(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Gm NFT enjoyers. We are glad to see that you’re still here. With all the drama and what seems to be a civil war going on within Crypto Twitter and NFT Twitter, we’re happy to put everything aside for a moment, to do our best in providing a level-headed overview of what’s going on in the market and what to look toward next. Volume is still down in the dumps outside of Art Gobblers/KPR, but high quality digital art continues to pump. This weekend was one of the worst we’ve seen for OpenSea, partially because of Blur and partially because there is barely any activity. Until there is a catalyst for new entrants to enter the system, this PVP environment continues to be a slow drain on our wallets. Time to dive in.

NFTs In The News

Rolex files for Crypto, NFTs, and Metaverse Trademarks

OpenSea introduces On-chain Tools to enforce NFT Royalties

Web3 gaming infrastructure startup Xternity raises $4.5 million

Meta’s Instagram Plans NFT Minting, Trading Tools

Monkey Drainer Scammer Strikes Again, Steals $800K of NFTs

Crypto Exchange Kraken Launches 'Gasless' NFT Marketplace

Animoca Brands CEO: 'There Is No Metaverse Without Web3'

NBA Top Shot Just Had Its Worst Month Since 2020

Dapper Labs Cuts 22% of Staff as NFT Market Craters

Japan to Invest in Metaverse and NFT Expansion

Market Update

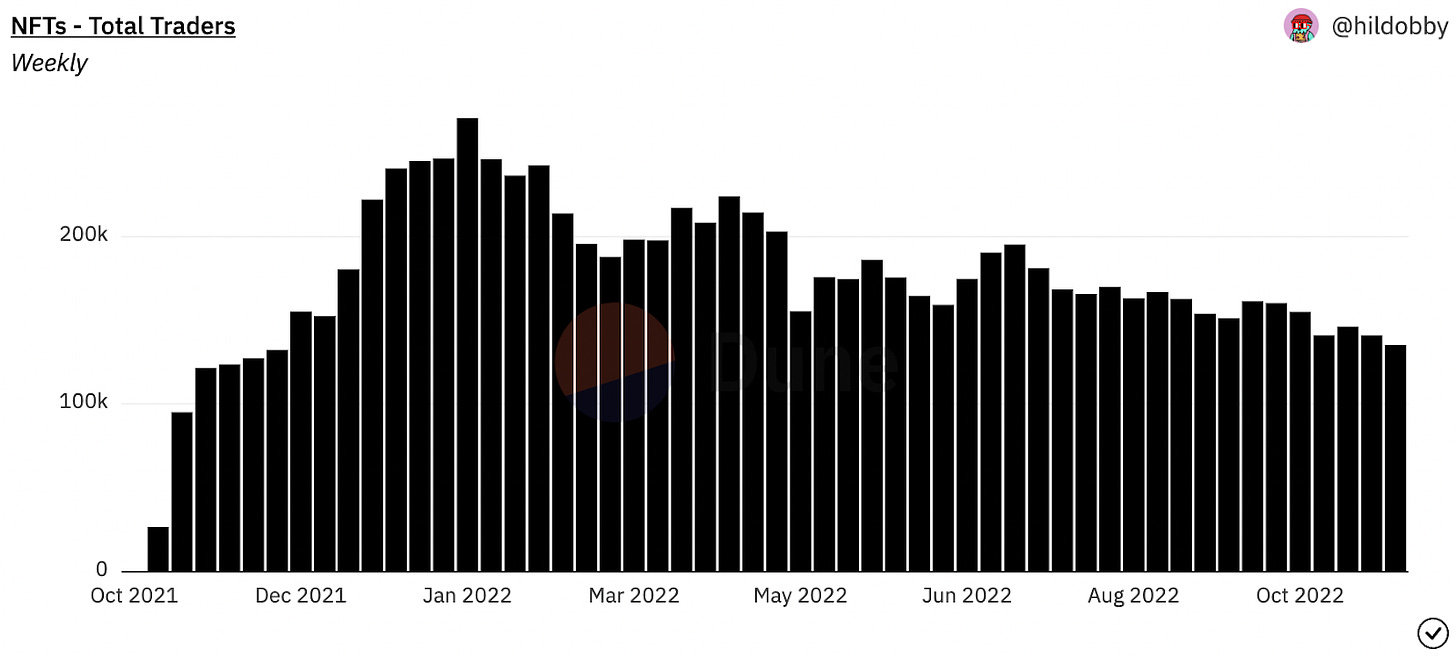

It certainly has been another stale week in NFT land. With a big week ahead from a macro perspective (US elections, inflation report, and rumors of exchange insolvency) it doesn’t seem that internet pictures on the blockchain will be top of mind. Unsurprisingly, volume is dead, and if we didn’t have Art Gobblers as a recent new mint this week would most likely be the lowest volume of the year. And even with the recent pump in Art Gobblers, it’s now down ~70% from the ATH in a week, and more importantly it doesn’t seem that the profits from minters rotated into any existing projects. We see the same spike in volume with KPR, with profits seeming to be returning to minters pockets as opposed to being re-invested in the NFT ecosystem. As a reminder, the bear eats its victims slowly. This is a slow bleed of floor prices continuing to drop and/or having little to no liquidity for you to exit your positions.

Blur is now doing over 20% of total trading volume (in ETH). It’s important to note that Blur has collected 0 fees thus far, but continues to gain market share. As an aside, it’s also just a lot better than all of the other marketplaces if you’re an *active* trader.

While we all await our 2023 Blur airdrop, what the market is really looking for is something new. The market is craving a new builder to come in to create something new and interesting. A future blue chip will be forged in the bear market, but nothing really has caught our eye at this point. Outside of Gabriel Leydon’s DigiDaigaku ecosystem, the market is craving something new and different.

