(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all. Let’s be honest, bear markets suck. With only a few weeks left of summer, we can only hope the market degradation is close to over. Unfortunately, what happens next remains unknown and fall is going to be *interesting* to say the least. On the bright side, there’s still opportunity in this market (yes, we missed the DigiDaigaku pump also). Finally before jumping in, today is the 1 year “twitterversary” of Mint Media (previously Mint Calendar). It’s been a fun ride, we’re glad to still be here, still going strong, and feel like we’re just getting started 🥂.

While the week has been slow (nothing new) we have a great guest post covering the various metaverse land market caps, our head of community safety TheChild did an amazing talk on web3 security and the prevalent scams in this space (highly recommend giving this a listen here), and we also have an interview with the Haas Brothers. Let’s have a great week folks!

NFTs In The News

Limit Break (Parent company of DigiDaigaku) raises 200 Million

Meta now lets you post your NFTs on both Facebook and Instagram

Sudoswap Erupts as NFT Traders Capitalize on Royalty-Free Sales

MTV awards feature Snoop Dogg and Eminem as Bored Apes, first metaverse category

Animoca Brands’ Japan unit raises $45M at $500M valuation for NFT push

Sotheby’s hires NFT specialist to join digital art team

Formula One applies for metaverse and NFT trademarks

Reddit Is Airdropping Free Polygon NFT Avatars to Its Most Hardcore Users

Report shows cybercriminals stole more than $100M in NFTs

Market Update

On paper, it was a relatively quiet week. Before looking into the numbers, the main story has been the DigiDaigaku pump, going from a free mint earlier this month to a now 13 ETH floor at the time of writing. The seethe, cope, and FOMO around this project is truly something else. Sadly, like most of you reading this, we missed this completely and are watching from the sidelines. From an optimists perspective it’s good to see that there’s still practically some sort of 100x+ every other week or so, which surely keeps the spirits alive.

Chart: Nansen

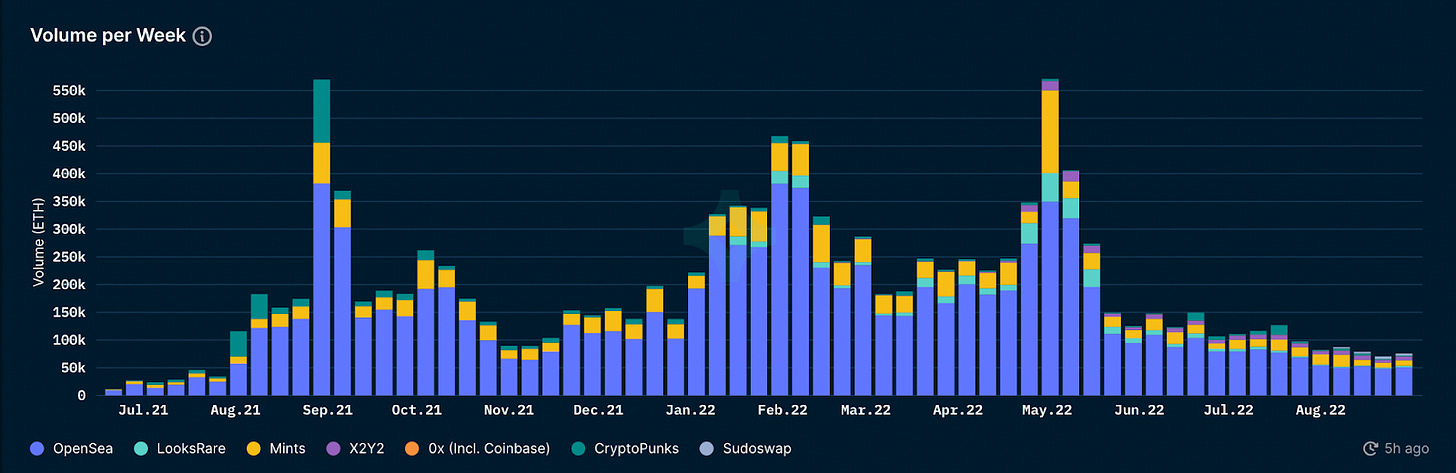

To our surprise, volume has actually ticked up over the last week (in ETH). Notably, Sudoswap has done 8K ETH volume in the last 2 weeks, which is ~2x that of LooksRare. X2Y2 also continues to slowly creep up in volume, taking more market share away from OpenSea. Notably, OpenSea has not broken above the 55K weekly volume range at all in August 2022, which is lower than the first week of August 2021.

