(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all. If you spent the week frolicking around in NFT land then it’s no surprise that we continued to trend down in volume. This week we did the lowest trading volume in ETH since the week of July 26th and of course, USD trading volume was down as well. It surely was quiet and slow. With the merge happening in a few days, this all makes sense. What we didn’t expect is that the volatility in jpeg prices thus far has been as quiet as its been. Seems as if most panic sold their jpegs already or the smart ones built liquidity in the previous weeks. On Sunday, a collection only needed to trade 12 ETH ($21,000 USD) to make the top 100 on OS. This is definitely the lowest we’ve personally seen… ever. Despite the low volume and volatility of the past week, we’re gearing up for a lot happening in web3 and the NFT space this fall and there is always a ton to cover. Let’s have another great week!

Today’s post is brought to you by NiftyCat

NiftyCat is pioneering subscription NFTs for brands - these are NFTs that brands can distribute to their customers (often for free) as an incentive to subscribe or reorder, and grow in value the longer a customer is subscribed or the more money someone has spent.

With NiftyCat, brands can create NFT collections in minutes and send them to their customers through a simple URL - crypto wallet and crypto-literacy are optional, not required.

Web2 brands have too often used NFTs as lazy cash grabs without any real understanding or desire to actually execute, these have largely flopped and not how more people will be onboarded into web3. NiftyCat is enabling brands to create low-cost NFTs to support the revenue streams they already have and grow loyalty vs. trying to milk the crypto community for money.

Brands can get started for free and for most brands, will cost less than $100 per month. To learn more, sign up on niftycat.com.

Letter From The Authors

We’ve been officially publishing this newsletter for over one year and have come a long way since our humble beginnings with Mint Calendar. Publishing articles to thousands of readers on a weekly basis has been a humbling experience. Having a constant pulse on any market (especially as niche and fast-paced as NFTs) is quite difficult. Keeping up with the volatile nature of the space has been exhilarating and we wouldn’t trade the experience writing has given us over the last year for the world. We’re certainly far from perfect, but we’ll continue to do our best to provide as much value as possible. Whether you have been a supporter since day 1 or this is your first time reading this newsletter, we are grateful to have you and won’t let you down.

NFTs In The News

Starbucks to Offer NFT-Based Loyalty Program Using Polygon's Blockchain Technology

LG Electronics Launches New NFT Marketplace ‘LG Art Labs’

Harry Styles and Adele's record label files trademarks for NFT-backed media

Bored Ape NFT Band to Make Music With Beyoncé-, Timberlake-Linked Producers

Sorare partners with NBA to launch fantasy basketball game

GameStop announces FTX partnership

Merriam-Webster Adds ‘Metaverse’ and ‘Altcoin’ to Dictionary in Nod to Crypto

Japanese government issues NFT awards to local authorities

HQ Trivia's NFT reinvention scores $7 million seed round

Market Update

It feels like there was no major *event* or drama this week for the first time since we joined the space. Post y00ts launch, there was no single collection or narrative that took up the timeline this week. While we didn’t necessarily get the “Solana Summer” we originally anticipated back in June, the liquidity from y00ts is pouring into the Sol ecosystem and for the first time we see Sol projects taking over the top 10 on OpenSea. We’ll touch on this a bit later.

