(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm all and happy Tuesday. What a whirlwind of a week it’s been. While twitter and discord still remains quiet, something in the air has changed and it felt like (for a short moment) we had a spark of life in the NFT market this past week. We understand this is probably a controversial statement (depending on what you hold) since the fact of the matter is that the majority of project floors continued their downtrend.

Amidst this *down-only*, we saw 8liens go from a free mint to a .8 ETH floor, hitting 5K ETH volume, while projects like Webaverse sold out their remaining ~8000 pieces (20k total) at a .45 mint price at auction (started at .25). Pudgy Penguins continues to put every NFT influencer in disbelief as its floor price flipped Cool Cats (a once universally accepted blue chip that hit a 12 ETH floor). Along with this, we saw the 1/1 Trippy Ape sold for 2300 ETH (3.9 million USD). There’s a handful of other projects that also did some quick 10x’s overnight and the degens are still here, in what has become an aggressive PVP environment.

We’re seeing platforms such as Sudoswap gaining a lot of attention due to their addition of liquidity to the market while at the same time causing controversies around royalties. Overall, the *winning* strategy has not changed: get in quick, get out quicker. You certainly don’t want to be left holding the bag of that degen free mint that did a 10x and full roundtrip in a 6 hour period, anon. A dense intro, so let’s dive deep into what happened over the past week and work to illustrate the path of what’s to come next. Cheers!

Updates

No major updates this week. As per usual, definitely check out Mint Jobs if you’re looking to mint your next career opportunity, or if you’re hiring, contact hello@mintcalendar.com to get your job listing posted!

NFTs In The News

NFT media management platform Pinata raises $21.5 million in combined seed and Series A funding

Snapple builds a blockchain bodega in Decentraland

Magic Eden - launching marketplace on Ethereum

College textbook maker Pearson eyes NFTs to claim a cut of second-hand sales

OpenSea now requires a police report in stolen NFT claims

BlackRock launches private trust offering direct bitcoin exposure

Meta is expanding NFT support on Instagram to 100 countries

Macro Update

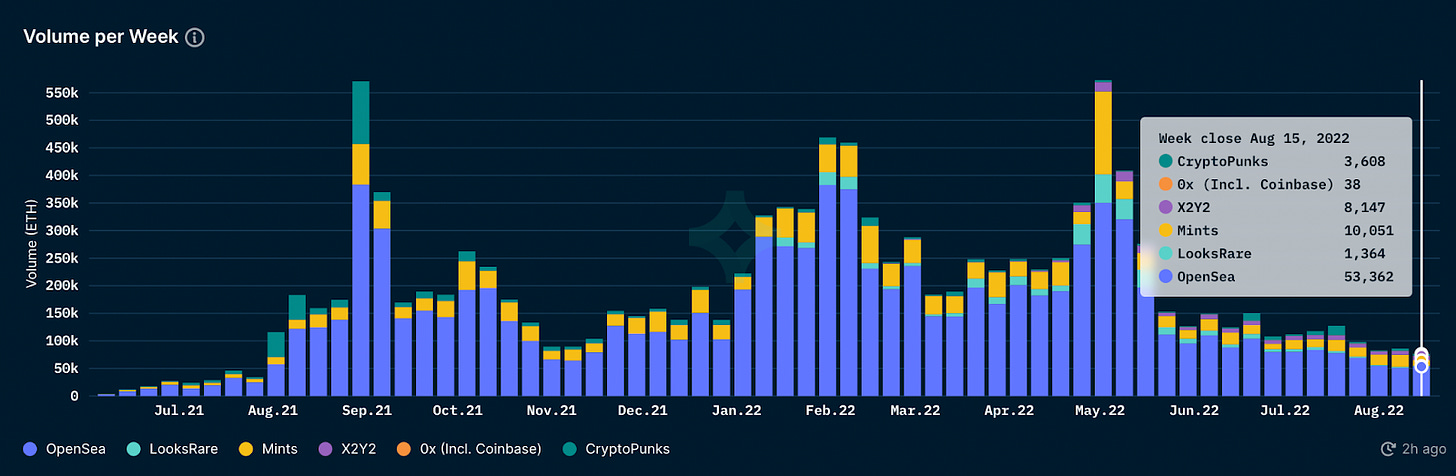

Overall volume was down again but this chart is a bit misleading, since it’s due to lower mint volume. OpenSea, Looksrare, and X2Y2 all had higher ETH volume than the previous week. This is the first time in 5 weeks that NFT exchange volume (in ETH) has gone up week-over-week. While this isn’t a sign that the bear market is close to being over, if we trend up again next week, it may be more telling that interest is coming back to the market.