Blue Chip Update

The blue chip PFPs continue to get beaten up in what has been a very slow and steady downtrend/consolidation. As mentioned last week, we’ll be using Blur.io for floor prices.

We’ll start off where we ended last. Punks are looking great, and are now holding steady above apes at a 65 ETH floor price. As the most time-tested asset in NFTs, Punks are showing their OG status and that they are the real #1 PFP.

The monkey ecosystem continues to struggle, with apes now at a 62 ETH floor and mutants selling in the low 11 ETH range. Both of these are at their bear market lows and the floor on blur is now sub 100k for the OG apes. Otherdeeds are also at their lows, sub 1.2 ETH and significantly below mint price at this point.

Next up is the Azuki, Moonbirds, Doodles, and Clone X crew. Moonbirds climbed back to 8 ETH but with Clones flat week-over-week, they’re still ahead. Azuki’s have taken a decent dip this week due to low volume but are still steady above all their peers in this range. Doodles are flat but with some decent volume this week – we wouldn’t be surprised to see these reclaim their 7 ETH floor. What’s notable here is that Azuki/Clone X are seeing the highest volume of rare sales going for 2-3x above the floor.

Similar story with the Cool Cats and Penguins. Both collections are flat with the cats holding steady in the low 2 ETH area and the Penguins acting as a 2.9 ETH stablecoin. We’re expecting some Penguin news within the next ~5 weeks so hopefully this can help the collection break out of its range.

All in all, this week has been a nothingburger. It’s been a steady downtrend/consolidation period for these collections. We’re either forming a bottom (in ETH) or these are simply continuing a slow low-volume grind down.

Last Week In Review & Musings

Digital art continues to run and is practically in its own bull market at this point – especially the high quality digital art. Squiggles are floating around an ATH and the floor price on Fidenza’s right now is 100 ETH ($160K USD). Art Blocks curated continues to be the cream of the crop here. On our radar is a new mint Miuzium coming up later this month which is a collection of 1001 1/1s from various artists.

The free mint meta seems to be all but gone at this point. Back in June/July there were tons of free mints every day that would run off of high volume and insane transaction numbers. Eventually, the combination of market participants botting free mints and minting 10%+ of a collection themselves (ultimately destroying projects) coupled with cheap ETH has led to this narrative basically busting. The free mints we see now, for the most part, are exclusive WL only collections. Hyped paid mints continue to do well ‘pre-reveal’ (we see KPR floating around the .8 ETH range right now). Expecting this to have the same fate of other hyped projects as always, and fall drastically on reveal.