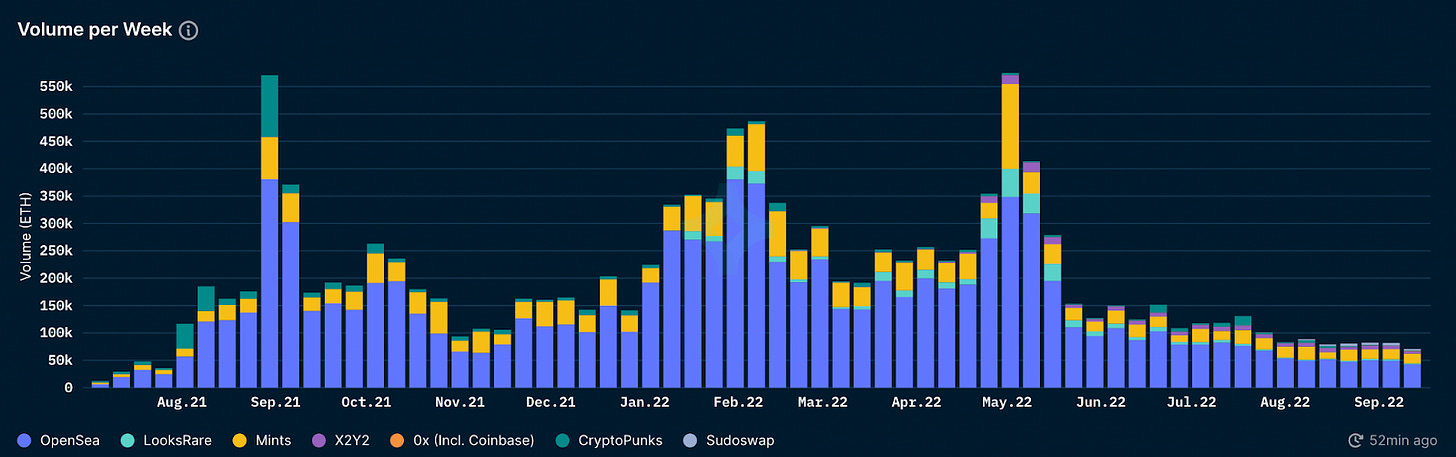

Chart: Nansen

Above, we can see that ETH volume continues to trend down after what was a flat-ish trend for around the last 6 weeks or so. Yes, we’re still in a bear market and the environment is the same ~200,000 wallets trading against each other. Very fun!

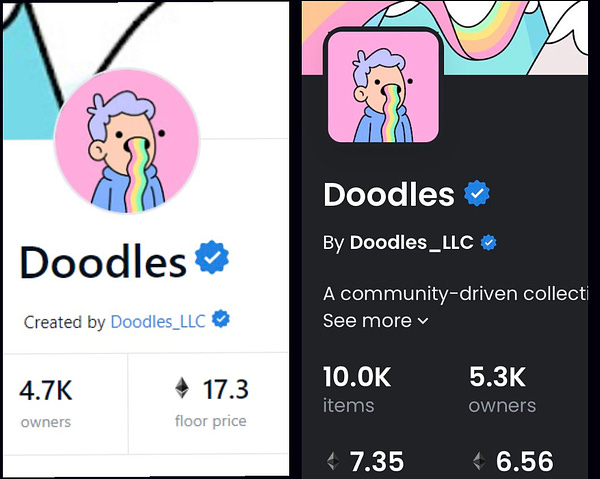

Blue Chips: Little has changed week-over-week, # of users is still flat along with transactions. Blue chips are in an interesting spot right now. Apes and punks are holding up quite nicely, at 74 ETH and 62 ETH respectively. Doodles are flat at 7 ETH and Azuki has been holding up nicer than expected at around 7 ETH as well. Clone X took its second dip below 6 ETH (lots of FUD around Metadata change).The big story here is Moonbirds getting absolutely crushed. Last week, Moonbirds fell below 12 ETH for the first time since mint day. As a clear #3 for some time, they’ve taken the biggest beating and fell even more this week below 10 ETH. They did recently reclaim their 10 ETH floor but have been losing a ton of momentum.

Remember when all of these projects were the brands of the future? The FOMO during the height of the bull market was surely something to behold.

Finally, our fan favorite, Pudgy Penguins continues to show an insane amount of resilience in this market. After spending a few weeks in the 3.2 - 3.5 ETH range, the pengus have risen firmly above the 3.5 range and are continuing their uptrend. Slow and steady wins the race?

A quick note on sentiment here and we think this is a good tweet:

We wouldn’t necessarily say speculation is gone, we saw a y00ts derivative make it to the top 3 on OpenSea this week. That being said, he makes a great point around a “reset”. “Blue Chips” down 75%, and in his other tweet below, he likens sentiment to the March 2020 lows: “Everyone thought it was over. No one was trying to spend any more $ on NFTs. So, if you still believe in this market, then here's your chance.”

Fair point for true believers in these projects, although we’ve yet to see the big money step in – these projects going down another 75% is certainly not off the table. The most common mindsets/strategies behind buying back into the *tier-2* “bluechips” are:

1. Be patient and wait

2. Buy the dip on these sooner than later and hope we hit bottom

3. Pour into projects like Pudgy Penguins or DeGods/Y00ts or

4. Degen into the new shiny objects.

MM team thoughts (biased): Unpopular opinion but we’d say #2 is the least likely option. #4 is unlikely as well at the moment since there’s not many new projects in the bear market. #1 is the clear winner and don’t expect this to change until a few weeks post-merge. #3 will depend on the continuation of the Sol meta and/or if projects like Pudgy Penguins can continue their momentum, but for now think this holds more likely than #2 and #4.

Solana: While ETH volume continues to trend down, something is happening with Solana NFTs. Below is a chart of Solana weekly volume.