Keep in mind, this does not include the Sudoswap NFT volume which did over 2500 ETH volume last week, adding to the increase in trading volume. While this is small, we expect the Sudoswap volume to pick up as more users are onboarded to the platform.

Chart: Nansen

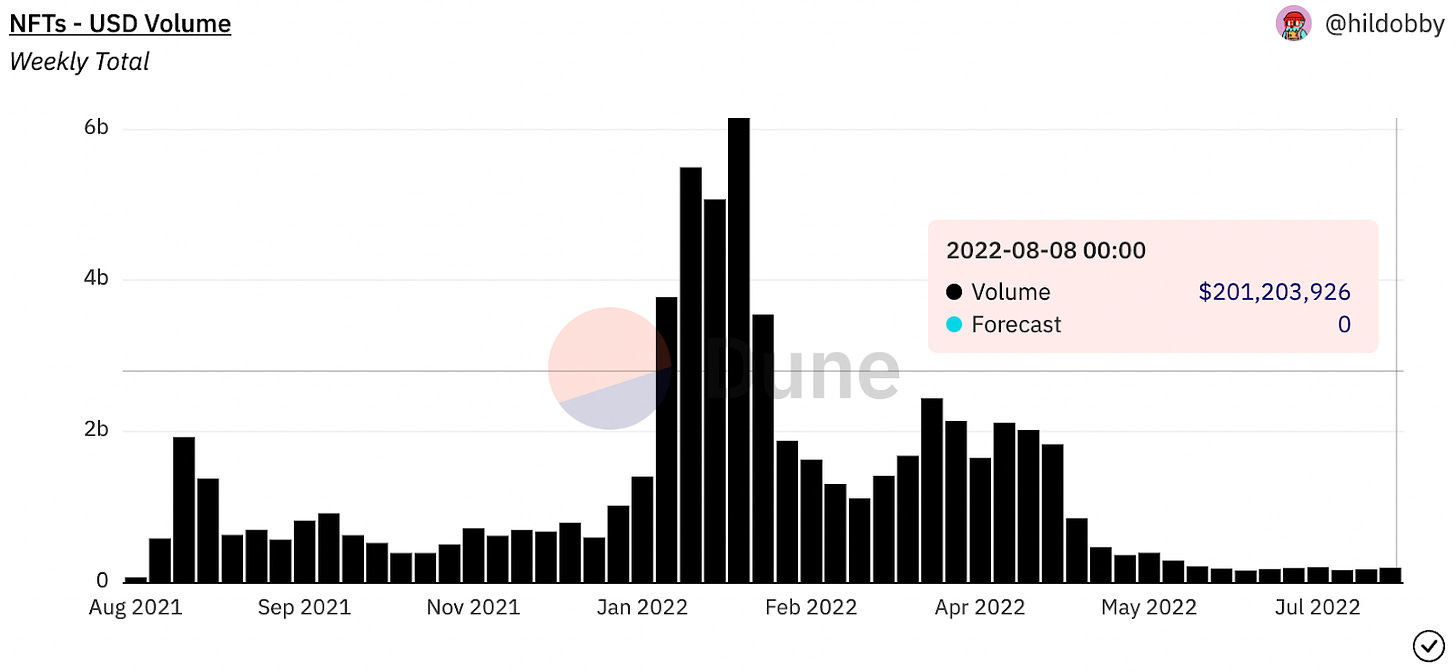

Along with this, NFTs increased in USD volume for the 3rd week in a row. This isn’t as telling as the ETH increase mainly due to the price rise of ETH in the $1,900 - $2,000 range. Not super telling but not worth dismissing. For fun (and sadness), compared to where we were earlier in the year this chart still wants to make us throw up.

Chart: Hidobby/Dune

From a market participant standpoint, the amount of users trading doesn’t paint as bleak a picture as we’d expect (similar to the buyers/sellers chart we posted last week). Users are significantly lower than during the height of the bull market. However, if we focus solely on the OpenSea section of the graph below, users have been flat since the initial drop off in May (early stage of bear market).

With how bleak things have sounded on twitter, especially with how quiet some project discords have become, we do find it reassuring to see that users (or wallets) participating hasn’t had a big drop off in the last 3-4 months. Wouldn’t be surprised to even see this trend up while the market stays flat, as more and more users are continuing to be onboarded to jpeg land.

Chart: Nansen

A devastating week for “Blue Chips”

This has been a tough week for” Blue Chip” nfts. We put this in quotes because this week has made many market participants re-think what exactly a blue chip NFT is. The consensus is that outside of the solidified blue chips (Punks, BAYC, Nouns) there’s about 4-7 contenders.