RENGA managed to come back from the dead this week, jumping over 40% and getting back to a 1.2 ETH floor. It is reassuring to see newly perceived *high quality* collections get written off, and then make a strong, seemingly unexpected comeback. There’s few projects that have been able to hold above 1 ETH this bear market, especially once they fall below. Overall quite impressive.

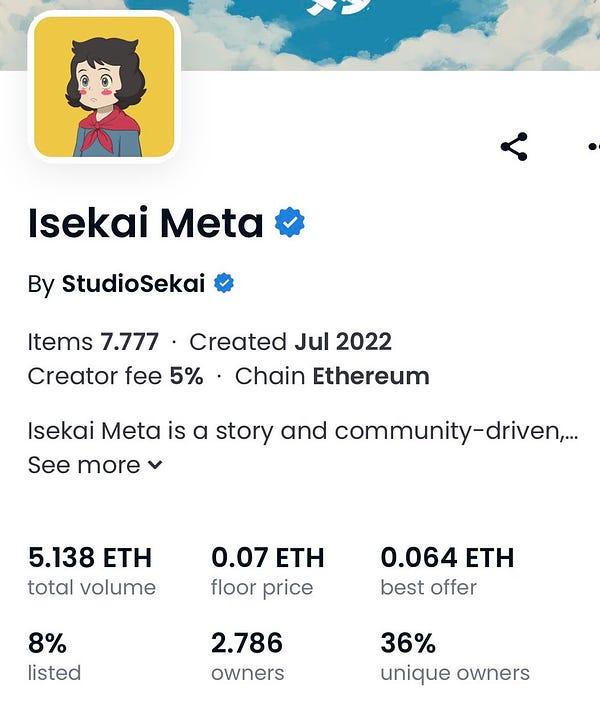

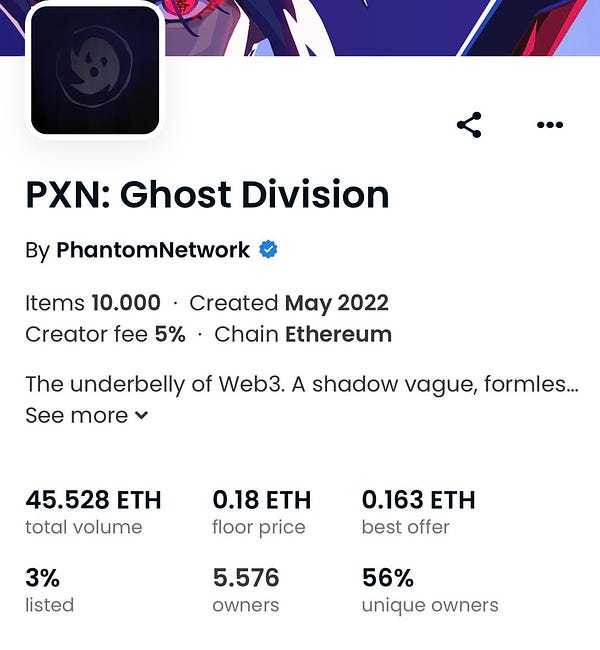

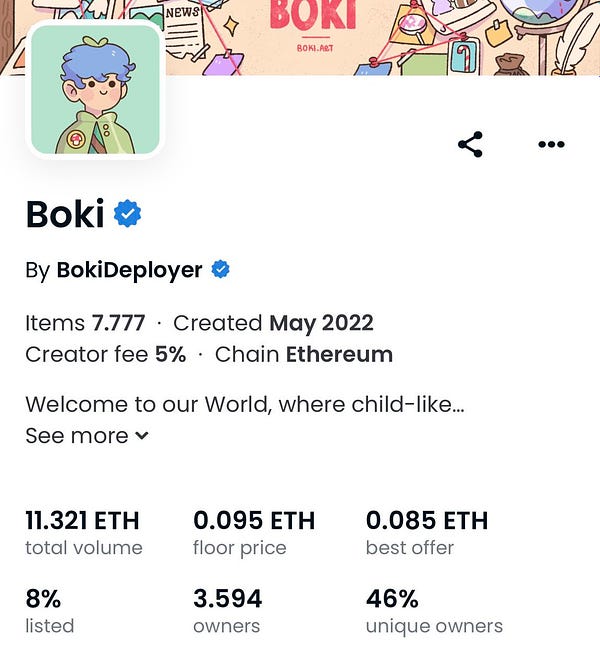

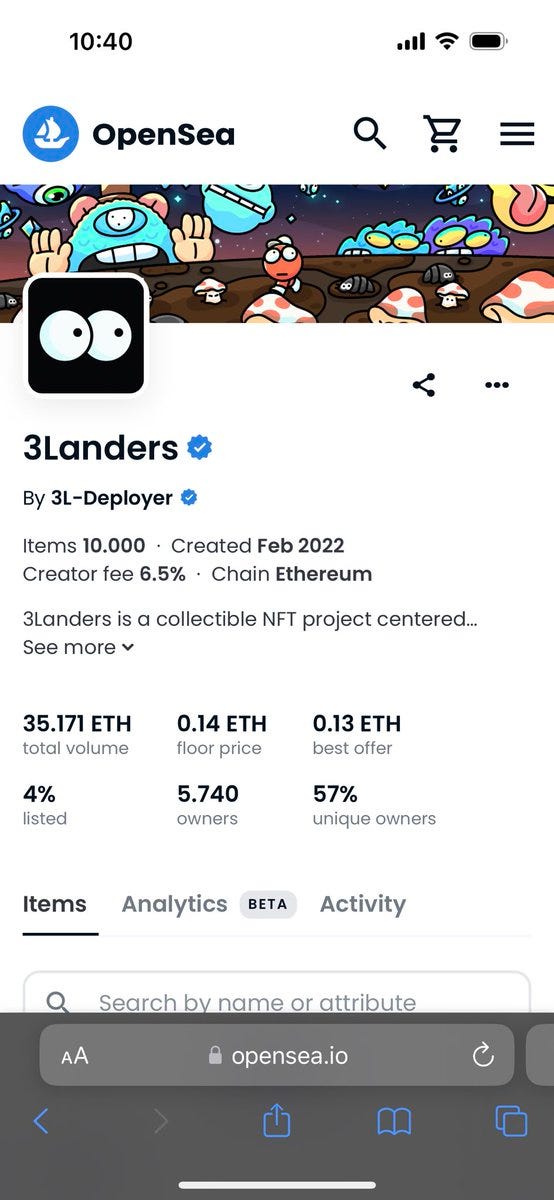

Volume is very bad. Simple. Not a single collection is doing 500 ETH 24 hour volume right now and the majority can’t even get above 200. It seems we’re at a full month now where doing 11 ETH of volume will get you in the top 100 24 hour vol on OpenSea which is quite sad. What’s even worse is watching the slow grind to 0 for many of the darlings of the bull market. The thread below is one of the funniest/disappointing we’ve seen in a while. But, don’t feel too bad, you’re not alone if you feel for 1 or more of the “this project is the next…”, we’ve all been there.

So… what to do now? Do you sit on your hands and wait or do you buy the dip on high quality collections that you believe will stand the test of time? Of course we don’t have all the right answers here. We’re still heavily focused on the AVAX NFT ecosystem as this is still the only place where volume and unique users are trending up over the last few months. The best thing you can do is keep an open mind and stay curious yet skeptical. There’s still multiple *big plays* to be made every week, which is what makes this space always interesting.

Chart: Dune @hildobby

With the NFT drama on Sunday evening we saw 5000+ people tune into spaces to listen to Frank speak. Though we’re living through a stagnant PVP environment, this is still an impressive number of attendees for some NFT drama in what has been the lowest volume week in over a year.

Conclusion

Sloooooooow week. Good time to start planning for the new year and putting together a shopping list for projects that may continue to grind lower. As always, patience is a virtue and we hope you refrain from FOMOing into something when it’s the only project being discussed on the timeline.

Have a great week!

- MM team