For what it’s worth, due to Solana only being $35, the total Solana volume in USD isn’t even 50% of ETH USD weekly volume for the most recent week. That being said, the uptrend here is strong and all week we saw at least two Solana collections in the top 10 volumes on OpenSea.

Disclaimer: Weekly NFT transactions on SOL are also significantly higher than weekly transactions on ETH, although this doesn’t say much since sol essentially has 0 fees and a lot of derivatives are traded with 0 royalties.

What’s important is the fact that during the depths of a bear market where we are right now, Solana NFTs have been trending up in volume and price throughout the last month. The entire market always trades on some sort of “meta” and under the hood there has been a growing Solana meta for quite some time. This will *probably* continue, especially due to the amount of attention and liquidity y00ts brought to the ecosystem. However, before blindly ape-ing into solana collections, it’s important to make sure that we watch if this trend continues.

Another notable collection has been ABC, which is created by the notable whale 9x9x9. ABC has been in the top 10 on OpenSea for around a week now and continues its uptrend. Chart from Magic Eden below:

While the only *established* blue chips on Solana right now that we’re aware of are DeGods and SMB, ABC looks to join the club at a 70 Sol floor. If newer collections like ABC on Sol continue to go exponential, this will certainly bring a lot of new degens to the ecosystem. We plan on getting more involved over the next month but it’s important that the uptrend vs. ETH sustains for the “meta” to play out.

Adding to the ease of onboarding, Magic Eden is an absolutely unbelievable marketplace and blows away OpenSea. They have some amazing data and it also acts as a launchpad platform that you can mint from. The UI/UX is much easier to understand and this adds to the ease of use.

Whether you’re a solana maxi or hater, this trend is ultimately good for all of us. If this ends up being a sustained trend instead of a short-term 1-2 month “meta”, this will bring a lot of new liquidity and *hopefully* users to the market. Something like this can lift up the entire ecosystem and ultimately we need new entrants to join to lift us out of this hole. Nonetheless, as mentioned, the $USD volume here is still extremely low and we don’t want to provide any hopium. We’re a long ways away from this becoming meaningful on a macro level. Anyways, Solana Fall *may* be upon us, so spin up a Phantom Wallet and do your best to get acclimated.

Updates, Musings, and Specific Projects

A Mint Media darling, Renga fell on reveal to around .25 but has been on an absolute journey over the last week, almost making its way to a .6 ETH floor rallying strongly off the lows. Black boxes, 2,500 which minted last month at .4 ETH, are now past a 1 ETH floor and continue to look strong. Unaware of what the overall catalyst is here, but Renga has always had a powerful mystique around it and objectively unbelievable art. If you’re still holding the black box, we recommend not burning it for reveal as we’re seeing the supply and demand dynamics playing out.

Lost Realms, a project we’ve been following for some time now released their deck here. Definitely check this out as it’s impressive. In our opinion, this is exactly what web3 gaming should look like. Still looks to be a long way out but definitely what we’re most excited about at the moment.

Adding to web3 gaming, which we firmly believe will be the primary catalyst that helps onboard new members to this space and will dominate the next bull run is Degenheim. Another project we’re going to take a deeper look into – looks promising.

Multibeasts mints on Monday. They cut supply to 4,444 and have a mint price of .08. We still think this collection is one of the most underrated new mints coming to market. Unfortunately, this is a few days after the merge so anything can happen. On spaces last week, we discussed the “IP Meta” we briefly mentioned in last week’s newsletter.

If this collection mints out quickly and gains momentum, it may get the attention it deserves.

Moving to AVAX, while Joepegs volume has trended down over the last month, Painight looks good. This collection minted out at 2 AVAX (relatively expensive for avax mints) in minutes, dominates the volume charts, and floor price is above mint. While it’s too late to be early to Solana NFTs, it’s not too late to be early to the AVAX Nft game. With the success of Painight, we’ll be getting back into watching this ecosystem a bit closer.

For all of the hype, Spells looked to be a dud. Don’t necessarily think this was influencers dumping but instead lack execution and general disappointment. Nonetheless be cautious around the *experts*, nobody *really* knows what they’re doing. For example, Ryan Carson's fund swept MoonBirds when they were 60% higher than they are now (referring to MBs below).

As always, FOMO is a powerful drug.

Conclusion

Another week in the books. This time next week, the Ethereum merge will have *hopefully* been successfully completed and we can add some certainty back to the market. No change in plans. Cherish that liquidity as things continue to remain slow. Keep your friends close and your ETH closer. Happy 1 year folks!

Onwards and upwards,

MM Team

Congrats guys!