Moonbirds took an absolute tumble from 16 ETH to 12 ETH after their CCO announcement, and Doodles/Clone X have been unable to stop the constant bleeding and are now under an 8 ETH floor for the first time in 2022. Mutant apes are also taking a beating and now in the 13 ETH range, which hasn’t been seen yet this year as well. The biggest loser in this story are the Cool Cats, who are floating around a 2 ETH floor at the moment. The Cats were consistently above 11 ETH for the first 2 months of the year and were as solidified a blue chip NFT as you get. They’ve now fallen over 80% and have sunken into the dreaded “mid-cap” NFT basket.

Mid-caps & 99% Going To Zero (Now Already Zero)

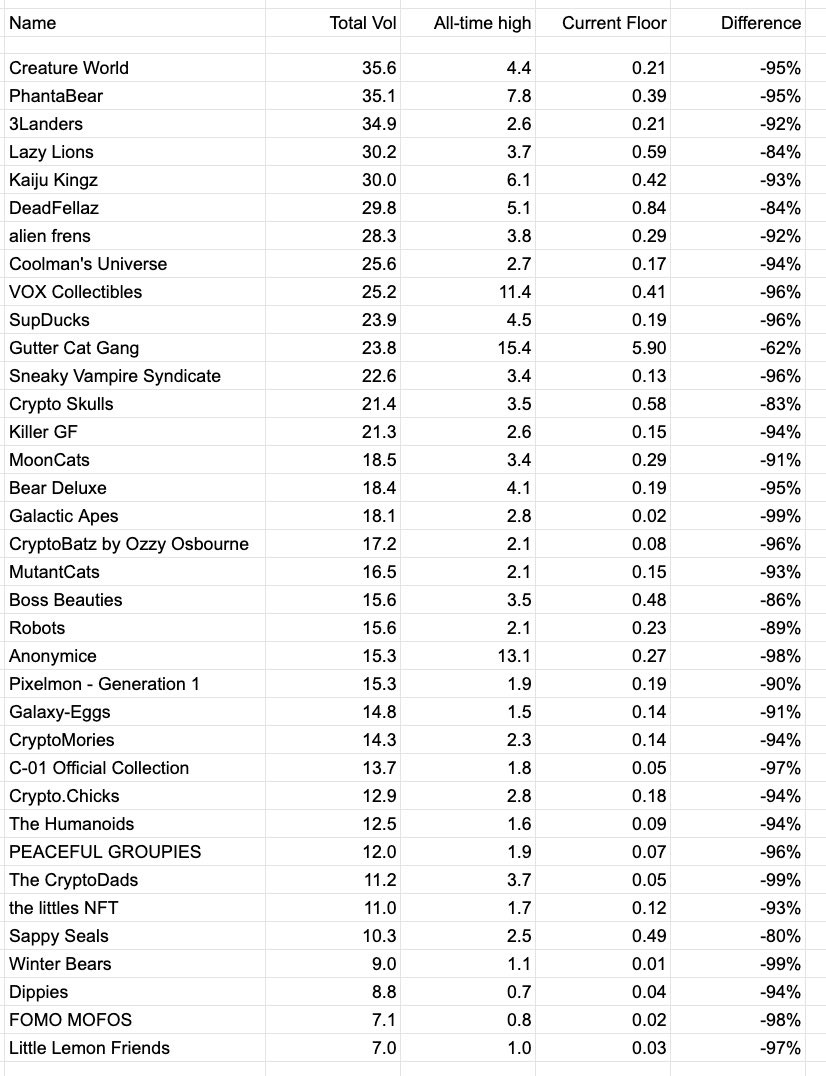

Let’s start off with this chart that’s been trending on NFT twitter from BulgariaInNFTs which we’re sure many of you saw floating around earlier in the week. This chart is from August 12th, so the prices for most of these are sadly even lower now. Disclaimer: a few of these numbers are *slightly* off (Gutter Cat Gang never hit a 15 ETH floor). However, for the most part, 90% of this chart comes off as accurate and it certainly gets the message across.

While we have constantly yelled to the heavens that 99% of NFTs will go zero (remember this is a consensus opinion, we’re not special), what we’ve been saying for the last few weeks is that this has already begun to happen. It seems like the market is starting to take notice now, since the above charts are nowhere near the “obvious” projects you’d think of, and many have been seen as potential blue-chips back in the bull market.

We’d be lying if we said that we didn’t endorse some of the above as great long-term projects back in 2021 (were big fans of coolmans/seals). The list above are the projects where most of retail got hurt on, whether they bought the top or round-tripped back to the lows. Since many of these projects have “great teams” and a “great community” a lot went down with the ship.