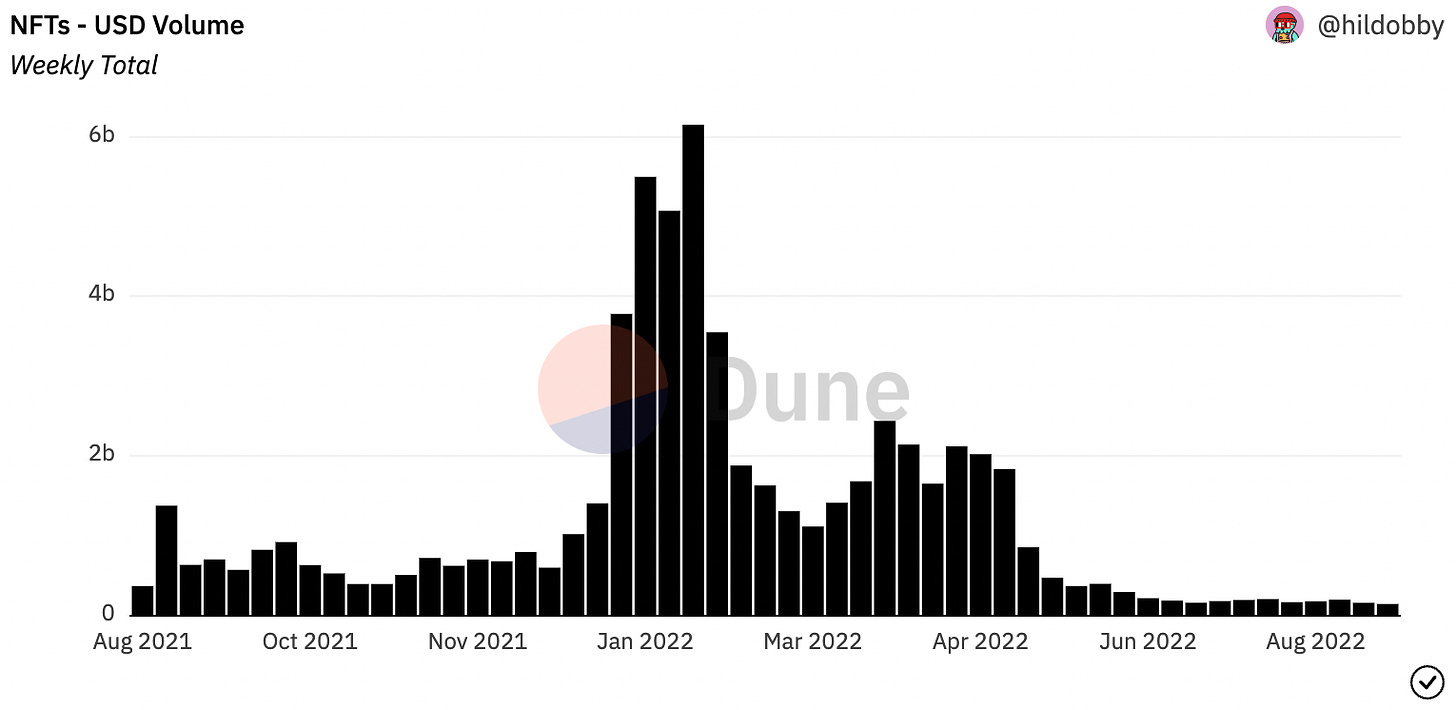

Chart: Hidobby/Dune

Insert sad USD volume chart. This isn’t surprising as ETH spent a lot of time in the $1500s this week. No need to over analyze anything – this is simply what not-fun bear market looks like. Now imagine we take the start of June to August and extend this chart to be down/flat until the end of 2022, how would that make you feel? This is certainly a possibility so make sure to keep this in mind. The name of the game is survival, anon.

The canary in the coal mine here is that overall NFT floors have remained *relatively* flat week-over-week in the face of ETH volatility. Blue chips quietly went up 20%+ in price and mid-caps for the most part finally didn’t go down again this week. NFTs don’t like volatility and perform the best when ETH is stable. Does this mean we’re in the process of bottoming? No. Is this reassuring and nice to see? Yes. But seriously, we’re just as perplexed as all the NFT influencers by this phenomenon last week - this chart is gross.

Chart: Coingecko

Speaking of blue chips – BAYC got back above 80 ETH and the Doodles/Azuki/Clone X trio all reclaimed floors above 7.5 ETH for the majority of the week, which was a ~20%+ move (at least) from their ~5.5 / 6 ETH floor bottoms. This doesn’t mean much for now but this is certainly something to watch out for next week. Overall, “blue chips” have been showing strength in their ability to hold relatively steady compared to all other jpeg assets. When things turn around, they will most likely lead the rally and pour liquidity into the rest of the market and *hopefully* your bags as well. It doesn’t look like this turn-around is happening anytime soon, but something to keep in mind.

