll continue to bleed from here.

Last Week In Review + Musings

We’ll do our best to keep this section strictly NFT related. While the elephant in the room is the FTX debacle, and many of the topics/projects we touch on have been impacted by what FTX has done to the broader market, we’ll remain focused on the jpegs.

True “digital collectibles” with no other utility outside of their collectibility have shown outstanding resilience. Digital art like Squiggles and Fidenza continue to hold strong not too far off their ATHs. OG digital art collections are also catching a bid throughout the contagion. Punks are another great example, revealing themselves as the true grail of PFPs. This isn’t super surprising as none of these projects made big promises to fulfill or are at risk of having treasuries on FTX. Time will tell, but ultimately these are becoming store of value NFTs that should trend up over time.

Been doing some digging to find *relative* strength in this market, and while there is not much, a few things stood out. Altered State Machine projects like Fluf World have been sitting around a 2 ETH floor the entire bear market and is only down 1% week over week on blur. Rarely see this project discussed on NFT twitter. The Potatoz are another one, staying within the 1-2 ETH range of the entire bear market as well. Don’t know enough about either of these but probably worth looking into.

Art Gobblers is down tremendously, and is anyone surprised? Now under 2.5 ETH, these were 25 ETH just a few weeks ago. While we all have our thoughts on the project and influencers in general, when it comes to NFTs, this is a tale as old as time. Simply exercise a bit of patience and don’t buy into the hype. Yes, we’re aware that you could have bought for 11 ETH right away and sold a few hours later for 20 ETH, and somebody probably ended up doing this. But most are left holding the bag. Ask yourself, why is this project immediately worth $20k USD+, is it really because somebody with an expensive PFP on twitter says it is? KPR is another project that’s down bad at .2 ETH (was 1 ETH pre-reveal). Obviously, the overall market conditions are playing a role here too, but this was another project where we saw people proclaiming its “future blue chip” potential all over twitter. When you hear that, run. If you can get WL for these hyped projects (ether and valhalla are next) you almost always make free ETH, but be cautious about buying into the hype.

For high-risk traders, the overall market volatility has created a ton of opportunities. Interestingly enough we usually see a bunch of degen flippers during this time but instead we’re seeing projects on the higher-end make regular 10%+ moves. Y00ts went under 40 sol last week when sol was around $12 and are now back to a 100+ sol floor with sol around ~$15. This is a significant 3x+ gain in just a few days if you were willing to buy the blood. With volume still depressed, there’s very little *degen* trading like we saw during the flush in June. Outside of Bankrupt SBF Yacht Club (yes this is real) its become a waste of time to monitor OpenSea trending or etherscan for mints right now. Unless you’re bargain hunting within the top 10-20 projects, it makes more sense to sit on the sidelines and let this blow over.

Finally, we think this is the time to double down. No, don’t go gamble your net worth away or buy something stupid, but double down on learning and building in this space. Most of the crowd is giving up at this point which is exciting because it means you’re able to get ahead. We’re probably somewhere in between the ‘Capitulation’ and ‘Anger’ stages right now and every day feels like it’s getting worse. That being said, we still believe some of the biggest brands in the world by the end of the decade are being built today, and will be powered by the blockchain. Keep learning from mistakes and *doing your own research*. Remember, when the bull comes back and you’ve been grinding in the trenches, they will still say you got lucky.

Conclusion

On the bright side, with prices so low, maybe you’ll be able to add a your dream PFP to your Christmas shopping list after all.

As we scour this mad max wasteland together, brighter days are ahead. It’s always darkest before dawn. Stay #SAFU.

Good luck out there,

MM team