Our opinion, and we feel very strongly about this, is that ~95% of these will become dead lifeless projects and will never recover in the next cycle. The Mint Media team won’t be focusing on any of the mentioned projects above. Of course, there is probably going to be an outlier there, but we’d rather focus on the proven time-tested strategy: true blue chips and shiny objects.

Moving along, this is why patience has become so important. If you’re truly looking to “buy the dip” on a project you believe in (maybe it’s one of the above), it’s still worth waiting until there are some signs of strength. We know everything is driven by hype and momentum, and until we sense that in the air it will be down-only.

Is this flush healthy for the market? Probably. Is it painful? Certainly.

Some Other Thoughts

We’ve seen a lot of comparisons on twitter, calling NFTs “altcoins with pictures”. While we can go deep and make arguments for both sides, the high-level (or *left curve*) comparison makes total sense. Many of these projects, especially the mid-caps, gave you the ability to have a 10, 20, or 30x + ROI on your initial investment, and the few who took advantage of that are sitting pretty.

Like altcoins, most of these have round-tripped or even gone lower than their mint price, leaving you to hold the bag. At the end of the day, it’s lessons learned for all of us. At least we get a cool picture out of it!

We still believe the overall state of the market is unhealthy. This definitely does not mean you can’t make money, it’s more that the environment is *unwelcoming*.

The combination of watching practically everything go to 0 while at the same time free mints (let’s use .01 ETH as a price point) are doing a quick 20x in a few hours is disheartening for many project founders. These quick 20x round trips also usually go to 0 anyways, but for the time being we’re still in a casino on steroids.

This is a really great thread that we think is a solid summary of where we are at and why we use the word unhealthy. Nobody really cares about any sort of building process, or past history, and just is searching to be *early* on the next project. In turn we see project floors dropping extremely fast due to under-cutters who expect the price to go up instantly, and if it doesn’t, will completely abandon and FUD the project.

To sum this up, a great quote from Sibel in this thread is “The current market is; Grind so hard until you get a WL from a hyped project & list it for floor in less than 5 minutes after minting”

We’re still in the phase (or maybe this was always how it was???) where the majority of the market is driven solely on hype and momentum, and *not* the art or what the teams are building. Azuki art surely looked amazing at a 35 ETH floor, but don’t you agree it sort of looks like any other anime pfp at 6 ETH? As quick as the mighty rise, they can fall.

While this may sound a bit doomer-esque, our discord is still having solid activity and we’re participation is still strong. In the macro update, we can see that nobody else is really leaving anymore, but instead the few remaining are here to stay (we’re stuck with each other forever anon 😂). Some of our personal biggest wins in the last 4 months have taken place in the last 2 weeks and there’s still a lot of opportunity (for quick flips) in this market. While we’re constantly scouring for new projects; new/free mints like Pocket Drgns, We All Survived Death, Crudeborne, Renga, Multibeasts and Lost Realms all present themselves as *interesting* places to look.

Moving on, consensus looks like the NFT market is still in for some more pain due to the ETH merge. Whether true or false, consensus sometimes becomes reality. Here’s a solid thread explaining why this may be the case, mainly food for thought:

If you’re too lazy to read, the gist is that all ETH will be receiving an airdrop (similar to Eth classic and Bitcoin Cash) due to the Merge in mid-September. Because of this, the theory is that traders will want to liquidate their NFTs for ETH in order to receive the airdrop. He also mentions that he’ll be looking to buy floors of high quality projects as he thinks this will be a quick move.

We tend to agree here and wouldn’t overthink this too much but wouldn’t really call this “alpha”. Instead, it is important to be aware of these things as it means we will most likely get some added market volatility around this time (i.e. opportunity).

Conclusion

Overall, we saw some life enter the NFT market this week with projects like Webaverse, 8liens, and DigiDaigaku stealing the show with their volume and volatility. Simultaneously pretty much everything else went from down 98% to 99%. Your favorite blue chip is now the topic of a heated debate on twitter around whether it’s an actual blue chip at all, and your colleagues at work continue to make fun of those who bought the monkey picture.

Some of us are enjoying the pumps/flips quietly, while others double down on their zero bags because of the “community” and others scream into the void on twitter that NFTs are dead forever. Whether you want to participate is your choice, as we’re certainly operating on the far end of the risk spectrum right now. In a sea of red, there are a few signs of strength, but it would be foolish to dismiss the progress and advances we’ve made year-over-year because of the bear market. If you’ve been a roach, and focused on survival over the last months, you feel nice and cozy. Waiting to deploy, but there is no rush.

Let’s have another great week trading cartoon images with each other!

Much Love,

W & P