Specific Project Notes

Some quick notes on other things that happened over the last week.

DeGods is building its own private utopia on Solana. The project hit a floor of ~650 Sol this week (or ~$20,000 USD, or ~12.5 ETH). This puts the project ahead of Doodles/Azuki/Clone X and right up there with Moonbirds (15 ETH floor). Frank and the team have been defying all odds and have built an incredible ecosystem. They will be launching y00ts in the next couple of months or so. You can bet that this project will also be uber successful.

RENGA, which we first covered back in May, finally had its mint. RENGA minted out slowly in around 36% from its white list and then reserve list at a price of .4. Following this, RENGA hit #1 on OS on Sunday and is now floating around a .65 ETH floor. While ~7,200 of the supply was airdropped to holders of TAOS, it’s an impressive feat to have minted out 2,500 spots at .4 ETH in this market. So far the momentum on this project has been solid.

New mint wise, some projects on our radar are Lost Realms, Zanozaverse, Multibeasts, Deep Objects, the cannibals, and operationSIN. Missing a few but paying attention to these for now.

Breaking Down The 3 Largest Metaverse Land Collections by Market Cap (Guest Post Coopernicus.eth)

Initial Note From Mint Media: Metaverse land has been a popular topic recently and we haven’t dove too much into it over the last few months. We brought along coop, an expert, to give a quick rundown on the size of the market and the current competitive landscape. Enjoy!

The metaverse is super competitive at this early stage of its life. There is no clear leader because most of them are not playable, nobody can point to adoption statistics to prove they lead. So instead of player count, let’s look at the market cap of their lands and holder counts as a way to gauge excitement and investment levels in each of the top metaverses along with key context updates for each world.

Market cap and holder counts are important in all things crypto as they represent risks that real people have taken to be a part of that project. These users become that project's network, invested both socially and in dollars, helping drive the growth of each project.

Market Cap and Holder counts pulled from Nansen.

Let's break them down:

#1. Otherdeed for Otherside, $223 Million Market Cap, 34k holders

Otherside is the Yuga Labs backed Metaverse in development by Improbable Labs, built in a bored ape themed environment. The first public tests of their metaverse concluded last month with resoundingly positive feedback.

Collection size: 100,000

Owners: 34,811

24 hour volume: 315 ETH, $491k

This collection size of 100,000 helps to set Otherside apart from most of the other leaders as many metaverse collections stuck with the traditional 10k collection for their Metaverse. This was a great move by Yuga Labs to enable a much wider audience to join in when their other projects are too expensive for the typical buyer.

Interestingly, 83% of Otherdeed holders have held onto their NFT since launch.

Learn more about Otherside with Fief's litepaper summary.

#2. Sandbox Land, $254 Million Market Cap, 19k holders

The Sandbox is not available for regular public play yet but has been in development since 2019 with regular alpha testing ramping up in 2022. The Sandbox has been a top Metaverse project when it comes to partnership experiences, having teamed up with brands like Playboy, Tony Hawk, and much more.

The Sandbox is a voxel themed metaverse where user generated content is the focus. Users can build games or businesses within the Sandbox world if they own a piece of LAND. The Sandbox is often seen as an opportunity for entrepreneurs to sell their own experiences and games within their larger world.

Collection Size: 112,000

Owners: 19,171

Volume: 32 ETH, $49k

The Sandbox may be the strongest competitor against Yuga Lab's Otherside, but users may be tired of waiting for their world to open fully. This month's alpha test has been successful in technical terms but has failed to garner real attention from everyday players.

#3. Decentraland, $44 Million Market Cap, 5k holders

Collection Size: 112,000

Owners: 19,171

Volume: 32 ETH, $49k

We see a huge drop in market cap and holder counts between #2 and #3. It could be in part that #1 and #2 are newer, have more updated models and hype. It could also be that Decentraland is already playable while the first two thrive on hype alone.

Decentraland is one of the oldest decentralized Metaverse projects in the world. They're constantly adding events and sponsorships, like last week's Metaverse Art Week in Decentraland.

Conclusion:

The current market cap of these projects do not define their future capability but do give a good sense of where the hype is for investors. Each of these projects sit in a different part of their lifecycle with big growth possibilities for each in the coming years.

Interview: The Haas Brothers

Initial Note From Mint Media: This is an interview with The Haas Brothers who are building Multibeasts. We have no ties to the project other than that we did a WL giveaway to our discord community. We simply think this project looks interesting and has a unique approach for standing out in the bear market and we wanted to learn more. Make sure to check out the website. Enjoy!

Who are you and what has your NFT journey looked like? What was the first NFT you ever bought?

We are the Haas Brothers!… We’re best known for furniture and Sculpture. The fine art world has been good to us, our work is in the permanent collection at the MET, LACMA, RISD museum among others. A lot of our work starts in digital. Blendr, photoshop, Illustrator have all been a big part of our practices for years.. So our first step into the NFT world started over a decade ago with the use of digital tools and digital expression. Our first NFT was a crypto Venetian from Bright Moments.

Why did you decide to drop your own NFT project? What was the inspiration behind the art?

We’re known for using our art practice to create alternative micro economies, usually with the intent of dispersing wealth and creative input down the chain rather than up. NFTs and Web3 gave us a really potent opportunity to kick that practice into high gear. The core of web3 ethos feels deeply aligned with our core values… and gives us a more efficient way of doing what we’ve already been doing for years. In that spirit the art is really meant to support that vision.. we were inspired by the larger audience we could reach, and the ability to include that larger audience in actually expressing the work with us.

The minter takes a personality test and we create a unique digital portrait that represents their input. The user dictates the composition of their own individual artwork as well as helps dictate the rarity structure of the entire collection. The image itself was inspired by a collection of work we’ve been making for the past 10 years called bests.. they are “personality portraits” of friends and family.. they’re really meant to represent the inner you.

What are the 3 month, 6 month, and 1 year goals of this projects. In 1 year from now where do Multibeasts.

The goals start at mint.. We really want a very palpable ‘input/output” scenario with our audience. The personality test is supposed to be art in and of itself. It’ll be funny and cool looking but also be figuring you out in a very abstract way. It’s taking our community into account immediately.. their input affects the collection immediately. The output 3,6 months, a year out will be aggressive use of our IP rights technology. Remaster has put some fucking awesome tech in place that allows for negotiable, viewable, enactable IP contracts that are attached to every single MultiBeast.. The minter can opt into all sorts of collaborations we’ll be bringing to the table… theoretically we could do clothing, cartoons, art shows, toys, you name it… If you opt in and we use your MultiBeast for a project you can strike a real on chain contract with us where both parties agree and sign electronically.. The roadmap for MultiBeasts is it’s art and IP.. I’m sure many other awesome things will come from our rad community too.. It's a growing experiment, and we want to be there to ride that momentum.

In your opinion, what are the best ways for NFT projects to sustain long term value without having to continuously find new buyers to pump floor price? How do you plan to implement these strategies with Multibeasts.

With Remaster tech… this is the first NFT project with legitimate contractural IP use.. And we hope to enact all sorts of long term IP use.. With this tech, if you opt into a contract with us you suddenly have a brand new asset… you can keep your MultiBeast but sell your IP contract to the highest bidder on our marketplace. The MultiBeast are legitimate Web3 assets.. From our perspective they’re more than just a collectible… they’re an asset, because they outline real ownership rights.

What are the 3 primary reasons that somebody should consider joining your community / getting involved with this project?

The Art is legit.. we’ve been building it in Blendr for over a year and a half to reflect a collection we’ve been working on for over a decade.

Remaster IP contract technology is groundbreaking… it’s implications are going to be deep and substantial not just to this collection but to all of Web3

NFTs are growing and changing as a concept.. we’re working hard to try and turn this into what a “next gen” NFT would look like from this point forward.

As prominent and talented artists, Is this strictly an art collection or are you building something more. Do you intend to grow the core team headcount?

It’s definitely more than an art collection. I don’t think there’d be much point in us entering web3 unless we had something to say.. as this grows we want to keep building these ourselves. If it gets big we want to stay a small core and as we enter IP usage we’ll need to build support around each of those unique projects as they come.

Do you think the future of NFTs is going to exist solely on Ethereum or multi chain? How does this affect your long term plans?

That’s a really hard question.. and honestly Web3 is so wide open that it feels like a real shot in the dark to conjecture. Ethereum is really elegant, and we’re super excited to see its next iteration… that being said it’s hard to imagine a future dominated by one network. In terms of our long term plans… I think ETH is so ubiquitous in the space so far that we're certain anything minted on ETH will be accounted for in the future.

Conclusion

Overall, August 2022 will go down as the slowest month since, well, August 2021. Despite the re-rise of Pudgy Penguins, the CryptoDickButt pump, and free mint DigiDaigaku’s minting some new generational wealth, most people were not having what we’d say is the time of their life. If you’re in the USA, we hope you have a wonderful holiday weekend. Expect another slow week ahead as the “last week of summer” winds down.

Stay liquid, touch grass,

MM Team